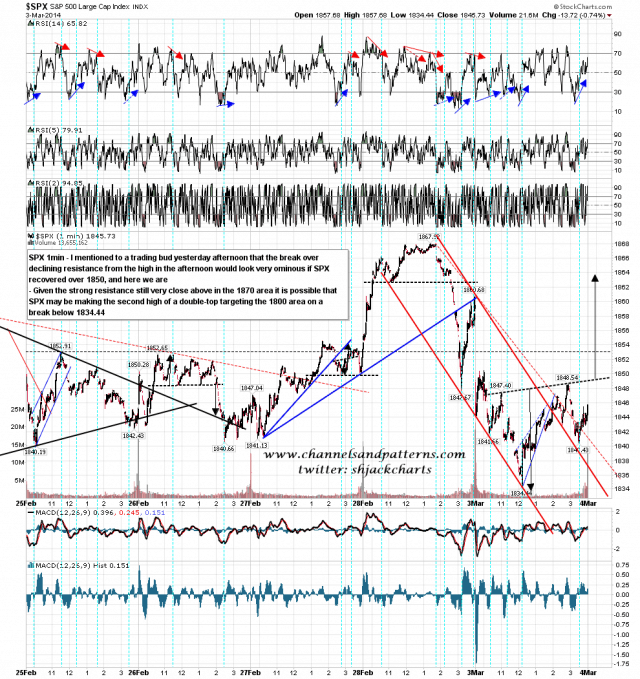

The bear side was obviously having issues yesterday afternoon when declining resistance from the high broke after the 1834 low. An IHS was forming in the afternoon with a target in the 1864 area on an RTH break over the 1850 area, which it seems safe to assume we will see at the open. This is best shown on the SPX 1min chart I use for intraday trading. SPX 1min chart:

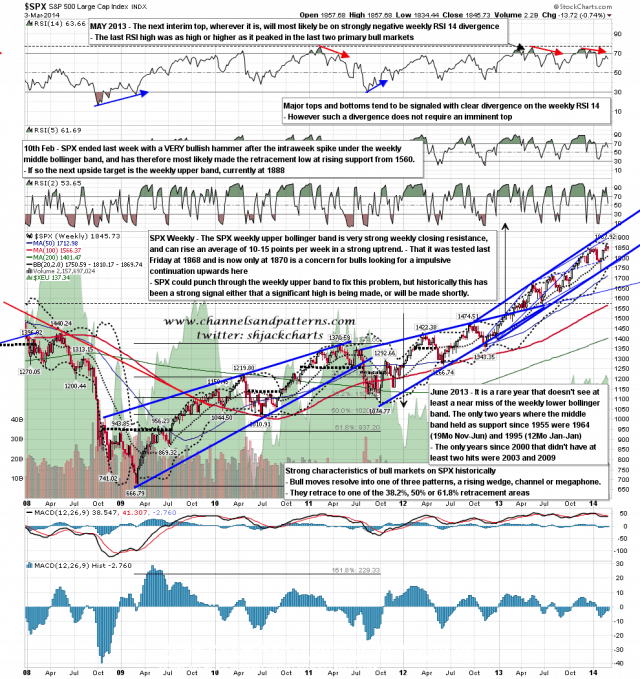

So what then? Well very strong (weekly closing) resistance at the weekly upper bollinger band was hit at 1868 last Friday and that’s now still only at 1870. I’m considering the possibility that SPX might be putting in the second high of a double-top targeting the strong support area around 1800 on a break below yesterday’s low at 1834.44. However there is still some headroom above, as I think SPX could close the week at 1880-5 without punching over the weekly upper band, and could of course go higher intraweek. SPX weekly chart:

I’m still of the view that SPX needs a retracement here and am considering the double-top scenario. This is a very heavy news week however and that seems likely to continue. This is very hard to call. I’m still feeling ill and may just take the rest of the day off.