The bears had a real shot at breaking this uptrend yesterday morning, but they blew it, as usual. That of itself would have been bullish but today is also Tuesday, and Tuesday has been up 17 of the last 19 sessions, a formidable track record. I’m leaning bullish today until demonstrated otherwise.

I’m going to keep it short as I will be doing a precious metals post three or four hours into the session and I’ll look at three US equity indices to see what they can tell us about support and resistance here.

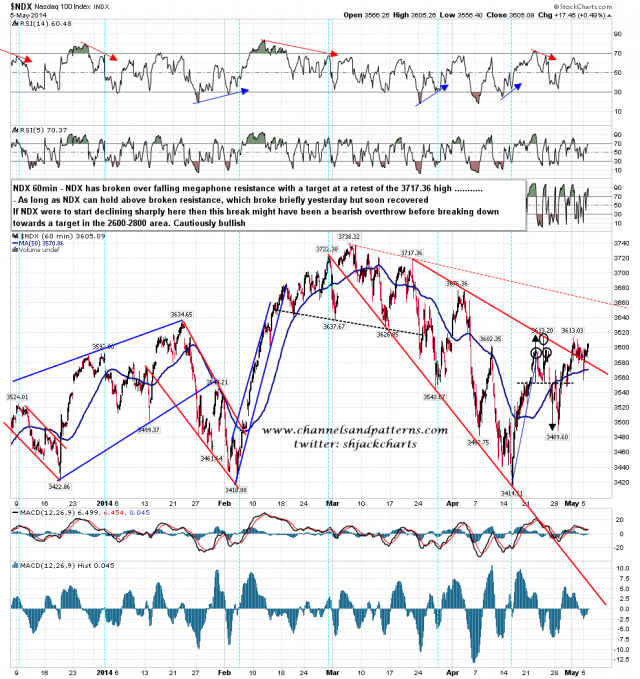

First is NDX, where the break below broken megaphone resistance was very swiftly reversed yesterday, and unless that changes today the pattern target is a test of the 3717.36 high. Making that target should at the very least have SPX testing the 1897 high, and might carry it considerably further. NDX 60min chart:

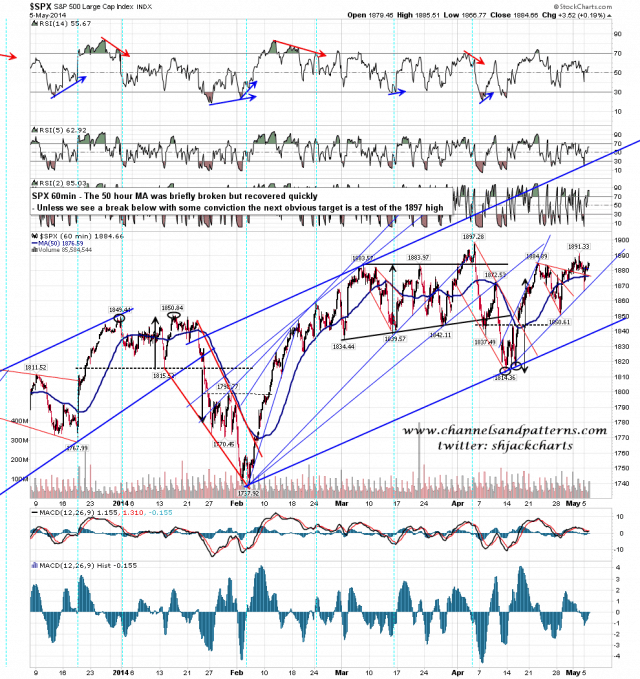

On the SPX 60min chart the 50 hour MA was also broken at the open yesterday, but swiftly recovered. That is first support, and there is now a strong rising support trendline in the 1870 area. That is now important support and a break below that would be a sign of real weakness. SPX 60min chart:

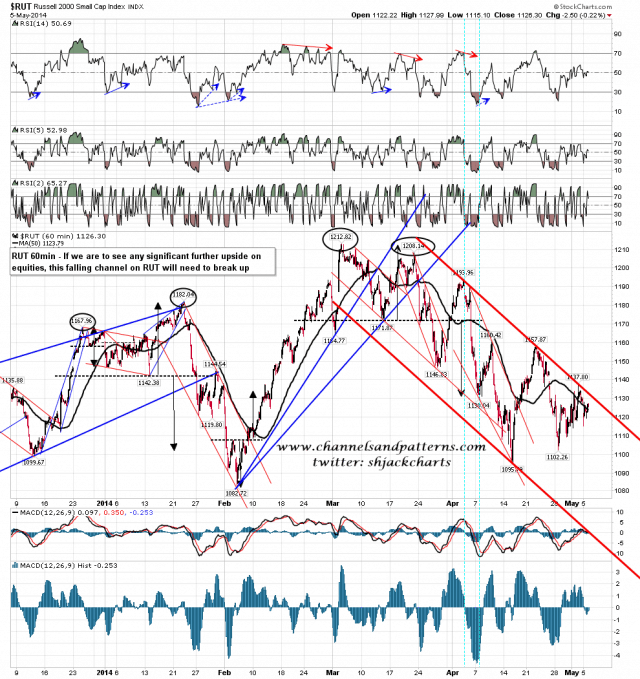

There’s a lot of talk that a new impulse wave up is getting under way here, and that could be right. If so however, it’s unlikely to get far unless falling channel resistance on RUT can be broken. That might survive SPX testing the 1897 high, but it’s hard to see it allowing a move much higher. I’ll be watching that on any retest of 1897, and if it breaks up then that will open a path for further upside. RUT 60min chart:

So there we have it this morning, three indices each telling us part of the story. NDX gives us an ambitious upside target. SPX shows us where to find strong support for any move up. RUT will cap any weak move, and the channel there will break to confirm a strong one. It looks as though there will be a decent AM dip today, and that should be a buy.