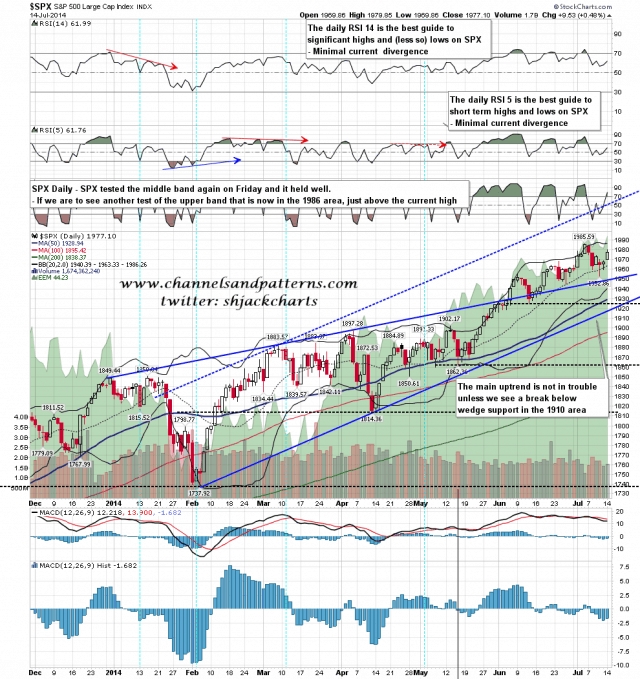

I’ve had a few questions about the candle stat I’ve been looking at and answered those on twitter yesterday. Only two of the reversals made a lower low at the hit of the lower band and all went on soon to make new highs. This isn’t a particularly bearish stat on the bigger picture, it is just striking that all three of the past instances of these candles going back to 1993 all then hit the daily upper band on SPY in 5 to 7 days after this rare candlestick, and then plunged to the lower band in the two to three days after that. Will that repeat again here? Who can say? I’ll be watching to see whether it does with interest though, and if it does, it should set up a decent buying opportunity there.

If we do see a move to retest the upper band, or close to it, then that is now at 1986, just above the current all-time high. The SPY upper band should be a couple of points lower and two out of three previous instances made marginal lower highs. SPX daily chart:

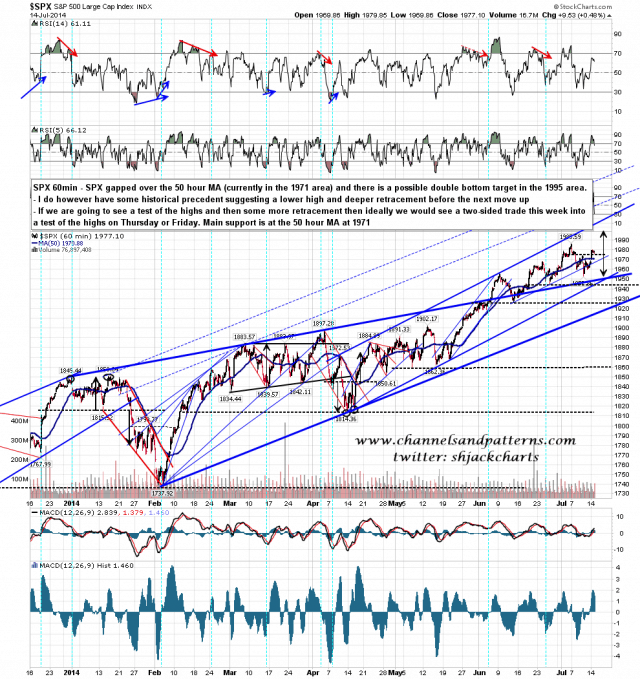

On the SPX 60min chart main support is the 50 hour MA at 1971 and I’ll be leaning bullish as long as that is not broken with confidence. SPX 60min chart:

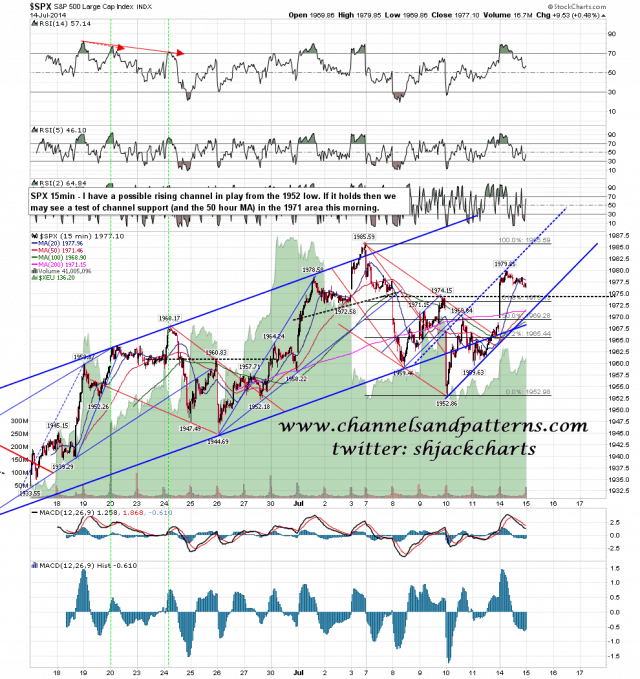

I have a possible rising channel forming from 1952 and if that holds then we may well see a test of channel support and the 50 hour MA at 1971 this morning. SPX 15min chart:

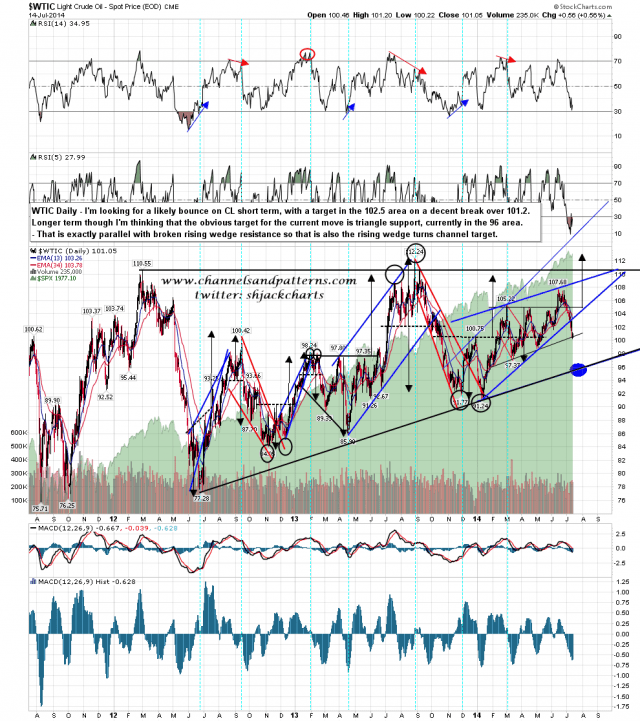

The short term bounce setup I was looking at on CL yesterday morning has come apart on the break below 100, but the chart I did for this morning is still relevant as it shows my preferred main target for this move at 96. At this rate that could be reached sooner rather than later. WTIC daily chart:

Unless we see a break back below the 50 hour MA on SPX I’m leaning bullish here. If we see slow sideways to up action that would fit with the stat I’m watching, which would have the intraday test of the SPY daily upper band between Thursday and Monday, with the hit of the daily lower band two to three days after that.