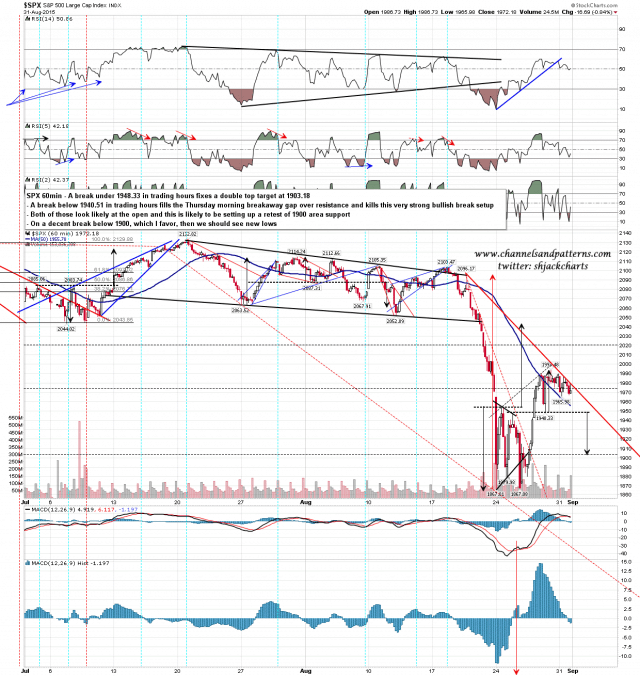

I was looking yesterday morning at all the double top setups on my optic run indices and they have all been playing out overnight. It seems highly likely at the time of writing that SPX double top support at 1948.33 and the breakaway gapfill at 1940.51 will both be filled at the open, so Thursday’s very bullish breakaway gap over resistance is killed off and there is now an open double top target at 1903.18 on SPX. SPX 60min chart:

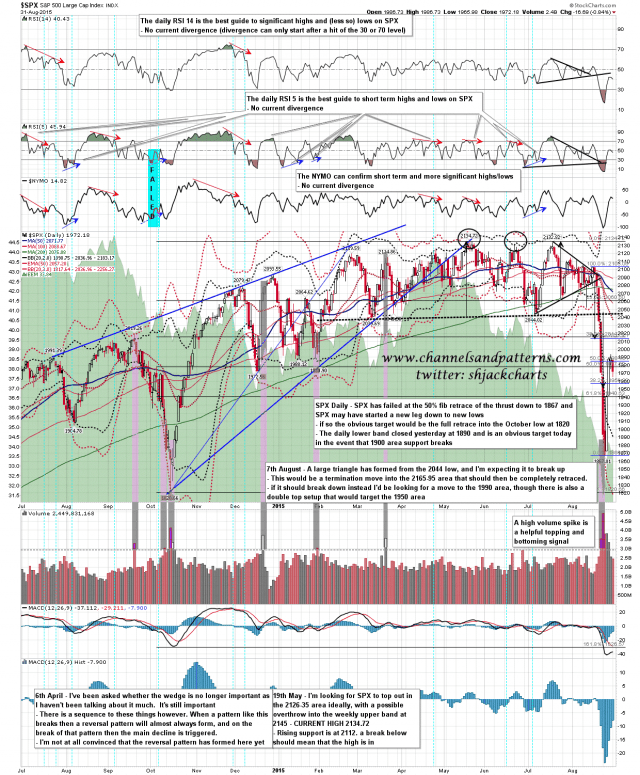

I’m expecting that 1903 target to be hit today, though we might see a strong bounce first. What then happens at this test of 1900 support will be key. On a hold there we could well see another rally wave up. On a decent break below 1900 I’d be looking for new lows with the obvious target for that still at the retest of the October low at 1820. The daily (2SD) lower band closed at 1890 so on a break below 1900 that would be a very obvious target. SPX daily chart:

Today is a cycle trend day so there are 67% odds of a strong trend in one direction lasting most of the day, though that need not be a full trend day. I’d suggest watching Stan’s update video from last night and you can see that here. If we are back into full bear here then I will be looking for an AM high that dies into a strong move down.