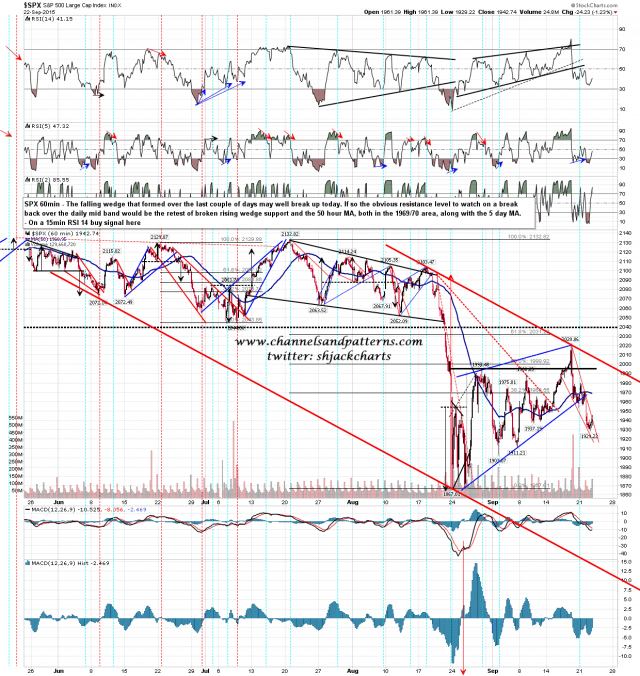

I posted short term falling wedges on twitter last night, and these are 68% bullish of course. On the 68% bull option I’d be looking for a retest either of the daily middle band in the 1955 area, or on a break above that I’d be looking for a retest of broken rising wedge support, the 50 hour MA, and the 5 day MA, all in the 1969/70 area. SPX 60min chart:

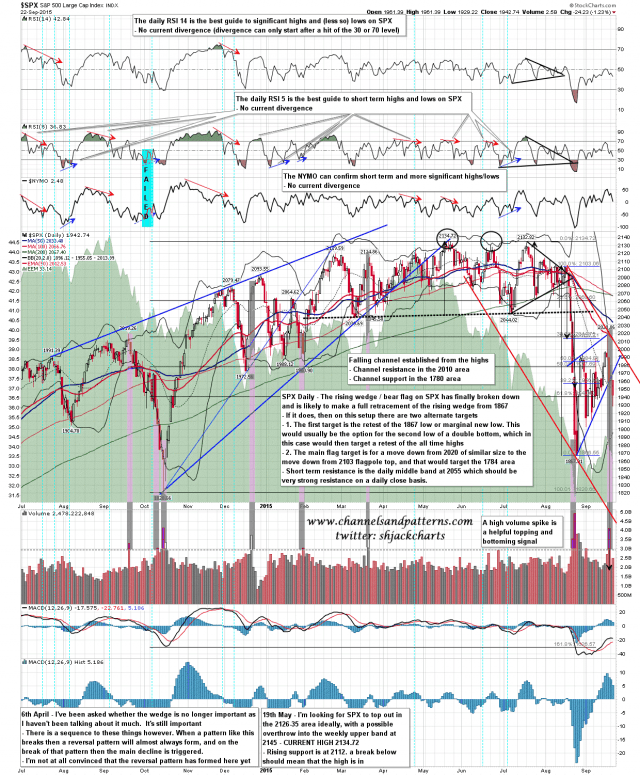

The daily middle band at 1955 should be strong resistance today, but that is daily closing resistance. A pinocchio through it intraday would be fine as long as the close is back under or at the middle band. SPX daily chart:

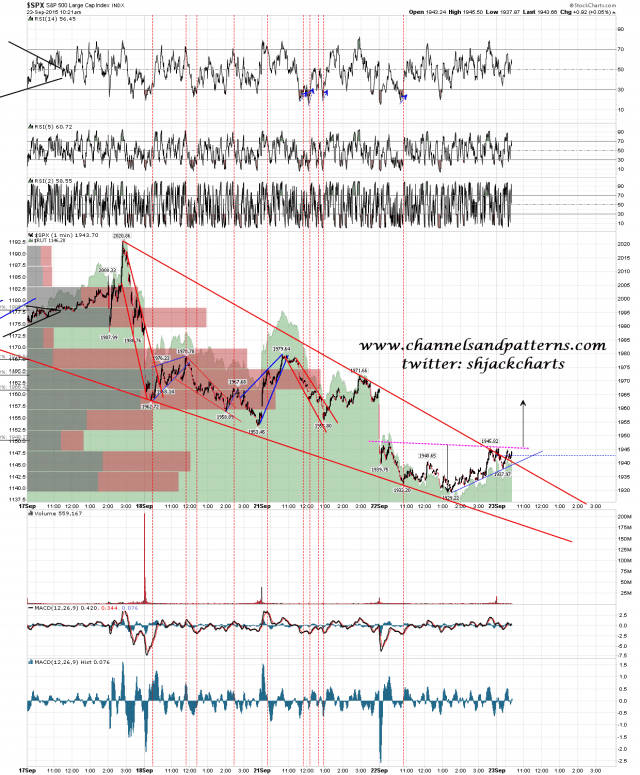

In the very short term I have pretty clear bull & bear setups here on the 1min chart. The bull setup is a break up towards 1963 area which is the 38.2% fib retrace area for the falling wedge and midway between the obvious 1955 and 1970 resistance areas. The bear setup is a fail here and the falling wedge takes the 32% option breaking down towards a target in the 1820 area. If we go with the bear scenario then the first sign will be a break of the rising support from yesterday’s low in the 1930 area. SPX 1min chart:

I’m leaning towards further rally today with the obvious target in either the 1955 or 1970 area. At the time of writing the IHS on the SPX 1min chart is starting to break up, so this should either fail hard here, or keep going to one of those targets.

The post is a bit late today. I’m feeling improved but still wading through treacle if you know what I mean. On the mend though.