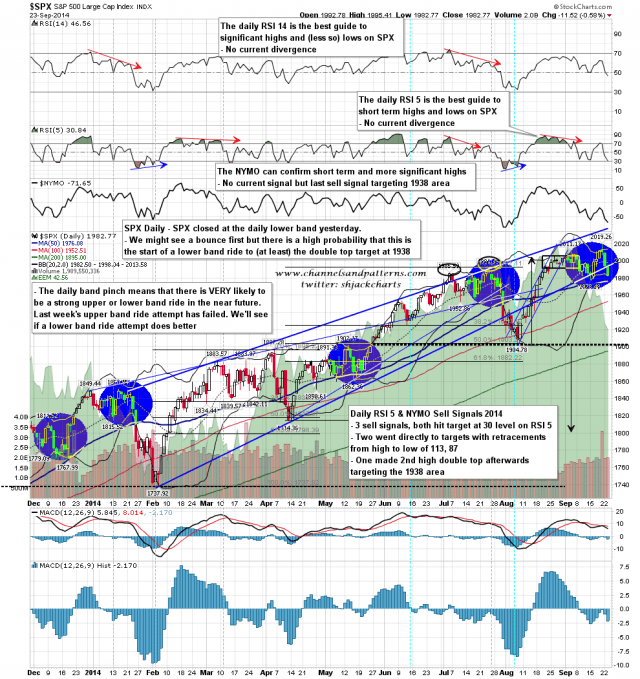

Last Wednesday I was warning that the odds were better than two to one that SPX would make a marginal new high and then come back to make a lower low, and SPX came within four points of making that lower low yesterday. You can see that post here. SPX hasn’t made that new low yet, but the RSI 5 / NYMO signal that I was using to make that prediction has now made target as the daily RSI 5 closed at 30.84 yesterday, and there is a visual hit of the 30 level on the chart, so I’m treating that signal as completed to target.

That isn’t quite the end of the story though, as there is still the matter of the lower low outstanding, and also the matter of the double top that has now formed on the SPX chart, targeting the 1938 area on a break below the last low at 1978 48.

Looking at the nine previous examples of this sell signal that made a new high and then reversed back down, it’s worth noting that all nine made a lower low, so the odds that SPX breaks 1978.48 here are very high. Of those nine though, three went on to make a marginal new high that was the second high of a clear double top setup, as this one has as well, and all three of those went on to break double top support (at 1978.48 here) and then play out to the double-top target, which in this instance is 1937.70, so history is leaning strongly towards a hit of 1937.70 in the near future, albeit from a sample size of only three for this permutation of this sell signal. For the moment therefore I am assuming that we should at least break lower than 1978.48 (very high probability), and then make the double-top target at 1937.7 (high probability).

Looking at yesterday the close was on the daily lower band, and that is supporting the start of a lower band ride down to the 1937.7 target. There is also an obvious target, and possible support, at the 50 DMA, now at 1976. SPX daily chart:

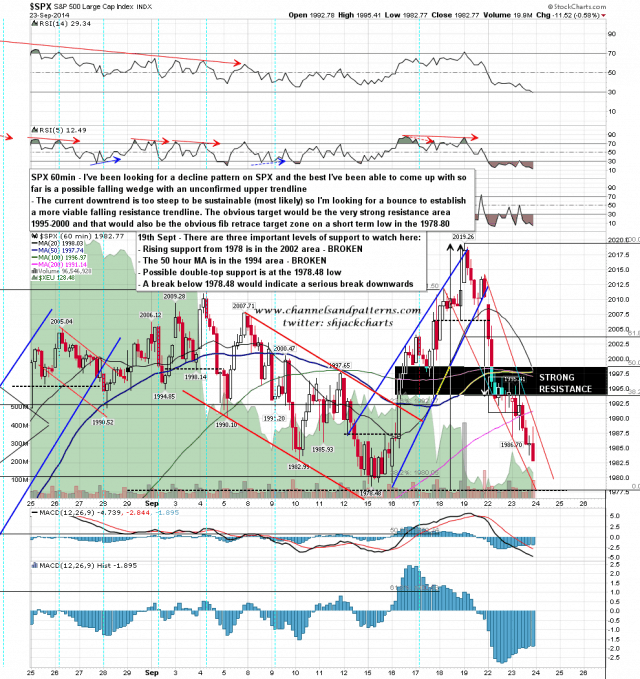

What are we likely to see today? Well the move down from the high has been very fast so far, and I haven’t yet managed to identify a decent decline pattern from the high, as I have a decent support trendline, but a weak resistance trendline. I have a tentative falling wedge, and I think we may see a break up from that wedge soon to establish a decent declining resistance trendline for the next leg down.

If that happens then I’d expect the wedge to break up, then a reversal pattern should establish, either a double bottom or IHS, then a break up to a fibonacci retrace target that in this case should be either the 38.2% or 50% retracement.

The target area for that dead cat bounce would be the 1995-2000 SPX area, with both of those fibs close by, and with a confluence of resistance levels there including:

1998 – hourly 50 MA

1998 – daily middle band

1998 – hourly middle band

If we see this hypothetical bounce then that resistance area should not be broken. I’d be leaning towards seeing a lower low today before such a bounce and that bounce would ideally come from a low within the 1974-81 area. I’d prefer the 1978.48 level to be unbroken before the bounce as that would improve further the odds that overhead resistance would hold. SPX 60min chart:

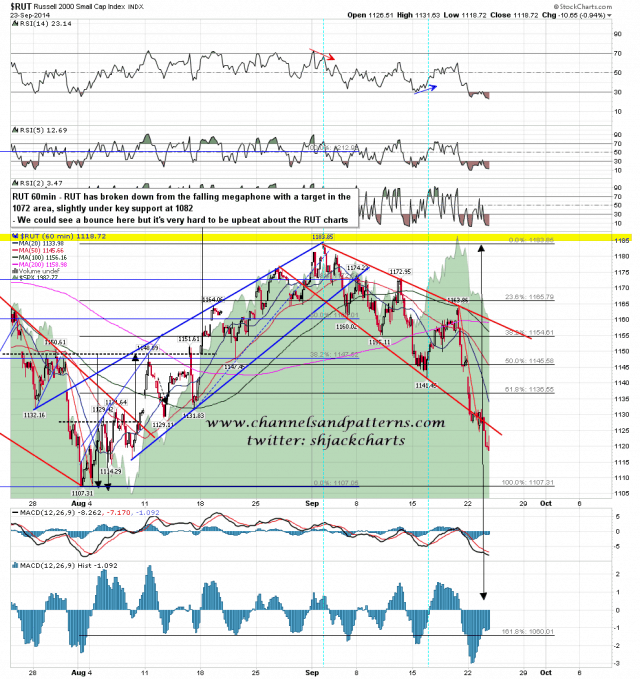

RUT has clearly broken down from the falling megaphone with a target in the 1072 area, just below key support at 1082. RUT has serious and urgent unresolved business to the downside. We could still see a dead cat bounce though. RUT 60min chart:

I’m expecting a low below yesterdays low in trading hours today and we may well see a strong bounce develop from there. Unless SPX can get back over 2000 and hold it, the next move down should target the 1938 area.