Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Option Avoidance=Good For Me

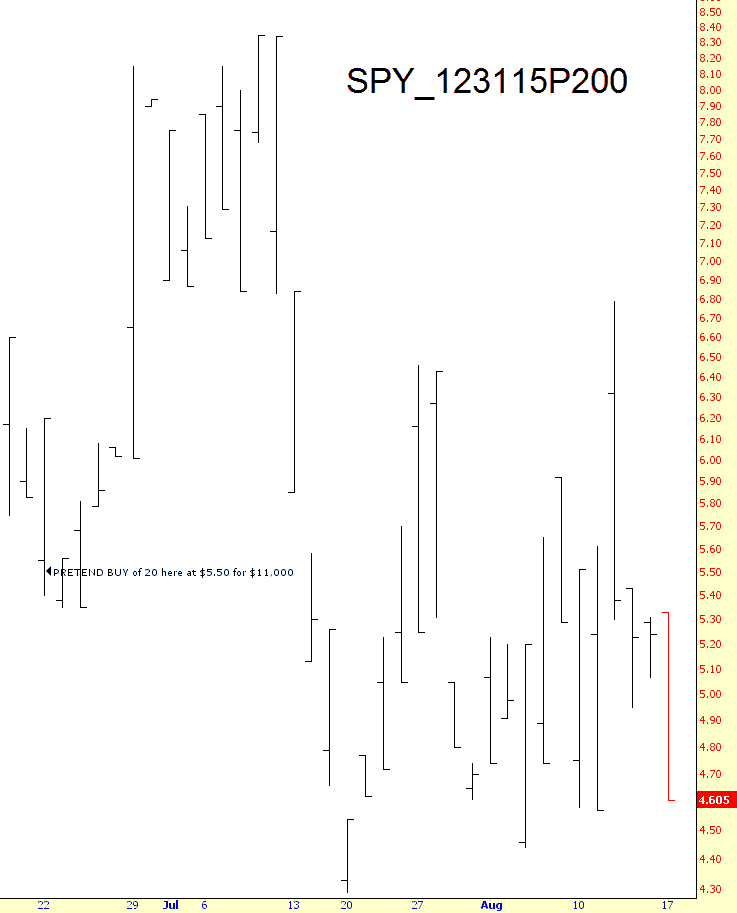

There are a couple of classes of trading vehicle I swore off years ago: options and FOREX. From time to time, I’m tempted to give options another whirl, but I hold myself back. This happened earlier this summer, so I did a little experiment: I put a marker on a chart of an option I would have bought indicating my “pretend” trade.

Well, after a few days, the option shot higher, pushing up over 50%. I begin to reconsider my self-imposed ban on options trading. But you can see what’s happened since then (and remember, this is a fairly conservative option, not expiring until the end of the year!)

I know options work great for a few of you out there, and that’s just dandy. For me, this little exercise just reassured me that I made the right choice swearing off the things.

High Above Stinson

I took the family to Stinson Beach on Sunday, and I brought the drone along. There are some very nice scenes in here. I was going to set it to the Chariots of Fire theme but, meh, I’m being lazy.

Swing Trading Watch-List: AXP, AAL, MAT, STX, GTN

Short Term Crossroads

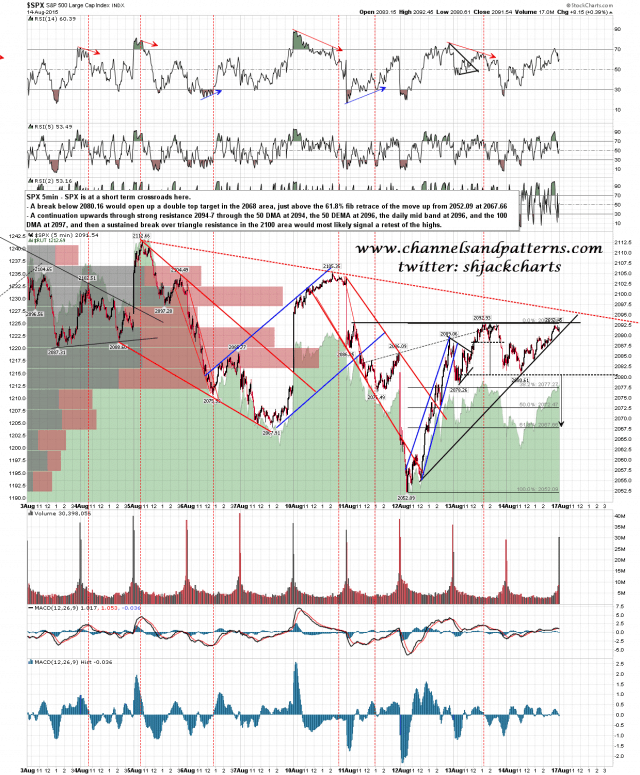

SPX is at a short term crossroads today, as Stan and I were discussing in Chart Chat yesterday. You can see the recording for that here. The option I outlined was a double top that would target the 2068 area on a break under 2080. That would be just above the 61.85 fib retrace of the move up from 2052. Stan was looking at a possible break up through triangle resistance into the 2120 area. We agreed it was a coin toss but so far SPX seems to be favoring the double top and retrace scenario. SPX 5min chart: