Our Highest-Ranked ETF is a Bet Against Oil – And The Global Economy

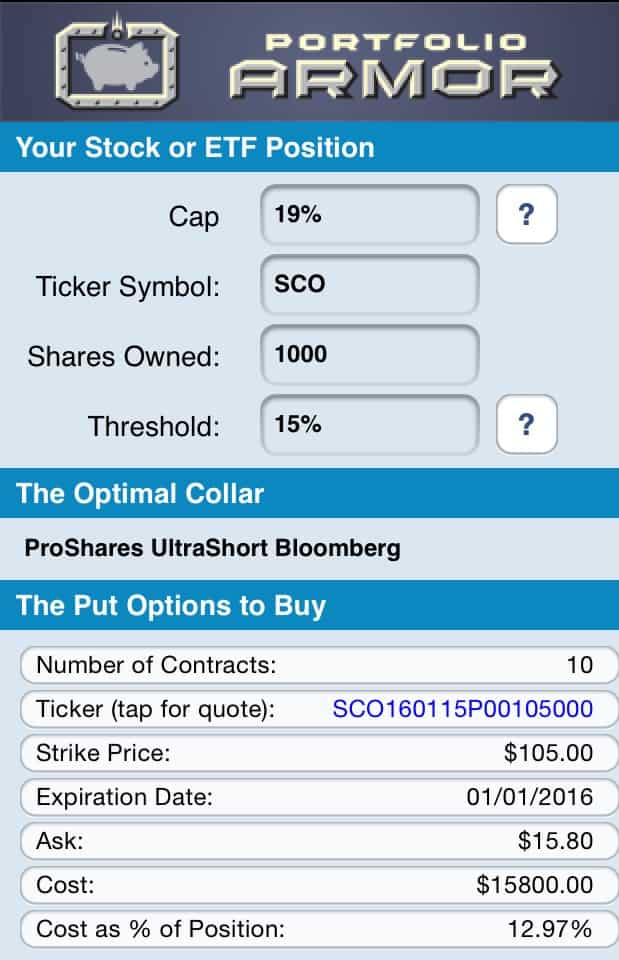

Each trading day, Portfolio Armor calculates potential returns for every security with options traded on it in the U.S. Potential returns are high-end estimates of how the security might perform over the next six months, and they’re based on an analysis of price history and on option market sentiment. On Friday, the security with the 5th highest potential return in our universe (which consists of all securities with options traded on them in the U.S.) was the ProShares Ultra Short Bloomberg Crude Oil ETF (SCO), which is 2x short oil.

SCO had a potential return of 19%, which was 5th overall, but the highest of any ETF in our system. Here’s a way an investor who wants to bet against oil (and, by extension, much of the global economy) can own SCO while limiting his downside risk to a decline of no more than 15% if SCO moves against him. The best part is, the cost of this hedge is negative, so our investor would essentially be getting paid to hedge.

Getting Paid To Hedge SCO

This was the optimal collar, as of Friday’s close, to hedge SCO against a >15% drop by January while capping its upside at 19% (the idea here is to capture the potential return).

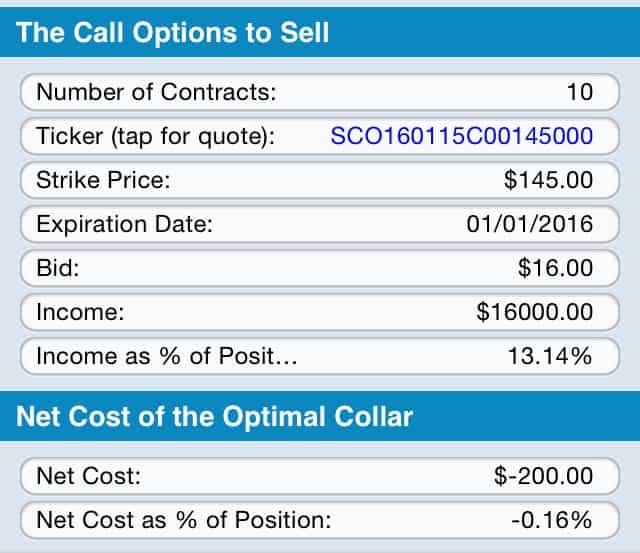

As you can see in the part of the screen capture above, the cost of the put leg of this collar was $15,800, or 12.97% of position value. But if you look at the part of the screen capture below, you’ll see the income gained from selling the call leg of this collar was $16,000, or 13.14% of position value.*

Pass Go. Collect $200.

So the net cost of this optimal collar was -$200, or -0.16% of position value.*

*To be conservative, Portfolio Armor calculates the cost of the puts at the ask and the income from the calls at the bid; in practice, an investor can often buy puts for less (for some price between the bid and the ask) and sell calls for more (again, at some price between the bid and the ask). So, an investor opening this collar would likely have collected more than $200 to do so.