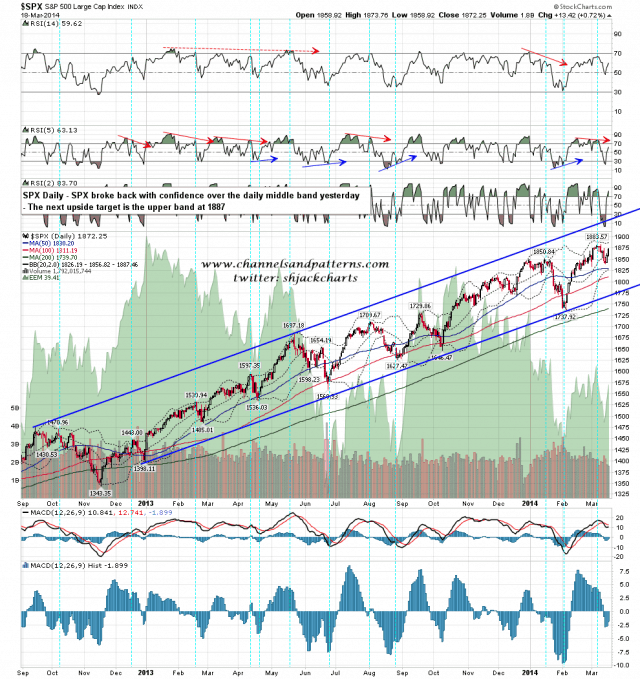

SPX broke up through both falling megaphone and 50 hour MA resistance yesterday morning, and as I said yesterday morning, that break targets at least a test of the current highs and most likely higher. The next target on the SPX daily chart is the daily upper bollinger band, currently at 1887. SPX daily chart:

Three weeks ago as SPX was first hitting the weekly upper band I commented that the weekly upper band was historically formidable resistance, and that we were likely either to consolidate under it or have an impulse move up that moved only at 10-15 points per week. Since then we have in effect consolidated, and the weekly bands have been pinching together, which should allow a slightly faster move up if we rise directly from here. The weekly upper band is currently at 1882, but if the rest of the week is strong that could close the week as high as 1890-5. SPX weekly chart:

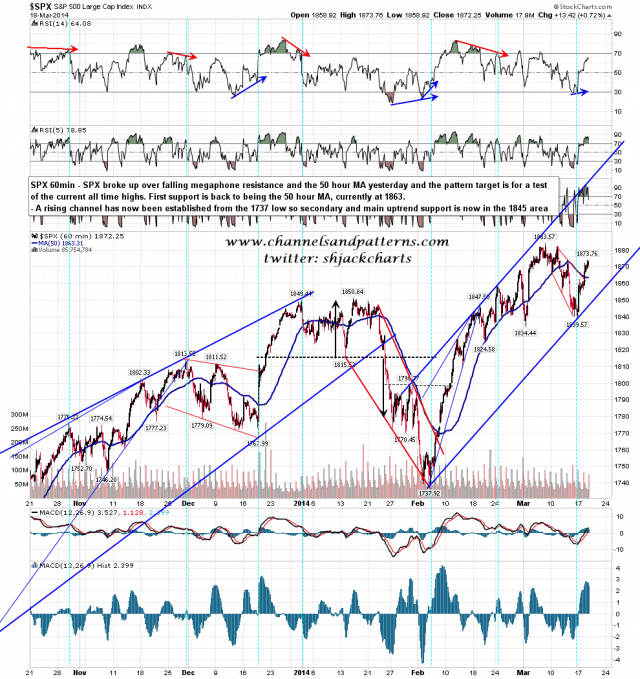

So what is happening on the shorter term charts? Well I was having a look at all the main US indices yesterday looking for clues for what comes next and the first thing to say is that a rising channel has now established from the 1737 low. That gives this current uptrend structure and support, so the key short term support levels on SPX are now the 50 hour MA, currently at 1863, and rising channel support in the 1845 area. I am expecting that this channel will hold until this (most likely) final move into the Spring high is either topped or topping, most likely after at least a very serious attempt to reach my wedge target at 1965. SPX 60min chart:

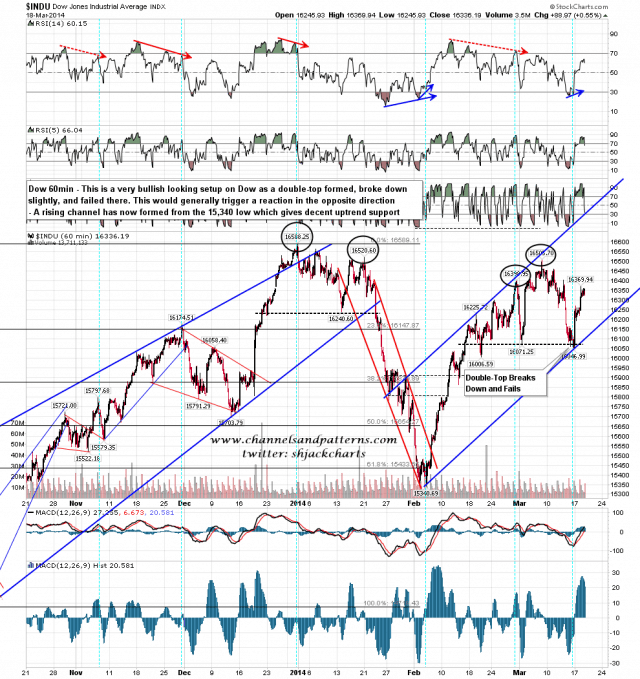

To back up that SPX rising channel there is also now a rising channel from the same low on Dow. That is further backed up by the double-top on Dow that failed just after breaking below double-top support. This would generally indicate a sharp reaction in the opposite direction. Dow 60min chart:

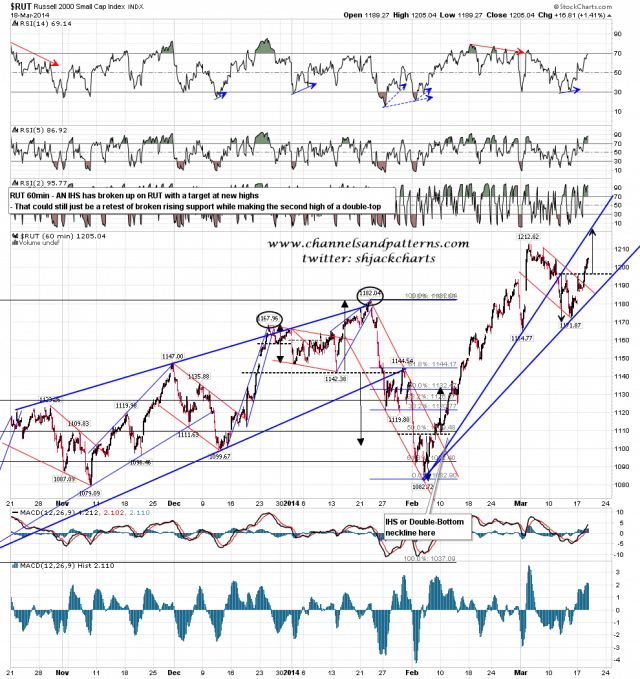

The only reversal pattern worth the mention at the low this week was on RUT, where an IHS formed at broke up targeting new highs. I’ve mentioned the possibility that might make the second high of a double-top, but given the overall picture I think that’s doubtful. RUT 60min chart:

Overall I’m pretty confident that a move to new highs has started, and my eye is on my wedge target in the 1965 area. As long as the SPX rising channel remains unbroken then this uptrend is well supported and there is little reason to think that a high is imminent or even very close. Buy the dips until further notice. Fed day today so we may well experience the usual Fed turbulence.