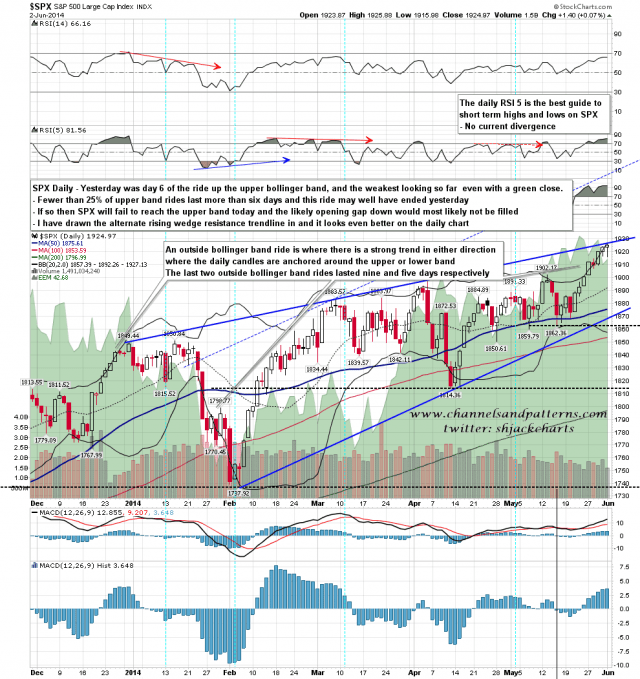

Yesterday was the sixth day of this ride up the daily upper band, and may well have been the last. Albeit SPX closed green it was the weakest day of the band ride so far, and never quite reached the upper band during the day, though it closed not far short. Fewer than 25% of band rides last more than six days, and fewer than 15% more than seven days, so the band ride is most likely over or ending shortly.

SPX has not quite reached my ideal rising wedge resistance trendline in the 1930-2 area, but it has hit an alternate and perfectly valid trendline at the high yesterday, so while SPX may go higher, equally it may not. If the high was yesterday then in all probability the likely opening gap today will not be filled. SPX daily chart:

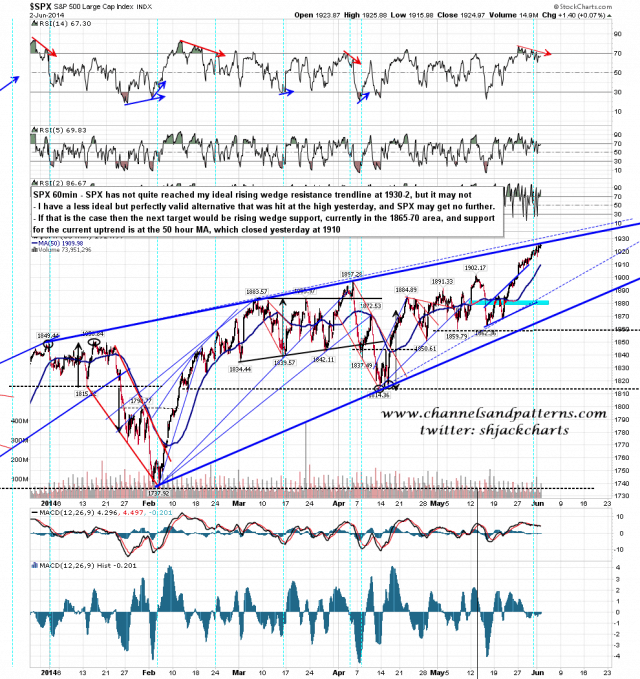

On the 60min chart I have also drawn in the alternate wedge resistance trendline as the primary, and if that is correct then the obvious next target is wedge support, currently just under 1870. Key support for the current uptrend is the 50 hour MA in the 1910 area, and if that breaks with any confidence that will open up wedge support as a target. SPX 60min chart:

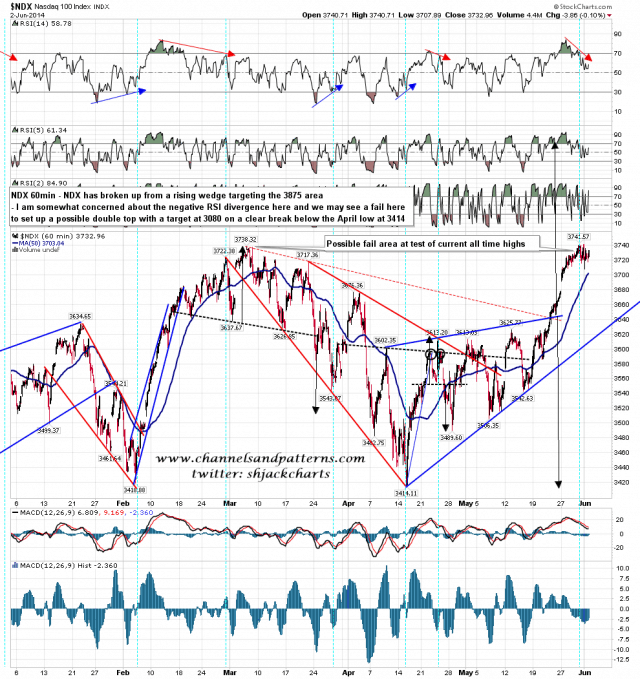

NDX looks as though it is failing at a marginal new high and I’m not seeing any support for more upside on this chart. NDX 60min chart:

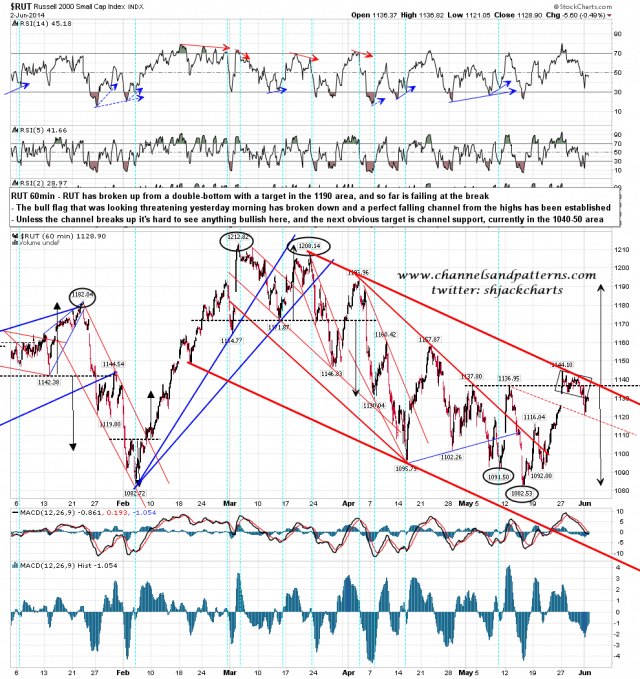

The RUT chart looks positively toxic for bulls here. Not only has the possible bull flag I was looking at yesterday morning broken down, but there is now a large falling channel from the high established. Unless that channel breaks up the obvious target is falling channel support in the 1040-50 area (and falling of course). RUT 60min chart:

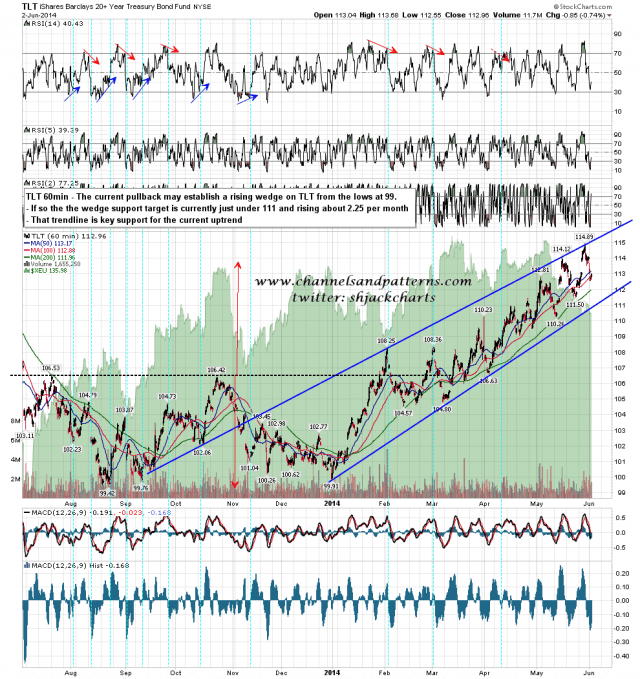

I’ve been considering the shorter term pattern options on TLT and the current retracement may well crystallise this uptrend as a rising wedge. I have rising (possibly wedge) support just under 111 at the moment. TLT 60min chart:

SPX, NDX and RUT all look tired here, and at the least I am expecting a decent retracement soon. It’s possible that the spring high on SPX was made yesterday afternoon, and if equities start to fall hard that is something to bear in mind if trying to buy that dip.