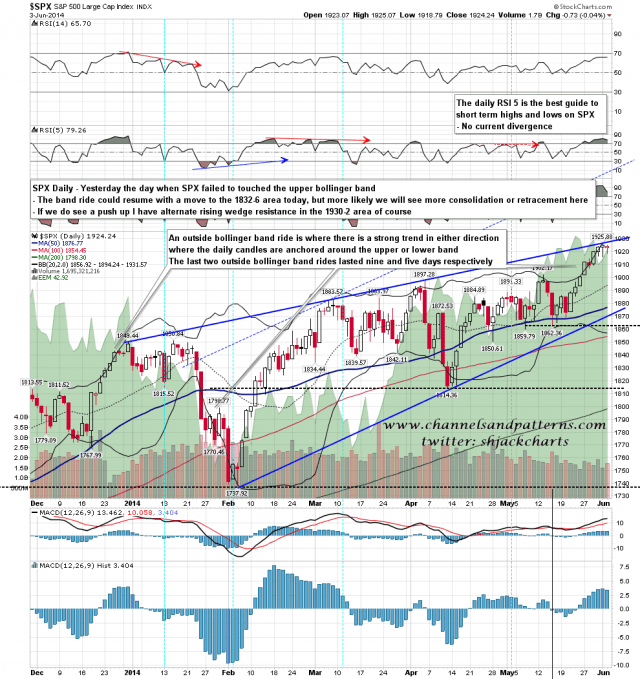

After a six day band ride SPX fell away slightly from the daily upper band yesterday, though it didn’t fall far, and the promising bearish look of the open faded swiftly. It is still possible that the band ride could continue another day or two, but if so we would need to see SPX return to upper band resistance today, and that would be in the 1932-6 area. It’s more likely however that we will see more retracement or consolidation over the next day or two. SPX daily chart:

n terms of potential bullish headroom here there is still some on the weekly chart.as primary rising channel resistance from 2011 is in the 1950 area. I’m not expecting that to be hit before a substantial pullback, but there is a lower probability option that would allow that hit. SPX weekly chart:

In terms of the 60min chart SPX is still making higher highs and lows and if the bears are to get any kind of shot here, that sequence needs to be broken. I have main uptrend support at the 50 hour MA, now in the 1815 area, and on a decent break below I would see the impulse move up over the last couple of weeks as over, though that wouldn’t rule out a subsequent retest of the highs as part of a topping process. The RSI 14 setup on this chart is bearish, that doesn’t always deliver a pullback but it usually does. SPX 60min chart:

NDX is trading sideways, again with a strongly bearish cast to the 60min RSI 14. On the bigger picture it’s possible that NDX has just made the second high of a significant double-top. NDX 60min chart:

RUT looks dead in the water here, with few buyers and a very nice looking falling channel from the March high. This is unambiguously bearish and the first job for bulls wanting a general move up here would be to break that falling channel. RUT 60min chart

TLT is reaching a point of decision on this pullback. I have rising wedge support in the 111 area and that is key rising support for the current uptrend. If that should break I would have a small double-top target at 108.11. TLT 60min chart:

I’m coming into the day leaning bearish. ES just broke yesterday’s low which is encouraging. If SPX can deliver a decent break below yesterday’s low in RTH at 1918.79, then I would have a small double-top target in the 1911.8 area. I’ll be out for the first three hours of trading today.