My apologies for the late post today. I’m a bit sleep deprived and today feels like I am wading through treacle getting anything done. I’ll be getting an early night tonight.

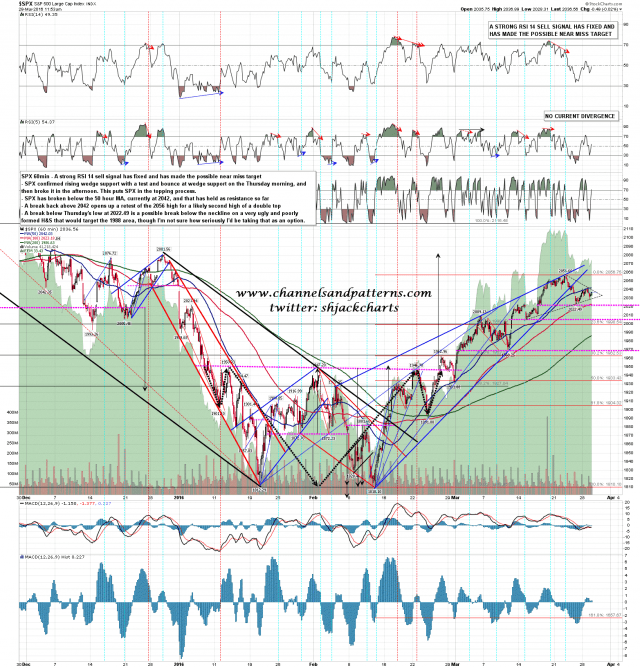

So where is the topping process now? Well the 50 hour MA on SPX held as resistance yesterday, but is being tested again today on the very doveish Yellen speech. If there is a sustained break above then I’ll be looking for a retest of the current rally high at 2056.60. On another fail at the 50 hour MA I’d be looking at a possible test of the possible H&S neckline in the 2005 area. SPX 60min chart:

The H&S setup on ES is a lot better formed and could still play out, but the left shoulder is already looking extended and a strong move down would need to start very soon. ES Jun 60min chart:

As I’ve been mentioning, as reversal patterns on SPX double tops and bottoms outnumber H&S patterns by more than two to one. Some kind of retest of the high to set up a double top here would therefore be the rule rather than the exception. We may well see that retest shortly. If so I’d normally be looking for a slightly higher high to set up daily sell signals.