Wednesday was another utterly unexciting day in these markets of ours. It had started off great, but then it withered away into another miniature end-of-day melt-up.

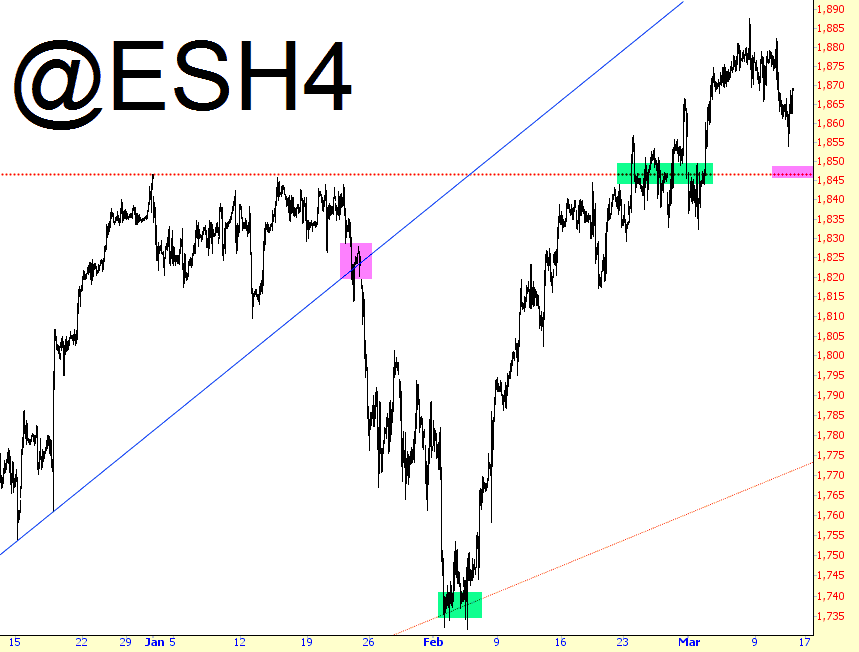

I just took a look at the ES over the past 120 trading days to try to make some sense of it. The first important break I’ve tinted on the left in magenta, which was a trendline failure that allowed the market to skid lower swiftly. It put the brakes on at the green tint at the supporting trendline (although it took a couple of days to figure out it wanted to go higher instead of break another line). Then then struggled to get into new-high territory (another green tint), finally broke free, but then swiftly rolled over again, which is where we found ourselves now. It’ll takea break of the horizontal line (the rightmost magenta) to get things rocking once more for the bears.

Of course, the big event looming – – since war doesn’t seem to be something that affects markets anymore – – is next Wednesday’s Big Fed Day. I trimmed back my own positions today, from 100% committed down to about 75% – – and don’t have a single ETF among the bunch. The market remains quite murky, so I’m taking things on a position-by-position basis, as it’s very challenging to come up with any tidy theme for equities right now.