Before beginning the analysis I just wanted to say I have been deeply touched by BDI’s post. I am relatively new to the forum, having been away from SOH since 2009, I do not know any of today’s forum participants and writers. I just had my very first brief, comments/jokes exchange with BDI in the forum two days ago, I am shocked to hear about his health issues and I wish him all the best. Posting market analysis in this moment, on this forum, feels a bit awkward… but anyway, here we go:

Last week, on Monday, we suggested that the ES was probably bottoming, because the WEEKLY and DAILY odds were quite good.

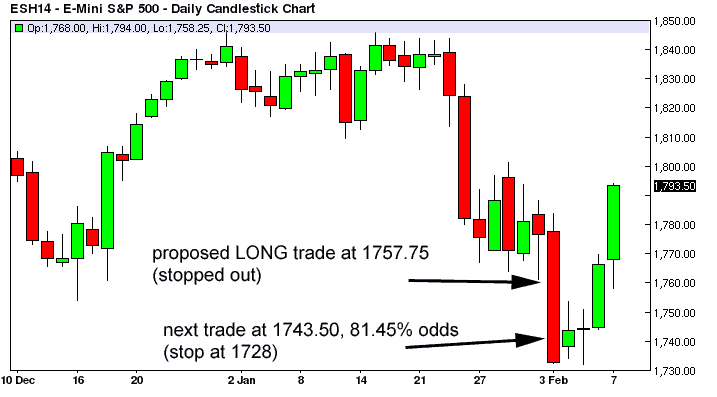

The trade at 1757.75 was trashed by the ensuing correction, however the odds just got better from there.

The trade at 1743.50, has 81.45% odds DAILY and the WEEKLY odds at that point were >90.32%.

What happened afterwards is well visible on the chart below: the market bottomed and reversed LONG, so this was potentially a good example of how to use the extreme odds to gauge a bottom and avoid the mistake of going SHORT at the bottom (we want to anticipate market moves, not join them when they are over).

What direction the market will take next week is debatable.

Many believe the market will tank again to lower levels. We don’t know.

Let’s make an analysis based on the odds.

1) SHORT: the odds to go SHORT DAILY are excellent at the moment >82%, so there is a high chance that the market will perform a DAILY reversal on Monday/Tuesday. This is also confirmed by the 4 days up in a row (CCOC).

2) LONG: we have highlighted below the odds for next week, around the 1760-1769-1765 level. Overall, 36.89% odds, which is OK, good enough if the market has started a new uptrend you won’t get more than this.

If the market goes lower, the odds become good, so that means you can go LONG.

The best thing to do is to see what happens early in the week and we’ll see if we are actually in a downtrend – or was it just a brief sell-off on the way to 1900?

If you want to sign up to the online quantitative tools shown in this post, please follow this link and subscribe to the special “SOH Offers”.

Copyright © 2014 Retracement Levels. All Rights Reserved