Here it is, Sunday evening, and I am loaded to the teeth with short positions. They tend to be very resource– and energy-oriented, and also emerging markets-oriented, so I’m not that rattled that the ES is, as of this moment, up 5.25. I will say, however, that my principal concern is that recent market history shows a very clear range in the ES, and we are at the bottom of it. We must break to the downside to cease this pattern, but until we do, the “obvious” direction is up to the top of the range again.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Icthus Shorts (Part 3 of 4)

Repeating yesterday’s explanation:

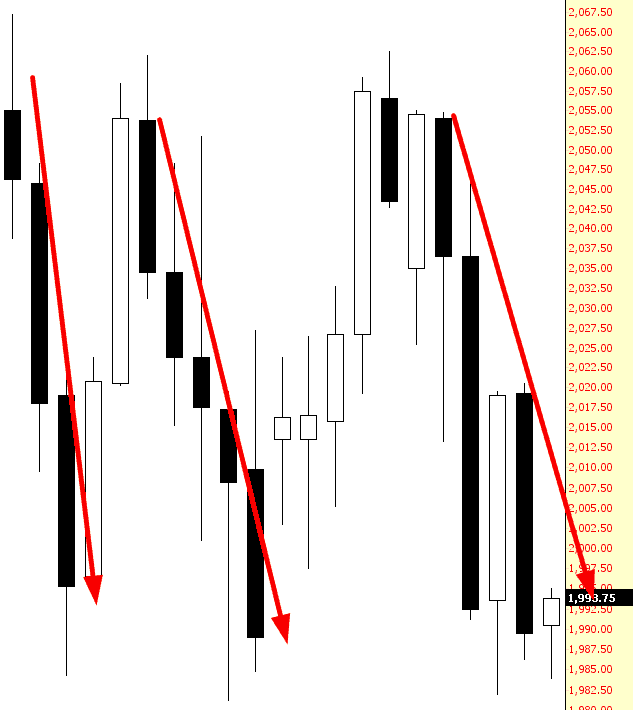

It’s been said that there is an inverse correlation between the confidence a trader has and the outcome of whatever they are predicting. If that’s true, I should be awfully worried, because I am ungodly excited about what’s coming up very soon (probably next week). Simply stated, I think the floor is going to completely be removed from the market. Perhaps my good trading month in January is corrupting my thinking, but I don’t think so.

Anyway, instead of doing videos this weekend, I took the time (and it took a lot of time) to take images instead. I’ve got 88 – count ’em – 88 positions. I have carefully selected my favorite 34 short positions and am sharing them on Slope: a little less than half of them for everyone, and a little more than half exclusively for my Slope+ readers (which, if you aren’t one, you should really consider joining……….since, errr, I’m saving my very best ideas for posts for subscribers alone).