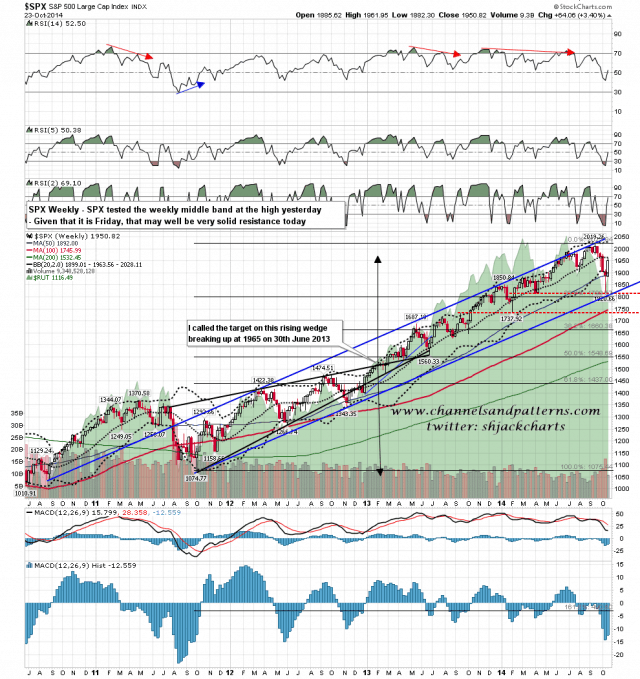

SPX broke above the daily middle band yesterday and tested the 100 DMA. More importantly though, the high yesterday was within a couple of points of testing the weekly middle band. Given that today is Friday that may well be formidable resistance today, and while I’d quite like to see a test of yesterday’s high today, I’m very doubtful about seeing a move significantly higher. This is closing resistance, so only the closing price today is important for that. We could see a move somewhat higher intraday. SPX weekly chart:

So what about all the patterns that broke down on Wednesday? They are all still in play here, and I’m showing the patterns from the lows for SPX, Dow, TRAN, RUT and NDX below to show where they all stand as at the close yesterday.

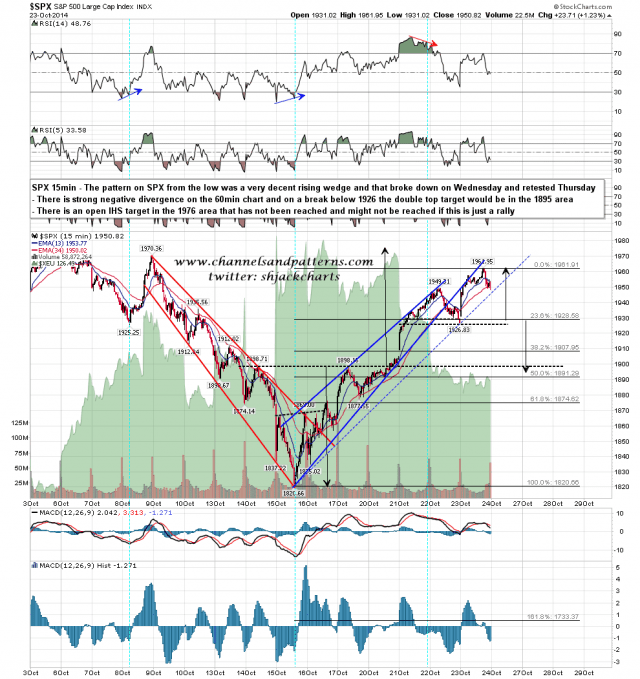

SPX formed a rising wedge that broke down on Wednesday and brutally retested broken rising wedge support yesterday. There is a decent looking double top setup here, and if we can see enough confirming weakness today the strong negative divergence on all the 60min RSIs on these five indices may trigger strong sell signals. This is not a chart I would see as in any way an attractive long here. SPX 15min chart:

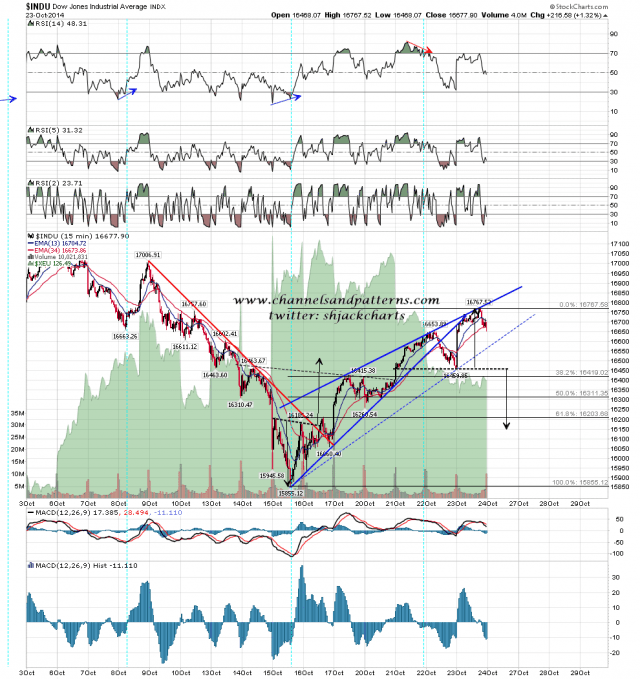

The setup on Dow is very similar to the setup on SPX. INDU 15min chart:

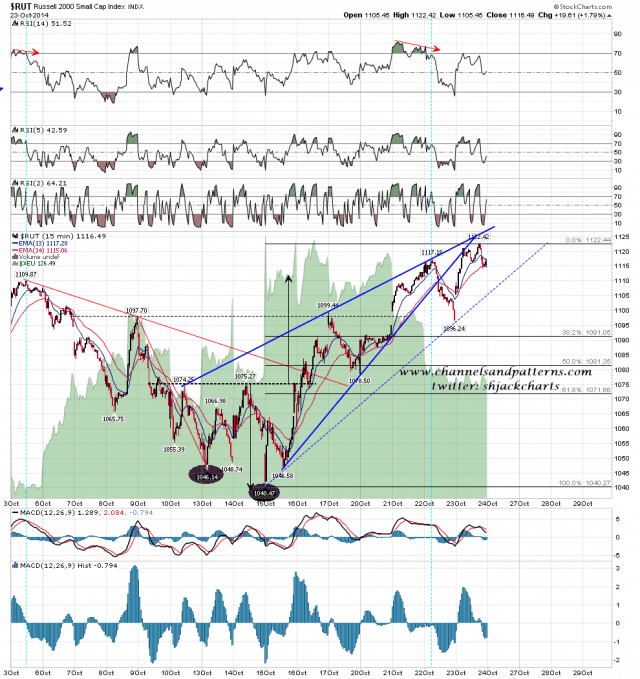

The setup on RUT is very similar to the setups on SPX and Dow, though weaker, as RUT is still lagging the other indices badly. RUT 15min chart:

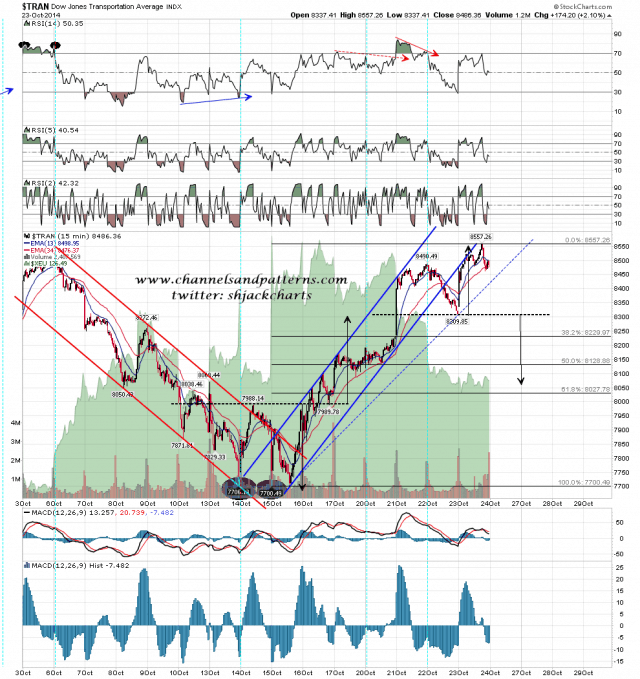

TRAN formed a very decent rising channel from the low that broke down on Wednesday and retested yesterday. Again there is a nice looking double top in play here. TRAN 60min chart:

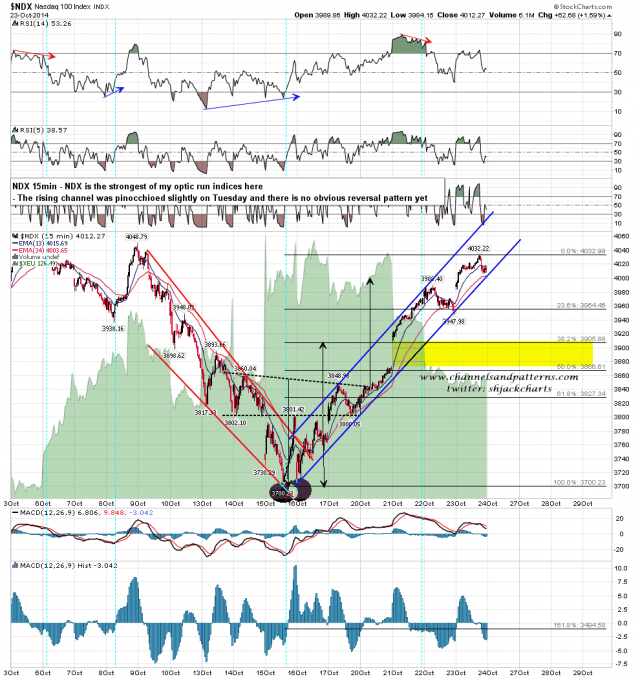

NDX is the strongest of these indices and only pinocchioed the rising channel there on Wednesday. For now I’m treating this pattern as intact and there isn’t an obvious reversal pattern formed yet, though there may be an early stage H&S forming. NDX 15min chart:

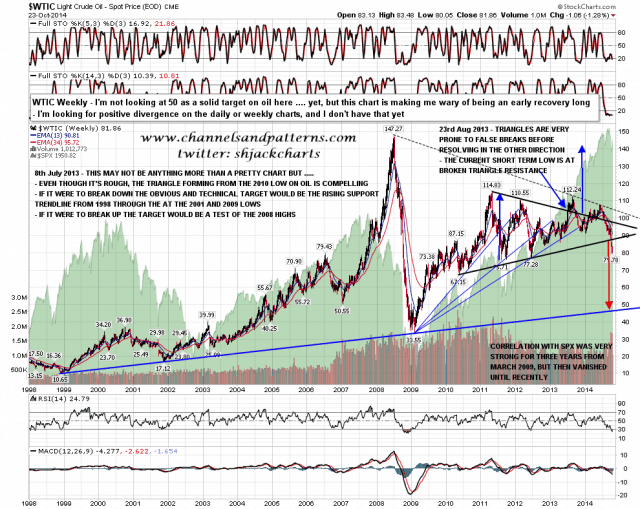

I was asked about oil yesterday and I’m going to post a few charts over the next few days showing where I think we might be on oil. What I would lead with though is the reason that I am unenthusiastic about arriving early to the oil long recovery party.

I posted this WTIC (oil futures in trading hours) chart in July last year, and have posted it a few times since then. What this showed was a triangle on oil that then broke up, which is when I added the note that triangles often break one way before resolving the other way, and then broke down hard. The triangle target would be the 50 area, just above the long term support trendline from the 1999 low.

Am I treating 50 as a serious target on oil? No ….. not yet, but it’s in the mix here, and I’m not wild about oil as a recovery play here until I see some solid evidence that it is really ready to turn back up. That would normally take the form of a strong positive divergence on the daily chart, and I don’t see that yet. I’ll be posting more on the short term oil setup next week. WTIC weekly chart:

So what’s the likely story on equities today? Well I’m not too concerned about Ebola, but then I don’t really do news. I’m aware of the IHS targets overhead (SPX at 1976) that have not yet been hit, but I don’t think we’re likely to see those hit today, and it’s possible that they won’t be hit at all, as these were all secondary reversal patterns, and the first series of reversal patterns that I called on all these indices have all already been hit.

The pattern setups on these equity indices from the lows look bearish across the board, with the arguable exception of NDX, and it wouldn’t take much weakness today to move the negative divergence on their 60min RSI 14s from being a concern to being outright sell signals. We’ll see how it goes today, but after this amazing run up from the lows, regardless of whether we are in an overall bull or bear trend, the short side is now looking a lot more interesting than the long side for at least a retracement soon.