ES had a bit of a retrace yesterday as some of the good news at the end of last week unravelled. The Greek talks have collapsed for the moment, and may well fail as it is plainly in the interests of Greece to leave the euro and default on their debt, rather than continue to destroy their economy by trying to stay inside the Euro. The Ukraine ceasefire seems to be failing as the main parties involved seem to have assumed that the ceasefire would not apply in areas where there is currently much fighting. Any agreement involving the Russians, who gave a firm treaty undertaking in 1994 to guarantee Ukraine’s sovereignty and borders in return for Ukraine giving up their extensive nuclear arsenal, has major credibility issues in any case.

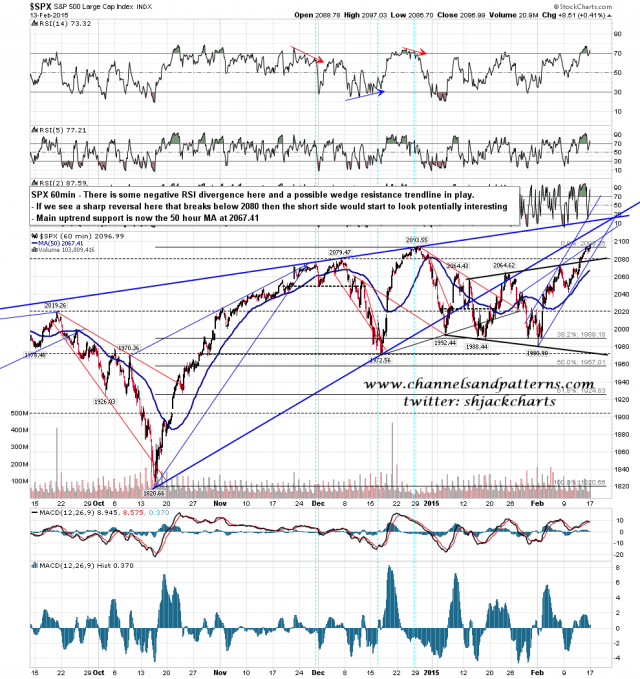

For the moment there is some negative divergence on the 60min RSI and a decent push down here could break that down into a sell signal. I have possible rising wedge support in the 2080 area, and main uptrend support at the 50 hour MA at 2067.40. SPX 60min chart:

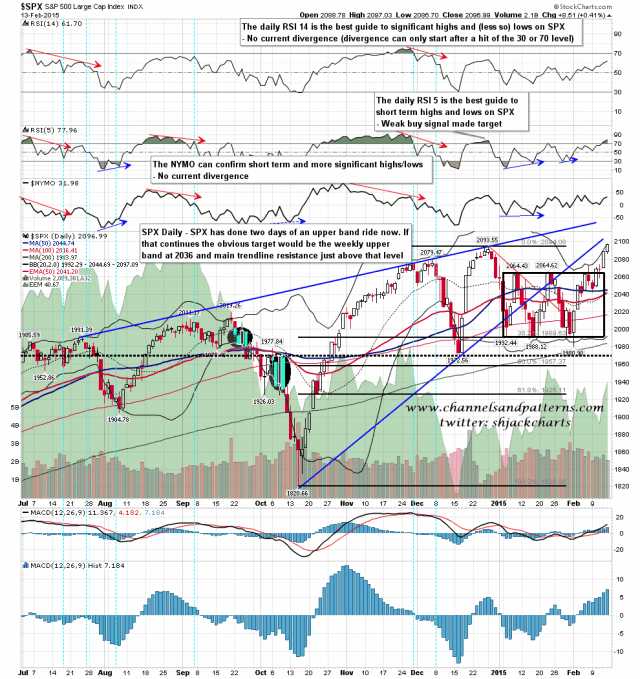

On the daily chart Friday was the second day of a possible 5min upper band ride. This could fail at any time of course, but the bulls have the ball as long as it lasts and if it persists into this week then the obvious targets are in the 2135-50 area. SPX daily chart:

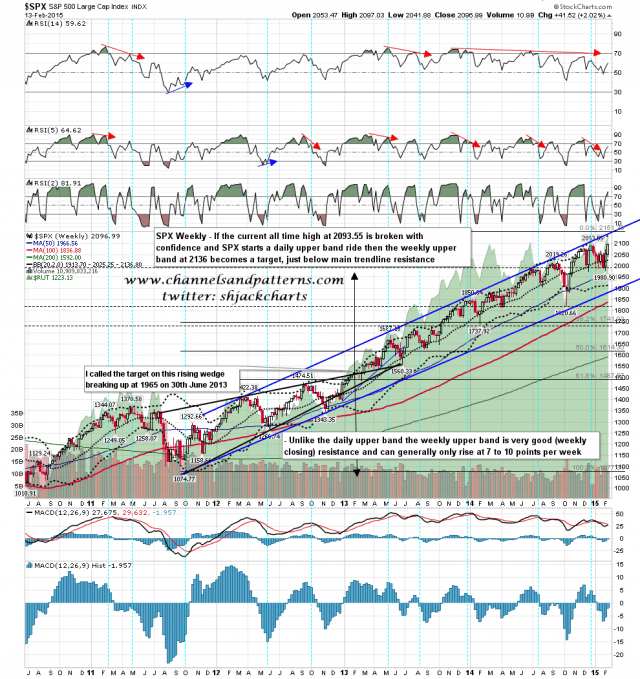

Those targets are the weekly upper band at 2136 and strong trendline resistance in the 2140-50 area. On any move up here I am not expecting that trendline resistance to be broken, though I could of course be mistaken. SPX weekly chart:

As long as trendline support holds (now at 2080 area and rising) there’s there’s little of interest on the short side here. In the absence of evidence to the contrary I’m treating this as a daily upper band ride and the daily upper band, now at 2097 and rising rapidly, as an anchor. An hourly close below the 50 hour MA would get me interested in the short side again.