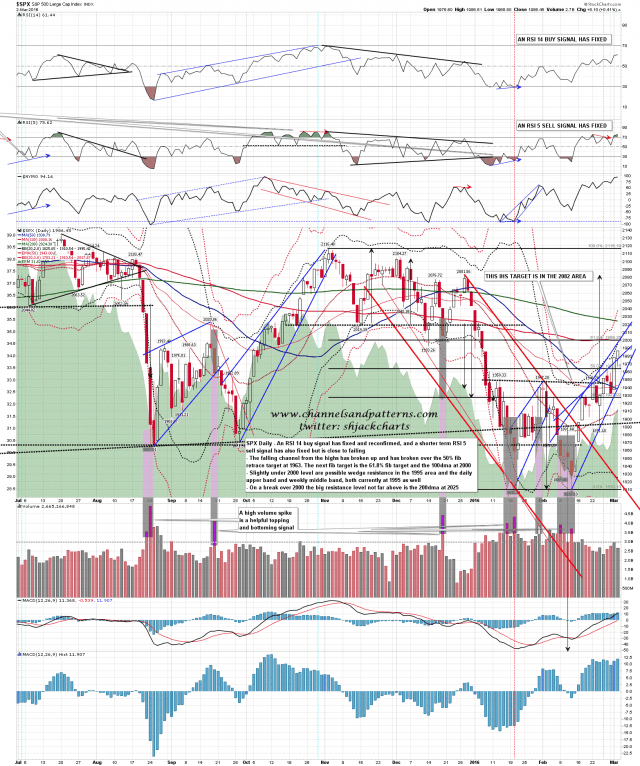

SPX inched a little higher to 1986 yesterday and there is a very possible fail area just a little higher. The main target level I’ve been looking at for this move is the 61.8% fib retracement in the 2000 area, and slightly below that I have possible rising wedge resistance, the daily upper band and the weekly middle band, all in the 1995 area at the close yesterday. There is a lot of negative divergence on SPX and ES here and we may well see a fail in that area. SPX daily chart:

On ES I have possible wedge resistance now in the 1994 area which is a match with this 1995-200 resistance zone on SPX. ES Mar 60min chart:

Today is a cycle trend day, which means that there are 70% odds that the day will be dominated either by buyers or sellers. This doesn’t need to be a full trend day if seen, but often would be. If we are to see a failure in the 1995-2000 SPX area then we might well see an AM high there and then selling for the rest of the day. If the bulls can deliver a trend up day today then the targets above 2000 are the weekly 100 MA at 2011 and the 200dma at 2025. If bulls can convert the 200dma to support then the IHS target at 2082 would become the next main upside target here.