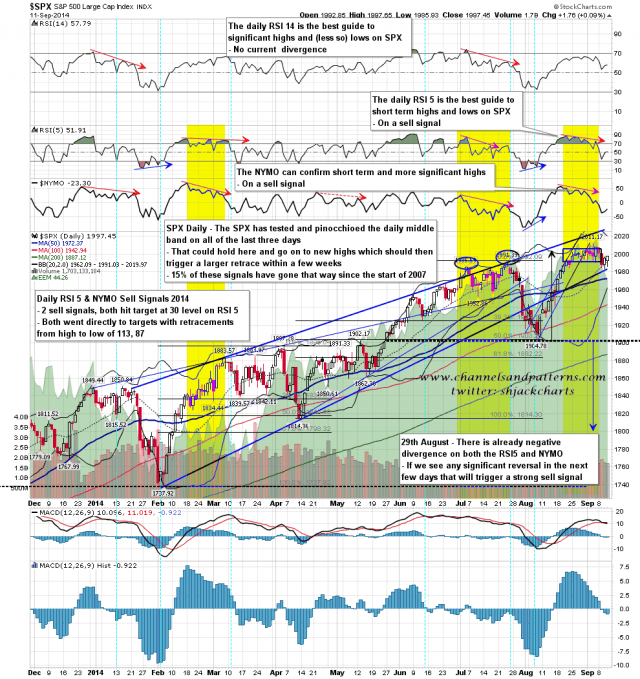

For the third straight day SPX tested the daily middle band, pinocchioed below it, and closed well above it. My RSI 5 / NYMO signal stats notwithstanding, if the bears can’t break below the daily middle band then this retracement has most likely bottomed out and we are on the way back up. SPX daily chart:

The falling wedge on the 60min chart has now clearly broken up, and is close to a test of both the hourly 50 MA at 1998, and possible (bull flag) falling channel resistance at 1999. We may see a test and reversal there today, and if so the falling channel support is in the 1978 area now. If SPX breaks over 1998/9 then I’ll be looking for (at least) a test of the highs. SPX 60min chart:

I’m also watching the possible bull flag on the Dow chart. I have possible (bull flag) falling channel resistance there in the 17095 area. INDU 60min chart:

Oil made my downside targets yesterday, testing possible double top support at 91.24 and reaching my H&S target at 90.5. So far oil is bouncing strongly after making the H&S target and if it can break back over 96, I would have a double bottom target in the 101.50 area. If oil breaks and holds below double top support at 91.24, then I would have double top targets in the 77.28 (conservative) and 70.24 (full technical target) areas. WTIC daily chart:

My RSI 5 / NYMO stats put the current retracement from the highs as the smallest (though only marginally) of any of the 29 similar signals since the start of 2007, including the failed ones. Nonetheless SPX shows no sign of wanting to go lower at the moment, and as long as the daily middle band holds as support there is no realistic prospect of going lower.

I think the takeaway from this stat here is that the bear case shouldn’t be written off altogether yet. Bull flag resistance at 1998/9 may hold today, and on a break higher SPX may fail under, at, or just above the current all time high at 2011. If so these might set up a larger retracement that would not be an extreme statistical outlier. If a new high is made with any confidence however, it’s then important to remember that the average flag is a mid-trend pattern, so on that basis the target might be the 2085 area.

For today key resistance is at 1998/9, and a break above would target a test of the highs. Daily middle band support is now at 1991, and we have seen five point pinocchios below that on each of the last two days, so anything down to 1986 would fit with that. Despite the bearish RSI 5 / NYMO stats here, I think SPX may well break up shortly, and if so, then it may well break up hard. There is currently some strong resistance in the 2025-35 area which would be the obvious target if SPX does break up here.