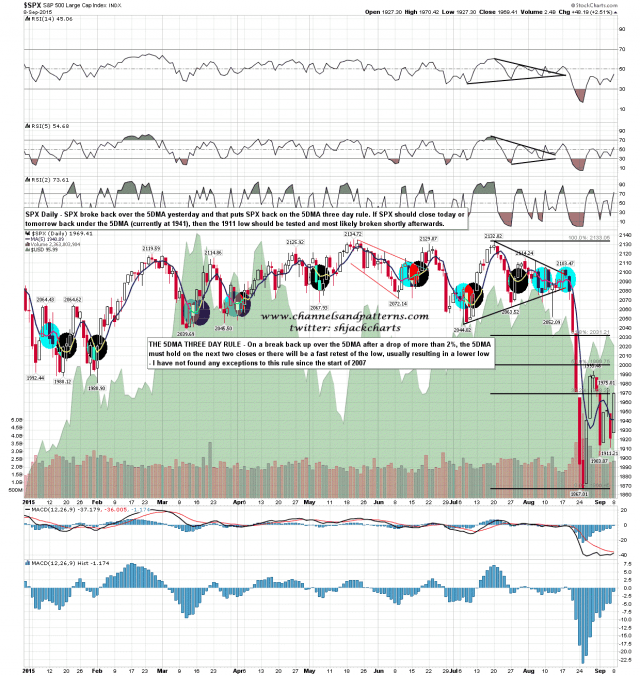

SPX broke back over the 5 day MA yesterday with a lot of conviction and that puts SPX back on the 5DMA three day rule. That rule is a very reliable stat that if SPX should close back below the 5DMA either today of tomorrow, then the 1911 low would be retested and most likely broken shortly afterwards. The 5DMA closed at 1941 yesterday so it’s some way below, but in a market this fast that’s only a bad day away. SPX daily 5DMA chart:

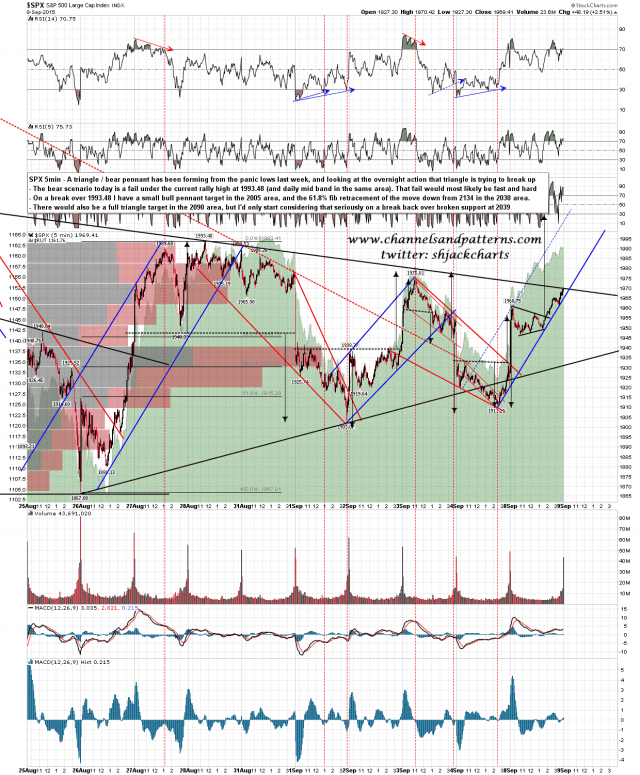

I’ve been considering the pattern setup here very carefully this morning and SPX is trying to break over resistance on the triangle that has been forming here from the panic lows last week. 1975 resistance was held yesterday but looks almost certain to fail at the open today. The next resistance is the current rally high at 1993.48, and if that breaks, and trading over that is sustained for long, then we will be testing the 50% fib retracement of the move down from 2134 at 2000, and the daily middle band which closed yesterday at 1999.

On a break over these then the obvious next target is the 61.8% fib retrace area at 2030, and that would be a fit with the A=C target at 2029. I would definitely be looking for failure in that area, but if we were to see a break back over broken support at 2039 then I would start to take the full rally triangle target at 2090 seriously as a target. SPX 5min chart:

Bears are on must perform this morning and must defend first 1993.48 and if broken, the 2000 area. If they both break then I’d be looking for the 2030 area and likely failure there.