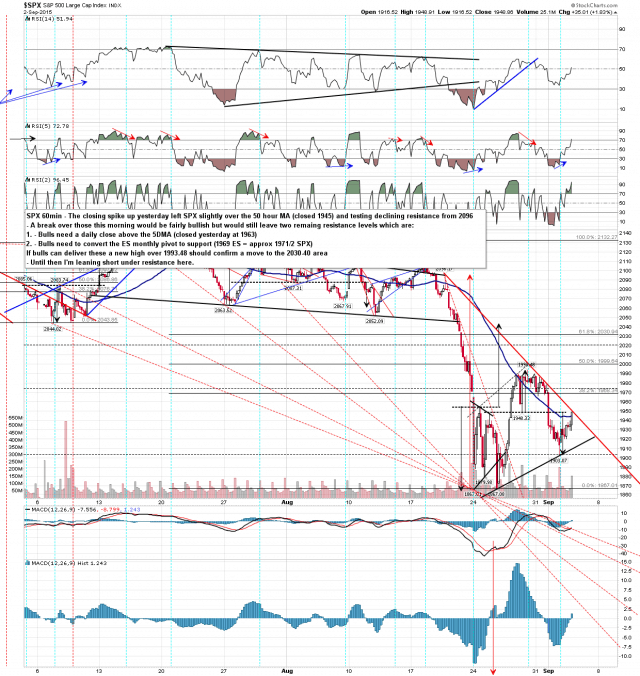

SPX is still in the inflection point I was looking at yesterday morning and closed yesterday at declining resistance from 2096 and slightly over the 50 hour MA at 1945. SPX has broken well above both at the open. The setup for today should be as follows.

On a fill of the opening gap at 1948.86 and sustained trade below there I’d be looking for new lows, which should confirm on a break below Tuesday’s low at 1903.07

On a break above the ES monthly pivot at 1969 (resistance at globex high), approximately at 1971/2 SPX, and conversion of that level to support I’d be looking for a move to the 2030-40 area, confirming on a break over the current rally high at 1993.48. SPX 60min chart:

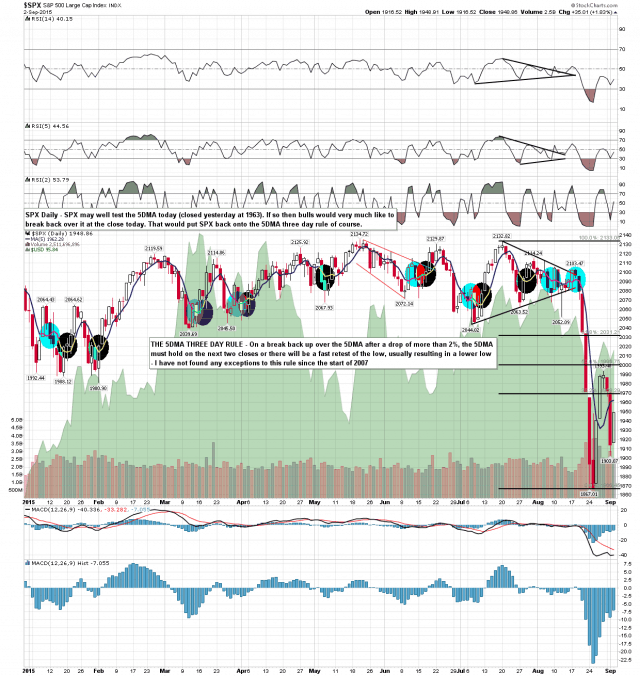

The other level to watch is the 5 day MA, which closed yesterday at 1962 and is now at 1957. Bulls need a daily close above it. After that we will go back onto the 5DMA three day rule. SPX daily 5DMA chart:

I’m leaning short here unless bulls can convert 1971/2 as support. It could go either way here though & I’m thinking 65% odds bear scenario and 35% odds bull scenario.