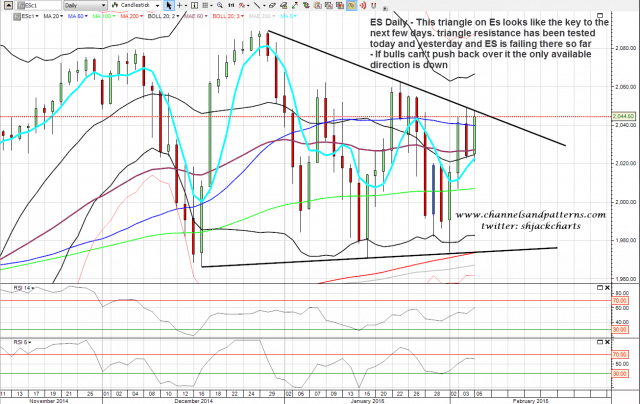

The late decline yesterday was interesting for a few reasons. The most important of those was that it was a failure at triangle resistance on the ES daily chart. That has been tested again in globex and is holding so far. The bulls either break over that triangle resistance today or the only available direction will be down. ES daily chart:

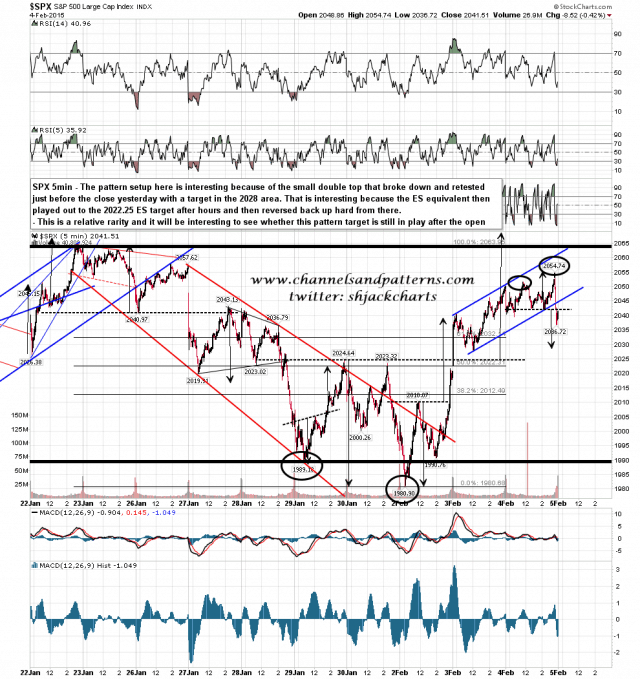

Another interesting point from that decline is the stranded double top that has been left on SPX. That double top formed and broke down yesterday with a target at 2028 SPX. That was just retesting broken support at the close and then the same pattern on ES, with a target at 2022.25 ES, made that target in globex and has since retraced almost all of that decline. Is that SPX double top still in play? We shall find out this morning. SPX 5min chart:

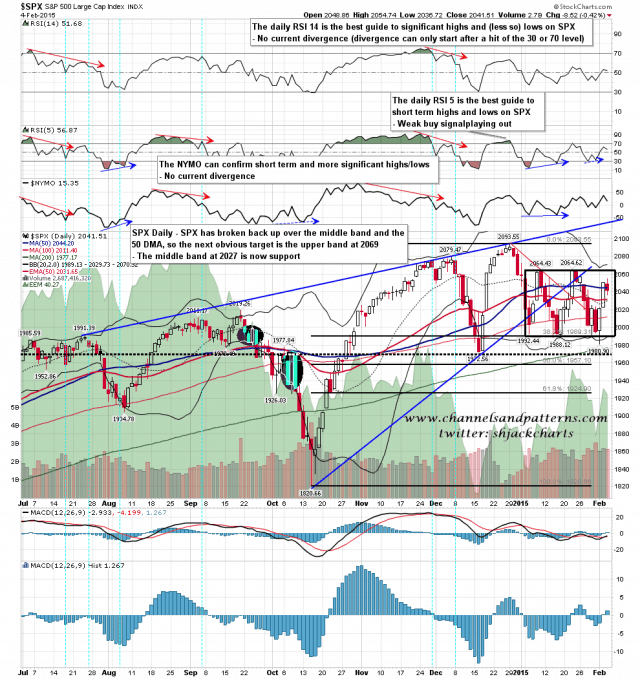

On the daily SPX chart the bulls are in charge unless we see another break back below the middle band at 2030. That double top target, if reached, would be a test of that middle band support of course. SPX daily chart:

Today is all about triangle resistance on ES. Can it be broken? If so can the break be sustained? On a failure there I’d be looking for support at the daily middle band at 2030 SPX. On a strong break down there I’d be looking for another test of range support in the 1990 area.