Well I said yesterday morning that if SPX closed the first hour of the day under the 50 hour MA and filled the opening gap then the bear side would start to look interesting, and so it was, strengthened by the fact that SPX failed even to gap over the 50 hour MA, instead delivering just a perfect retest in the first few minutes of RTH.

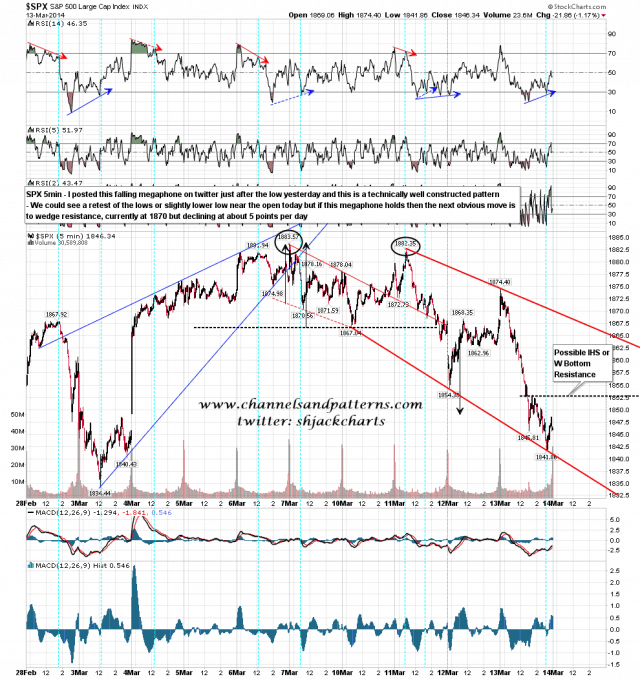

After it became clear that SPX was trending down I was watching my preferred support trendline option for support, and SPX bounced there in the afternoon. I posted the newly formed falling megaphone on twitter just afterwards. This is a technically well formed pattern and may well be the retracement pattern here. SPX 5min chart:

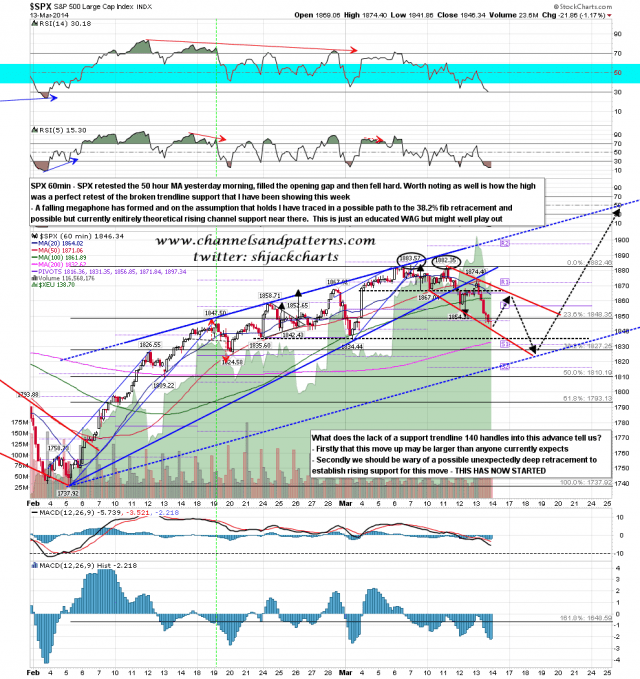

I’m expecting this pattern to hold this morning, and if I’m right, then the next target is a test of megaphone resistance before a (most likely) reversal back down towards the 38.2% retracement target at 1827. I have sketched out a possible path for this to happen while establishing a rising channel from the 1737 low and we’ll see how that performs. This is just an educated WAG though so to be treated with caution. SPX 60min chart:

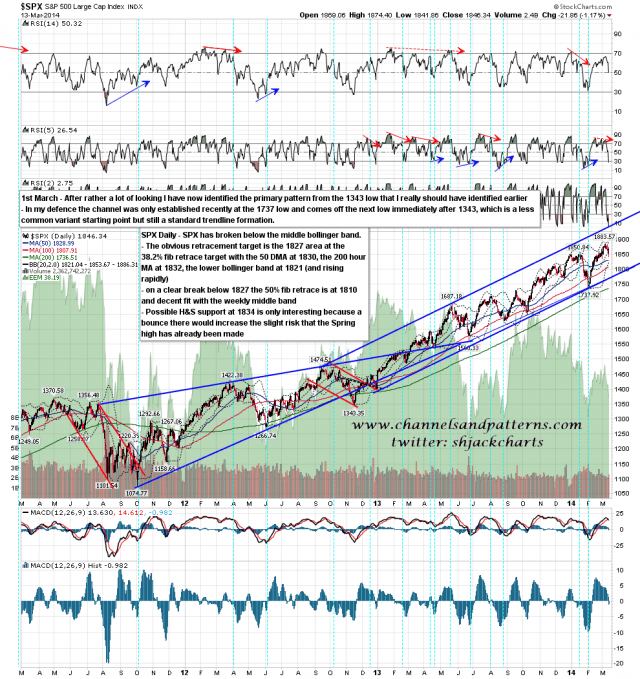

Why am I thinking that this retracement is not yet finished? Well the SPX daily RSI 5 that I showed earlier this week, while arguing that a short term break down was more likely than a break up, has now reached 30 but if you look back at the last five retracements you will see that four of those bottomed on clear RSI 5 positive divergence. It is therefore probable that we are going to see more downside on that basis. in addition to that the daily middle band was broken hard yesterday, with a new target from that at the 50 DMA (1830ish) or lower band (1822ish), which bracket the minimum target for a decent retracement at the 38.2% fib retrace (1827). All in all more downside seems likely. SPX daily chart:

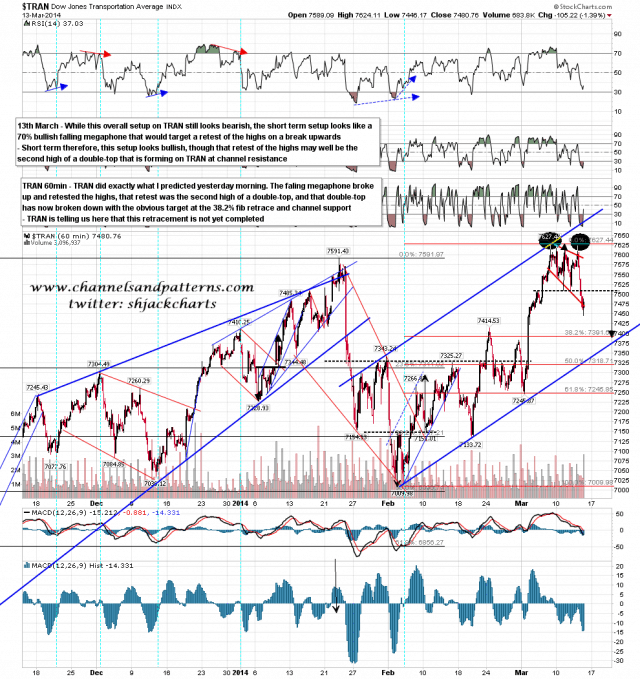

There is also the matter of the TRAN chart. I said yesterday morning that the obvious next move on TRAN was to break up from the small falling megaphone (check) to retest the high (check), and that high might well be the second high of a double-top (check). That double-top then broke down with a target at the 38.2% fib retrace there, which TRAN is not close to reaching. The obvious trendline target is also rising channel support which is close to that 38.2% fib so that is a very decent target area. TRAN 60min chart:

As far as I am aware I am alone in thinking that a bounce today may well overshoot a retest of the broken daily middle band in the 1854-8 range, and it’s obviously possible that I am mistaken. The falling megaphone is a technically decent pattern however and I’d expect it to hold. If we see an overshoot to test (and reverse at) the possible H&S neckline at 1834 today, as most seem to think, that would increase the chance that the Spring high has already been made, but in the context of this falling megaphone that would be a bullish overthrow that would target the 1900-10 area on a likely subsequent break over megaphone resistance.