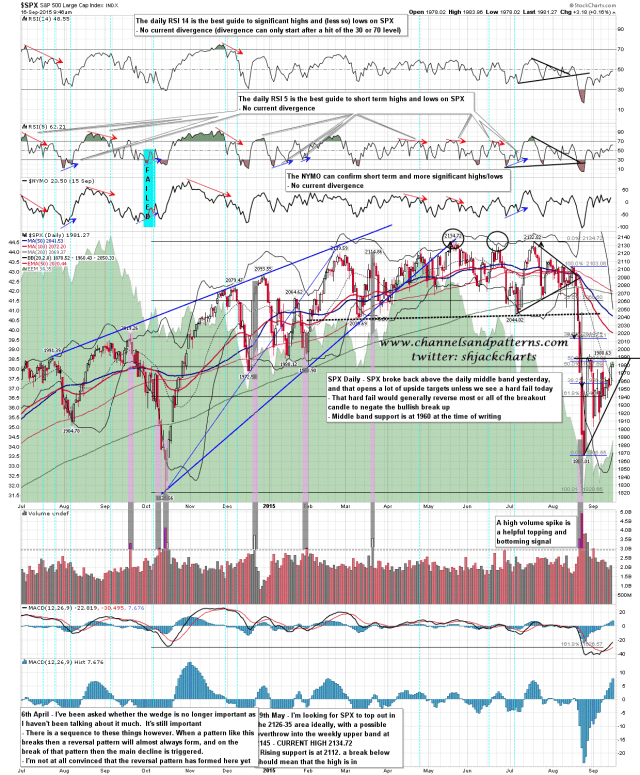

The bulls had an excellent day yesterday and broke back over the daily middle band. This opens up the upside on a further break over 1988-93 resistance, unless we see a rejection candle today that breaks back under the daily middle band. This would be a rejection candle and would normally reverse most or all of yesterday’s breakout candle. The daily middle band is at 1960 at the start of today. SPX daily chart:

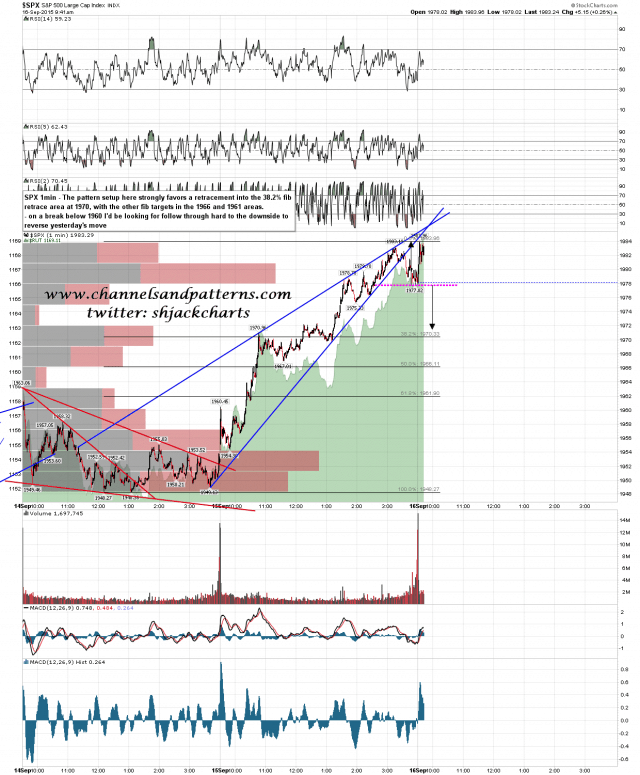

Is there a possible setup for retracement here? Yes, very much so. A rising wedge formed yesterday and broke down at the close. That’s backed up by a 15min sell signal and sets up a retracement to the main fib retrace targets for the wedge which are in the 1970, 1966, and 1961 areas. I’m expecting to see that retracement and if SPX finds support at 1961 or above that holds today, then we see more upside and the full test of the 1988-93 area. If SPX drops under 1960 then I’d be looking for yesterday’s daily candle to be mostly or fully retraced, and a close well under the daily middle band. SPX 1min chart:

This is almost the last chance saloon for the bears short term and and if there is no rejection candle today then we could well see the first fail on my 5DMA Three Day Rule stat since the start of 2007. As I have not looked further back than 2007 that would in fact be the first fail on this stat that I have ever seen. No stat is 100% though, and this one may mar its perfect record here unless bears can reverse this back down today.