Only three charts today as I’ve had a lot on this morning.

One reason I do my optic run views on my seven main US equity indices is because while SPX is often the technical leader, by which I mean not that it moves fastest, but that it is delivering the cleanest trendlines/patterns and fibonacci retracements, that is not always the case. That leader at the moment is the Dow Industrials, and my first two charts will illustrate why that is.

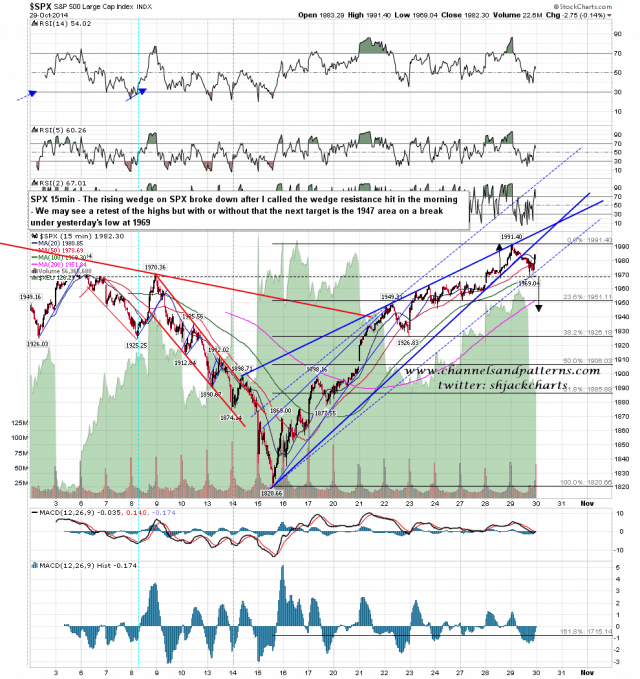

The rising wedge on SPX that I tweeted on Tuesday night hit the very well defined wedge resistance (tweeted at the high yesterday) and then broke down on the frankly very predictable not really news that QE3 had ended in October as planned, and the usual assurances that the Fed would be fighting hard to keep interest rates near zero until the stars fall from the sky. Now those of you who have been looking at my work closely for a while might have wondered why I was giving strong weight to a pattern on SPX that was mediocre due to the poorly defined support trendline, and the answer to that question is of course that ………. SPX 15min chart:

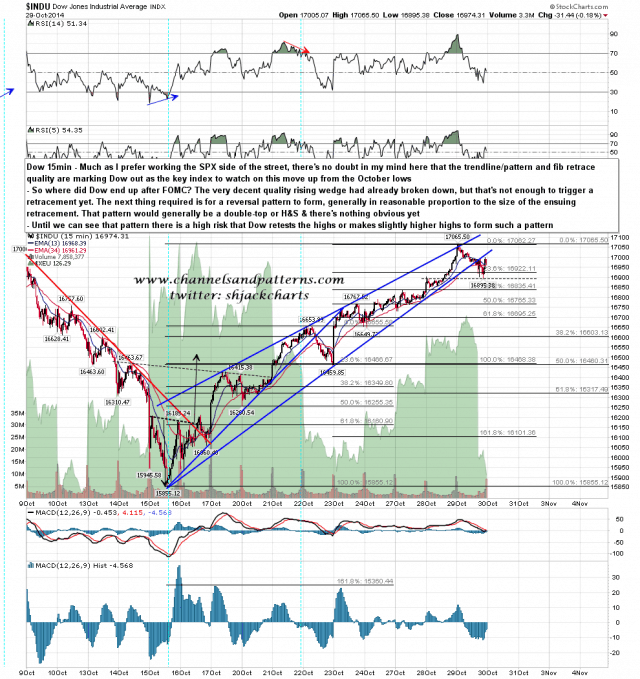

……. it was supported by a far better and directly equivalent pattern on the current technical leader index, which is the Dow. The pattern on Dow is very well formed, overthrew slightly at the high yesterday, and then broke down and retested broken wedge support at the close. At least the main part of this move up from the 1820 SPX low is over, and that overall move may well have topped out, though if so then we may well retrace, retest highs, then retrace more as part of the usual formation of a decent sized H&S or double top. Dow 15min chart:

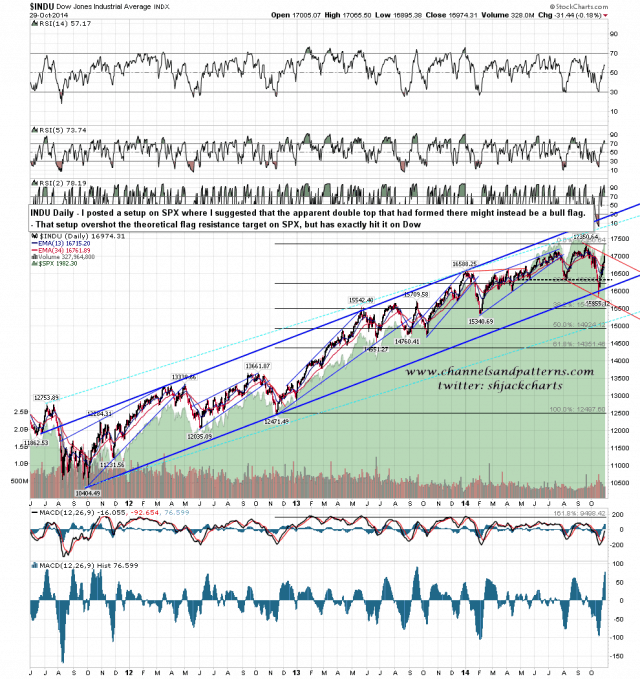

Are there any other implications from Dow being the technical leader here? Yes. I posted an SPX daily chart the other day considering the possibility that the double top that broke down and failed to make the 1789 SPX target was actually a bull flag forming. I see these initially misleading setups a lot on the intraday charts, though they are rarer on the daily and higher timeframes. SPX overshot the ideal theoretical bear flag channel target but here’s how that looks on Dow as at yesterday’s high. Obviously this setup is leaving the possibility open that the October low might be taken out if a retrace here should run away, though it wouldn’t be likely to be broken by much of course. Dow daily chart from 1110:

On a break under 1969 SPX today I’d be looking for a target in the 1946.50 area. If seen we might see a strong reversal there to retest yesterday’s high as a larger reversal pattern forms at these highs.