It can be difficult to identify the pattern for an advance or decline, though at the least it is usually clear in retrospect. Sometimes, as with the move up from 1820, it can be hard to identify even then. This retrace hasn’t been as hard as that, but has been a tough road to identify with these fast whiplash moves and a total of three decent falling channel candidates having established so far. The first that I posted yesterday broke up in the morning, the second had me looking for another two handle move up from the intraday high that never came. The third one however was clear by the end of the day, and with the quality of the trendline anchors and fit so far I’m very confident this is the correct one.

I have channel support in the 2013 area at the moment, declining obviously, and we have see channel support hit this morning. if we see a break below then I’ll be treating that as this channel breaking down, possibly evolving into a falling megaphone, and I’m not sure where the next support above 1998 (50 DMA) might be. Unless we see that break I’m a buyer at channel support, though we may well see a bounce before a hit there. SPX 60min chart:

Bigger picture, yesterday was the second day of a daily lower band ride. As long as that lasts then every day should touch the lower band and anything more 20 points below the lower band should be a decent buy. The lower band closed yesterday at 2028 and the lower band isn’t breaking down hard yet so that level isn’t declining fast yet. SPX 60min chart:

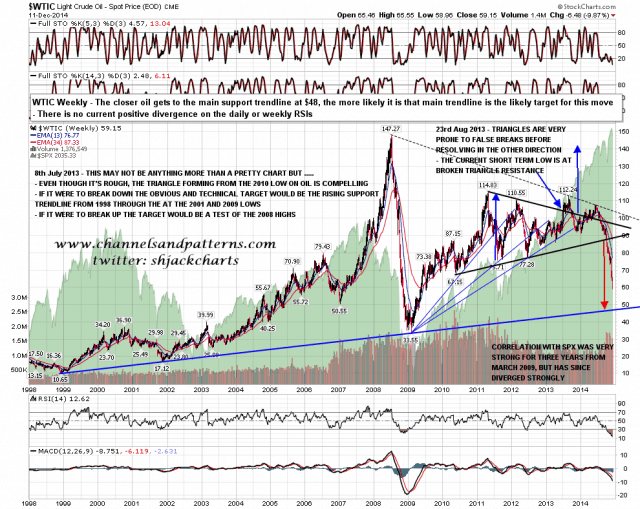

I mentioned the other day that the closer oil got to $48, the more likely it is that the final target of this move is a test of the 16 year rising support trendline in that area. CL has dropped $9 to $58 since I wrote that and I am expecting that test soon. I’d normally expect a strong bounce first though. WTIC weekly chart:

The scale of this retracement is a fairly petite 2.5% so far (RTH) but that range has included some serious volatility. That may feed through into a break below 2000. For the moment though there is a very decent falling channel and I’ll be trading that on the assumption that the channel will hold, with one eye on the exit if it breaks down.