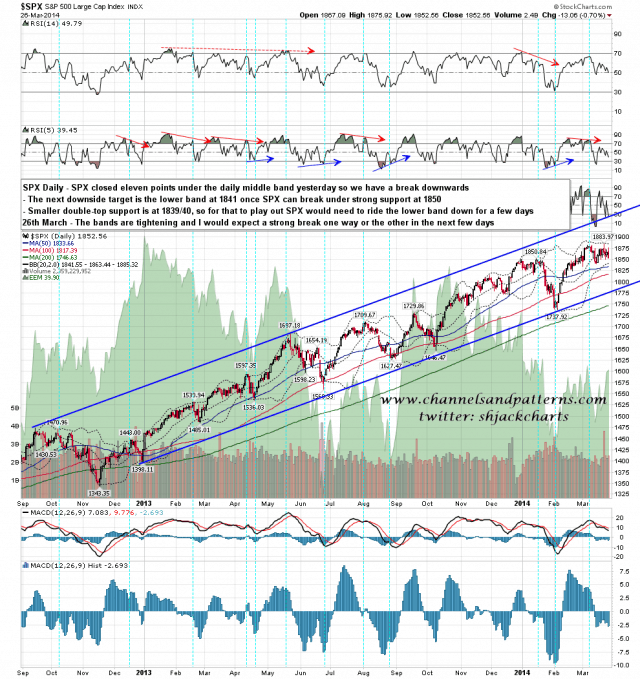

SPX held 1874/5 resistance yesterday morning and then declined strongly to close eleven points under the daily middle band, which is a definite break downwards from the middle band. The next target is the lower bollinger band at 1841, just above double-top support at 1839/40. SPX daily chart:

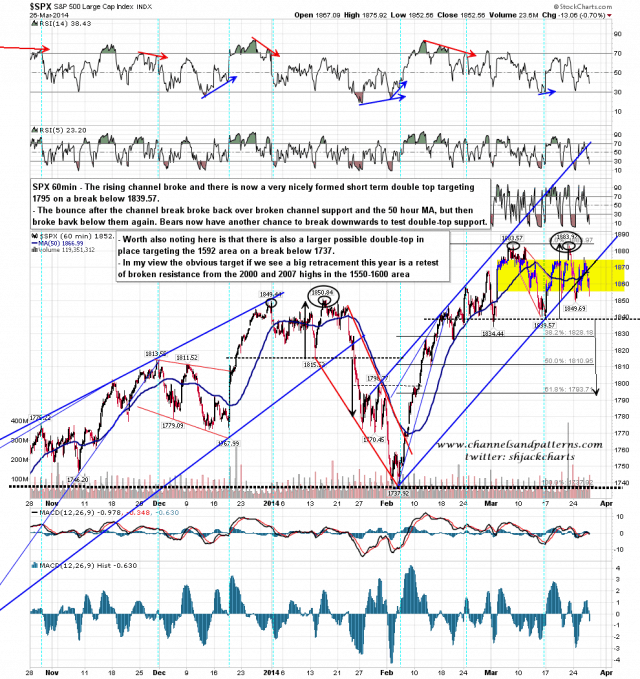

Now that SPX is near the bottom of the current range again the question is whether SPX can break below strong support at 1850 and test double-bottom support at 1839/40. If we do the same today as we have in the last few days, with an AM high followed by a strong decline, then we will no doubt find that out this morning. Worth mentioning that AM high followed by weakness is a bear trend characteristic just as AM low followed by strength is a bull trend characteristic. SPX 60min chart:

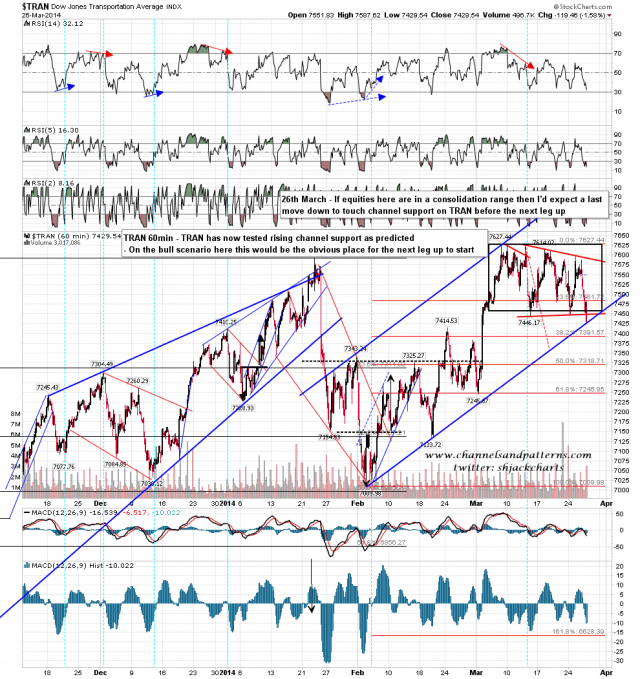

Yesterday morning I was saying that if we are in a consolidation range rather than forming a double-top, then I would expect another swing down to test rising channel support on TRAN. That rising channel support was tested at the close yesterday (buffs fingernails modestly). If this is a consolidation range then this channel support touch should be the springboard for the next move up. If this is a double-top on TRAN, Dow and SPX, then channel will break. I’ll be watching that with interest this morning. TRAN 60min chart:

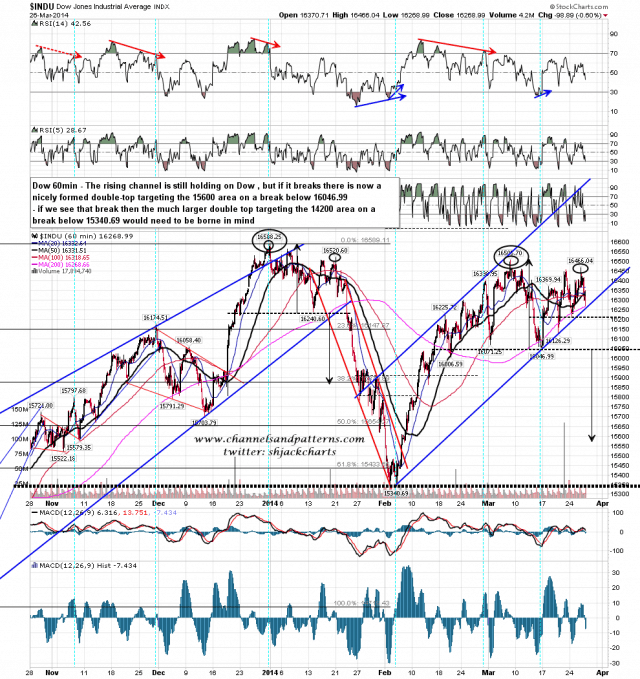

Strengthening that channel support setup on TRAN is the rising channel on Dow, which is close to retesting channel support for the fourth time in two weeks. it’s worth mentioning that repeated trendline retests in a short timeframe like these generally result in a break downwards. Dow 60min chart:

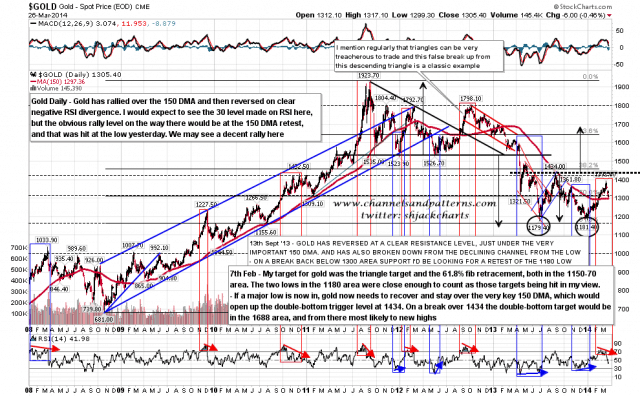

On other markets Gold is at an interesting stage. The strong rally from the last low topped out on negative daily RSI divergence, and the retracement from that doesn’t look finished yet as the daily RSI has not yet tested the 30 level. Gold is now retesting the very important 150 DMA however and that is an obvious level from which to see a strong rally. Gold daily chart:

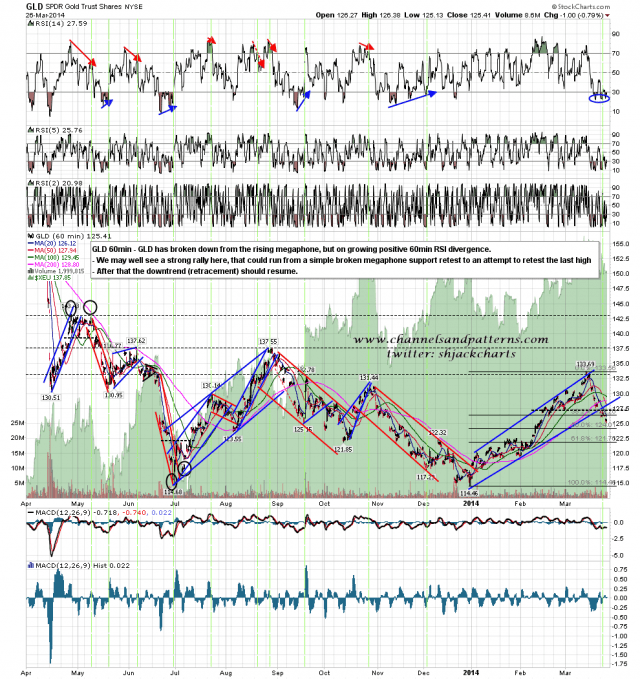

The GLD 60min chart looks encouraging for a rally here. The rising megaphone from the low has broken down, which strongly suggests more downside later, but in the short term the 60min RSI is oversold and showing increasing positive divergence. GLD may well rally here. GLD 60min chart:

I continue to lean towards a break down and then those double-tops playing out, but we could see a last rally first from here before that happens. one way the other though, SPX will break up or down from this range in the near future, and when that happens the direction of the break should be respected.