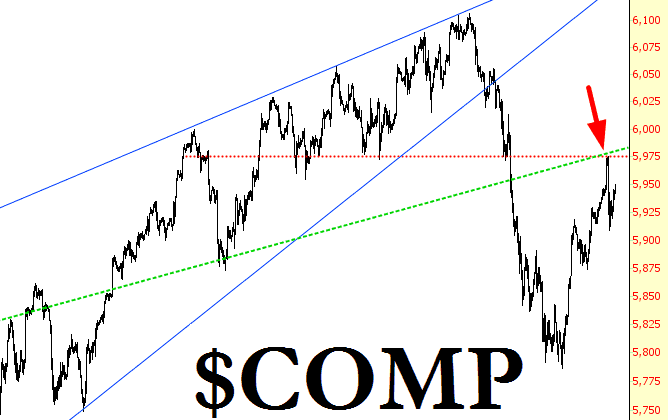

The past three weeks are simply characterized: the first two, a swift, reliable slump, and the third, a robust bounce-back which, at the end, lost its steam. It’s week four – next week – that is on my mind, because – simply stated – the market needs to re-weaken to constitute a discernable rhythm and pattern. If we get more strength next week, a lot of charts are going to get messy and much harder to interpret for bulls and bears alike. The reversal on Friday, marked below with an arrow, could be a crucial starting point.

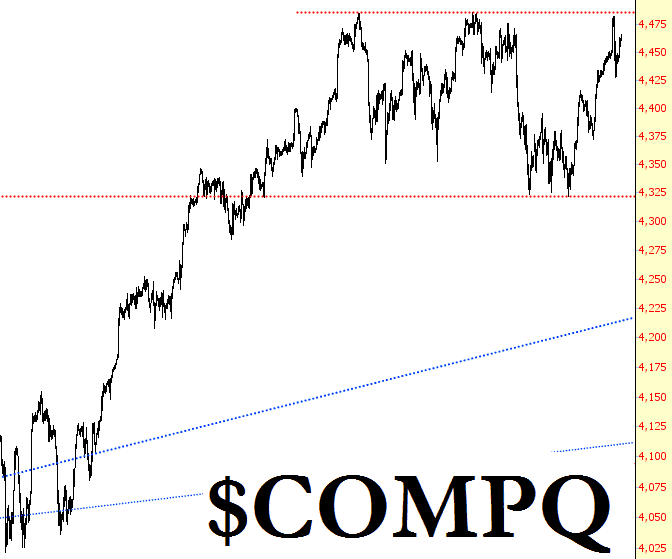

The NASDAQ has been much stronger than the Dow or S&P recently. Even during the couple of weeks of weakness that we had, it wasn’t particularly weak itself. It may be completed a triple top now.

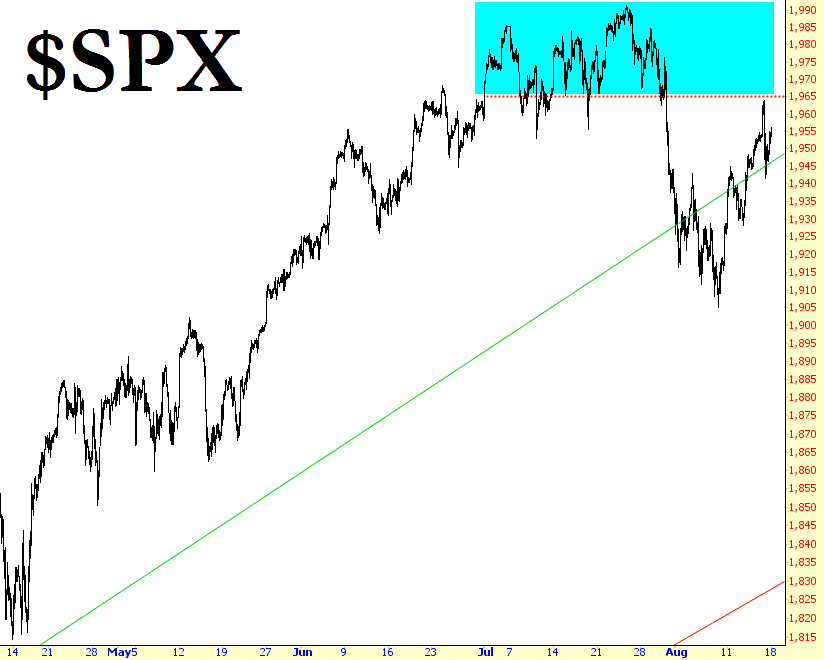

Most indexes have an easy-to-see topping pattern, and the surge from Friday-to-Friday pushed us from an oversold state right to the doorstep of that overhead supply. I say again: we’ve got to fall in the week ahead, probably right from the get-go.

The guidepost for me is the VIX chart, which I’ve shown before, and I’ll probably show many times again in the weeks ahead. It is stomach-wrenching to hold on tight to a huge short portfolio (particularly on mornings like Friday, where it seemed like everything would just keep zooming, until the rug got yanked out). But what makes sense to me is for the market to weaken enough in the next month or two for the VIX to get to almost 22. For that I shall wait.