[edit] I got the shivers when I read TK’s post about Gartman being still “bearish of stocks” as it seems to lend credibility to the bullish scenario.

The market, despite weakening corporate profits and several other headwinds, has decided it liked what it heard from the Inflator in Chief yesterday as it has scored the game Janet Yellen 2, Hawks in Drag 1 and US dollar 0. Is it a final score? I am not sure how our hawkish transvestites can be taken seriously now.

But with a market running on the black boxes of a million quants, large and small, who knows what will happen the next time some clown decides to eat a microphone and dispense dissonance into a situation that Yellen seems very clear on; as my late friend Jonathan Auerbach once famously said (it was famous to me anyway) as we prepared for the post-2008 inflation phase, “it’s inflation all the way baby!”

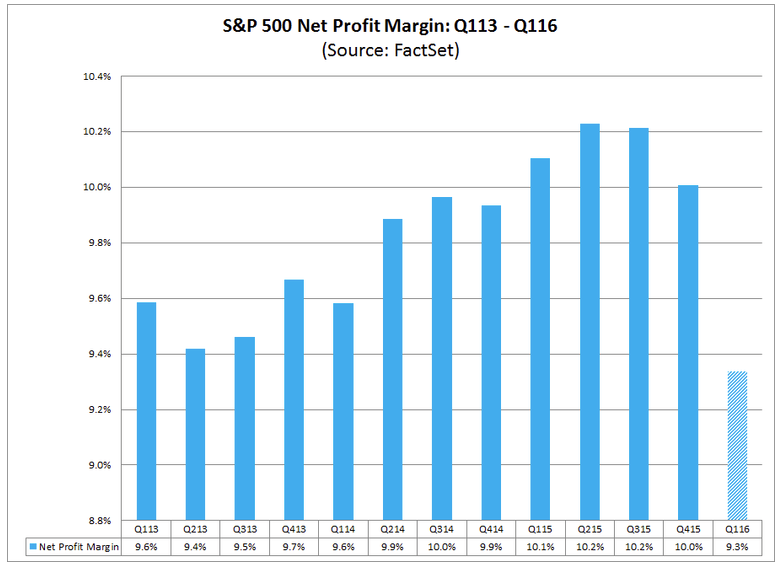

While this would be a backdrop that can be very exciting for global investors (precious metals, commodities, emerging markets, etc.) if the Fed gets what seems to be Yellen’s way, we will see increasing fears of inflation, which would drive up depressed asset prices and keep aloft the already over valued (considering corporate profit weakness) stock market. Here is the latest profits data, courtesy of FactSet.

Juxtapose this against an S&P 500 that is breaking its Dome on today’s open. If this follows through it would be a dunce cap no more. See S&P 500 Simply Following its Stimulus for more.

Of course it could also be a post-hype whipsaw as the machines decide to screw over the maximum number of traders, first sending the shorts to cover (I am still short SPY, but now more than balanced out long in sensible anti-USD areas) and then trapping bull momos. You’ve got to love this casino that Greenspan Bernanke has built and Yellen maintains to perfection.

In the article linked above, Macro Changes and Future Inflation Problems, and previously in NFTRH, we have introduced a theme that sees parallels between the current phase and the 1999-2001 phase in the markets. This is a loose correlation and no matter what the quants think they see, there will always be differences. One difference is that we could potentially be further along toward a Greenspan style post recession inflation environment, with the stock market not having entered a bear market first. It is very possible that the global deflationary backdrop has done the heavy lifting this time where forcing policy makers to capitulate, Greenspan style, is concerned.

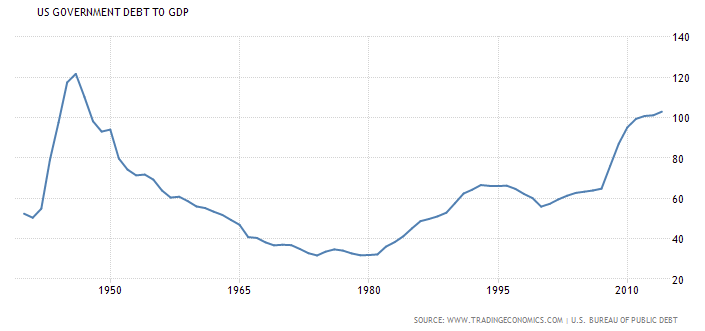

The US may be relatively okay on the surface of the economy, but beneath it there is this tell-tale sign that the economy will only go as far as the ability to expand debt allows (you of course caught Yellen’s sledge hammer hint about QE 4 and actual mention of “debt to GDP” yesterday). Here’s the Debt-to-GDP once again, showing a 70 year high of 103%. I do believe part of the strategy is to try to inflate some of this away.

So it looks like “inflation all the way, baby”. At some point the Kabuki Dance the various Fed members are doing to keep us confused will fade away and it will be full frontal Greenspan, no apologies, no regrets… until much later.

When I named the once and possibly future Biiwii.com in 2004 (but it is what it is) what I had in mind was that I was bearish, wanted to be bearish, but could not remain bearish as the stock market levitated in the face of the Greenspan credit inflation. So I had to eat my gall and get bullish on the stock market in 2003. I then saw many a bear get eaten alive fighting the inflation.

So while the break upward on the S&P 500 chart above could be a bull trap whipsaw, it could also be the doorway to the next inflationary phase, which the US Fed seems to be supporting along with its NIRPing fellows at the ECB, BoJ and various other global central banks trying to inflate/reflate in their own unique ways.

Stay tuned, as the market gets ever more interesting going forward. If this is not a trap and a Greenspanesque ‘inflation trade’ is being unveiled, prepare to invest accordingly.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com. Also, you can follow via Twitter @BiiwiiNFTRH.