A comment I made last Friday yielded a response from a reader……..

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

¡Ay Caramba!

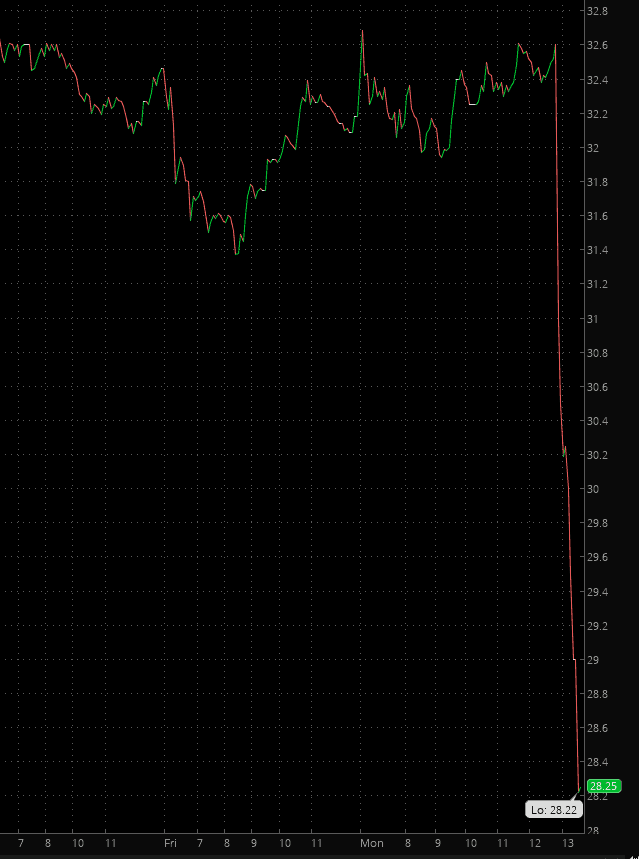

This weekend, as I so often do, I put together some videos of short ideas. I just noticed in after hours trading that Fiesta Restaurant Group, which was the very first stock mentioned on Sunday’s video, is doing this after hours:

NYSE Margin Debt as % of GDP Signaling Ugliness for Equities

From Goldsqueeze: Just one chart for today – it’s one that I update every so often because I think it’s a worthwhile indicator to follow. The NYSE reports total margin debt each month (with a several week lag) on its website, linked here. Margin debt, as you know, is money borrowed to invest in equities. The higher margin debt goes, the more money is being poured into stocks. The absolute value of margin debt isn’t terribly meaningful because you have to take into account inflation, a growing number of investors, etc. What is meaningful, however, is anchoring margin debt to the U.S. Gross Domestic Product. Taking this ratio allows us to follow the level of margin debt relative to the size of our economy.