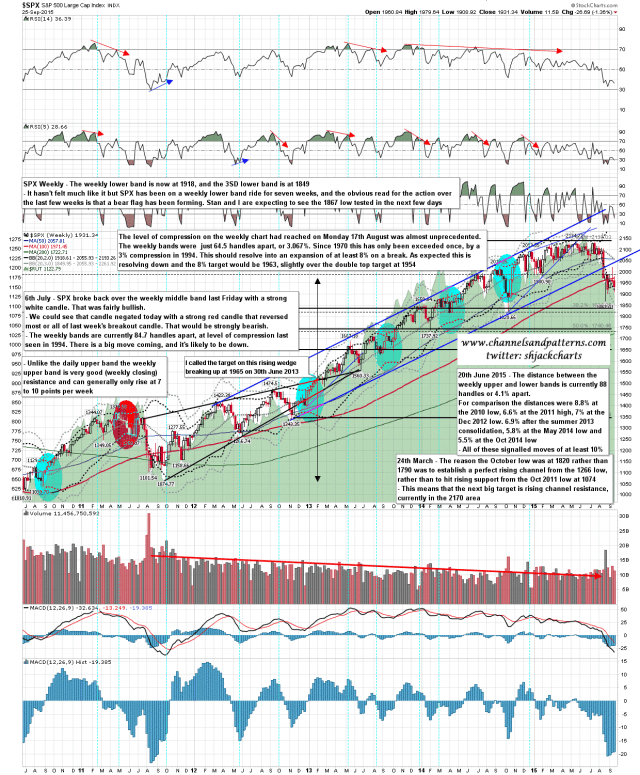

It has been a choppy few weeks, but on the weekly chart the whole period has been part of a weekly lower band ride that is now starting week 8. The weekly lower band closed last week at 1918 and SPX looks likely to open close to it. The weekly 3SD lower band closed last week at 1849 and Stan and I are thinking we could see that level tested and possibly lower this week. SPX weekly chart:

In terms of the pattern structure here the overall decline is within a falling channel with channel resistance in the 1995 area and channel support in the 1770 area. A lot of these channels evolve into falling wedges, so we may well not see a test of channel support on this current move.

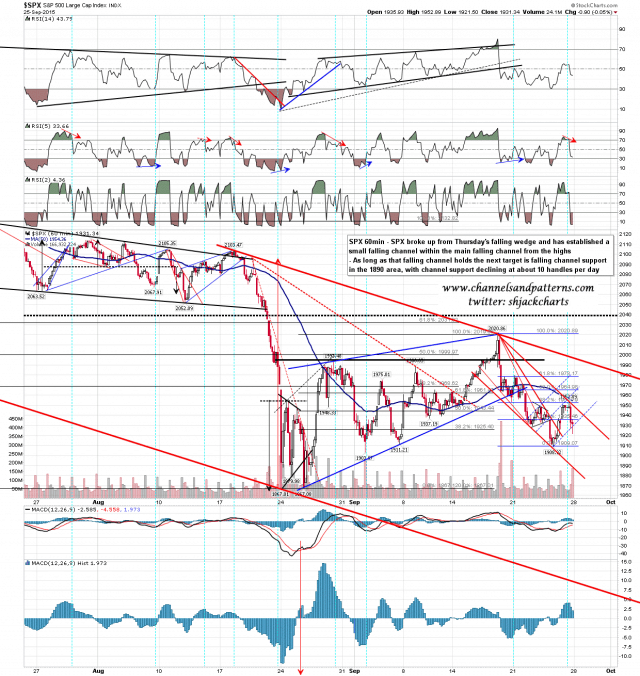

Shorter term Thursday’s falling wedge broke up, retraced 38.2%, and established a falling channel from the 2020 high. As long as that channel holds today the next obvious target is channel support in the 1890 area (and falling at 10 handles per day). Channel resistance is currently in the 1945-50 area. SPX 60min chart:

I’m looking for an AM high that fails again today. Stan has this as a cycle trend day today and that means that the odds are 70% that one side or the other will dominate the day. That would not necessarily be a full trend day though.