A quick and early post today as I need to be away at a funeral all day.

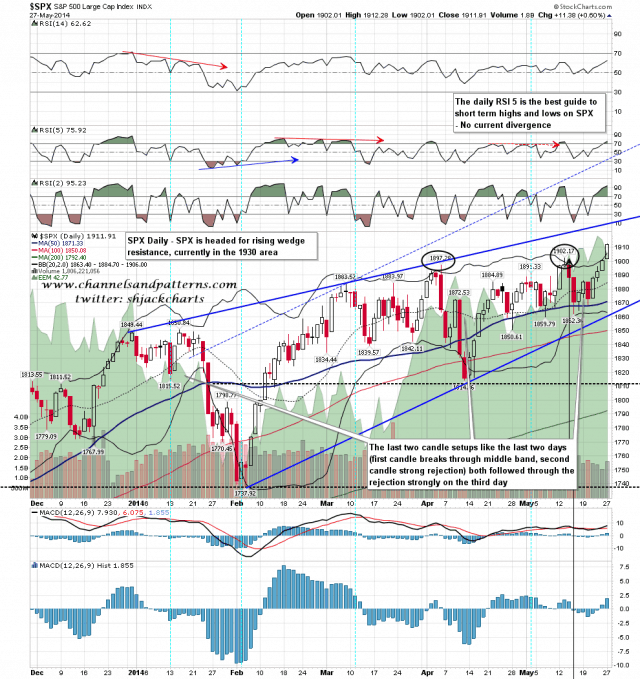

Yesterday was the second day of the current ride up on the daily upper band, and SPX closed the day six points above the band. That most likely limits upside today somewhat but 1920 would still be in range. I’m not expecting this band ride to end yet but if it does then middle band support is in the 1885 area. SPX daily chart:

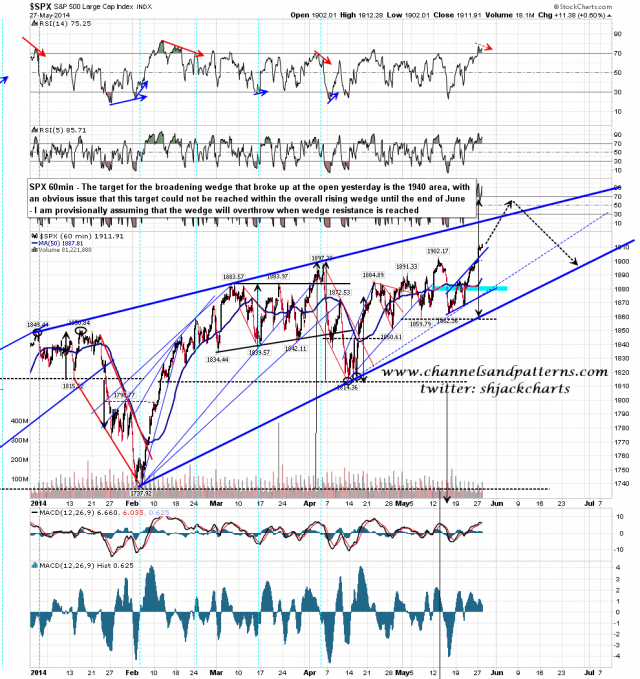

SPX gapped above the megaphone upper trendline that was resistance on Thursday and Friday, and the megaphone target is in the 1940 area. There is a slight issue with that, in that in order to reach that target within the current overall rising wedge, then that wouldn’t be able to happen until the end of June, which seems rather too far away. The megaphone may fail to reach target but for the moment I am assuming that there will be a bearish overthrow and have marked up the chart accordingly. SPX 60min chart:

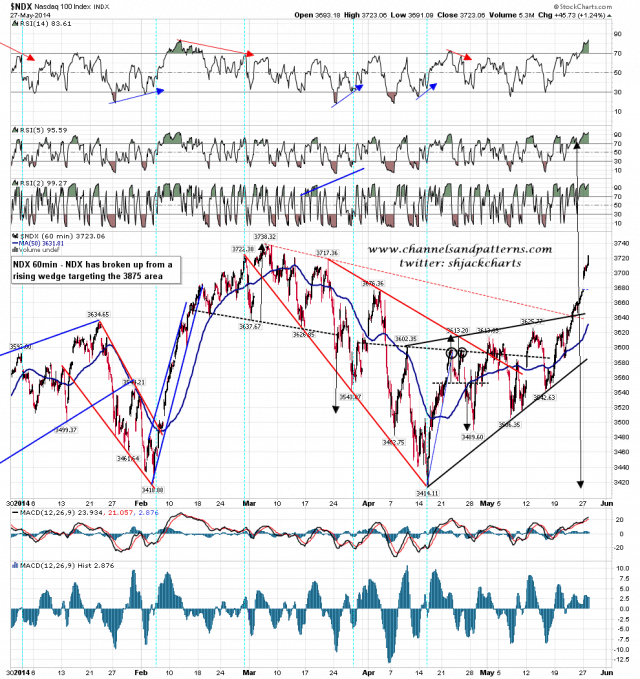

NDX broke up from a rising wedge with a target in the 3875 area at confident new highs. NDX 60min charts:

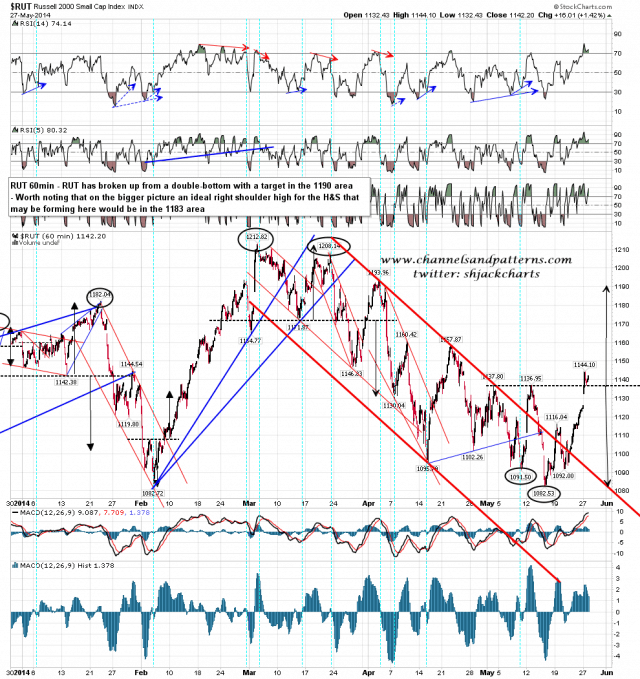

RUT broke up from a double bottom with a target in the 1190 area. That is close to the ideal right shoulder high for the possible larger scale H&S forming on RUT, which I gave in the 1182 area a few days ago. RUT 60min chart:

Yesterday was an impressive break up, and assuming that yesterday’s opening gap on SPX doesn’t fill, that was an breakaway gap on SPX backing up the higher upside targets on SPX, NDX and RUT. I have no reason to think that these targets won’t be made. We may see some weakness today and I’m wondering whether we will see a retest of broken megaphone resistance in the 1903/4 area.