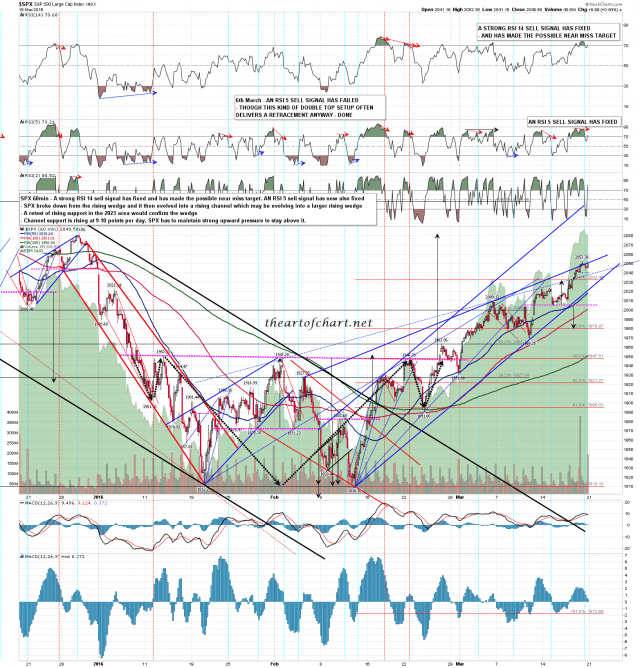

The ES weekly pivot is at 2025 this week and that is in the SPX 2034 area. I’m leaning towards a test of that area today or tomorrow morning because this generally gets tested during a trading week, and the RSI sell signals on the 15min chart and the RSI 5 sell signal on the 60min SPX chart are suggesting that we likely see that test in the next few trading hours before any significant further upside progress.

Longer term though there is currently no negative divergence on the 60min RSI 14 or on the daily chart RSIs so that is suggesting that the rally high is not yet in. SPX 60min chart:

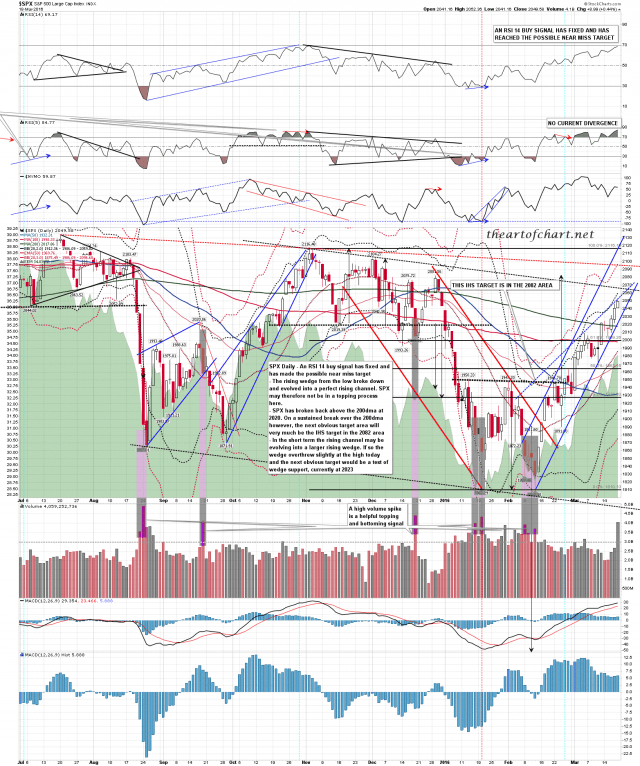

Resistance at the 200dma has been broken and unless SPX breaks back down through that quickly then the big target above is the IHS target in the 2082 area. SPX could well now make that target. SPX daily chart:

The short summary for last week was that the weekly pivot was tested early, held as support, and SPX then trended up for the rest of the week. I’m expecting an early test of the weekly pivot this week as well, and if it holds as support again, we could see a rerun of last week. I’ll be watching that test carefully.