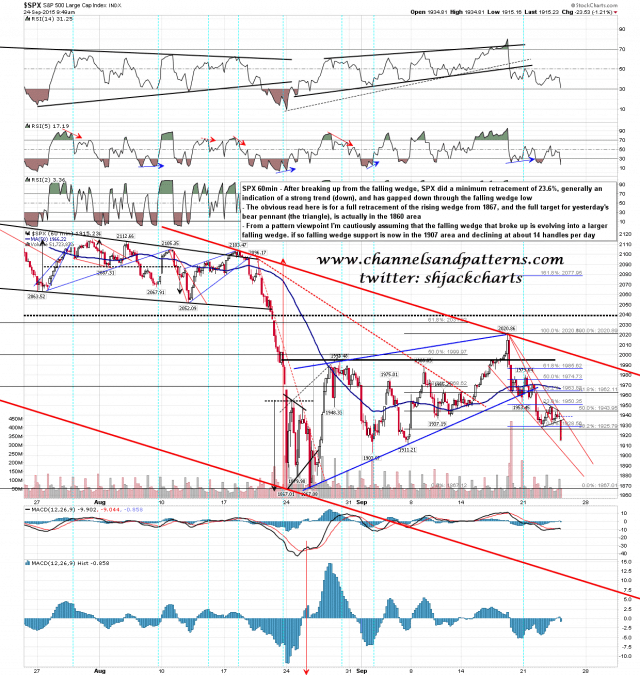

SPX only made the 23.6% fib retracement of the falling wedge that broke up yesterday, forming a bear pennant/triangle from the falling wedge low that has broken down this morning. This kind of retracement is indicative of a strong trending move and suggests also that the falling wedge is evolving into a larger pattern, which I am cautiously assuming is a larger falling wedge.

If so then falling wedge is in the 1907 area at the time of writing, and declining at about 14 handles per day. If hit this morning that would coincide with decent support in the 1903-11 range and we might well see a strong bounce there.

Longer term the full bear pennant target is in the 1860 area, which is a good fit with a retest of the panic low at 1867. Bigger picture falling channel support is currently in the 1780 area, and that may be the ultimate target for this move. SPX 60min chart:

The daily lower band is at 1910 now, which again is a decent fit currently with possible falling wedge support and the 1903-11 support range. If we see that this morning I’ll be looking for support in that area and, if found, then a rally before continuation lower.