Some how it escaped me today to provide a daily watch-list. Nonetheless, I’d like to make up for it by posting my weekly list of short setups that I am currently following. Tuesday’s rally definitely strains some of these setups, but they are still worth checking out and seeing whether any of them might work for you. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

General Boy

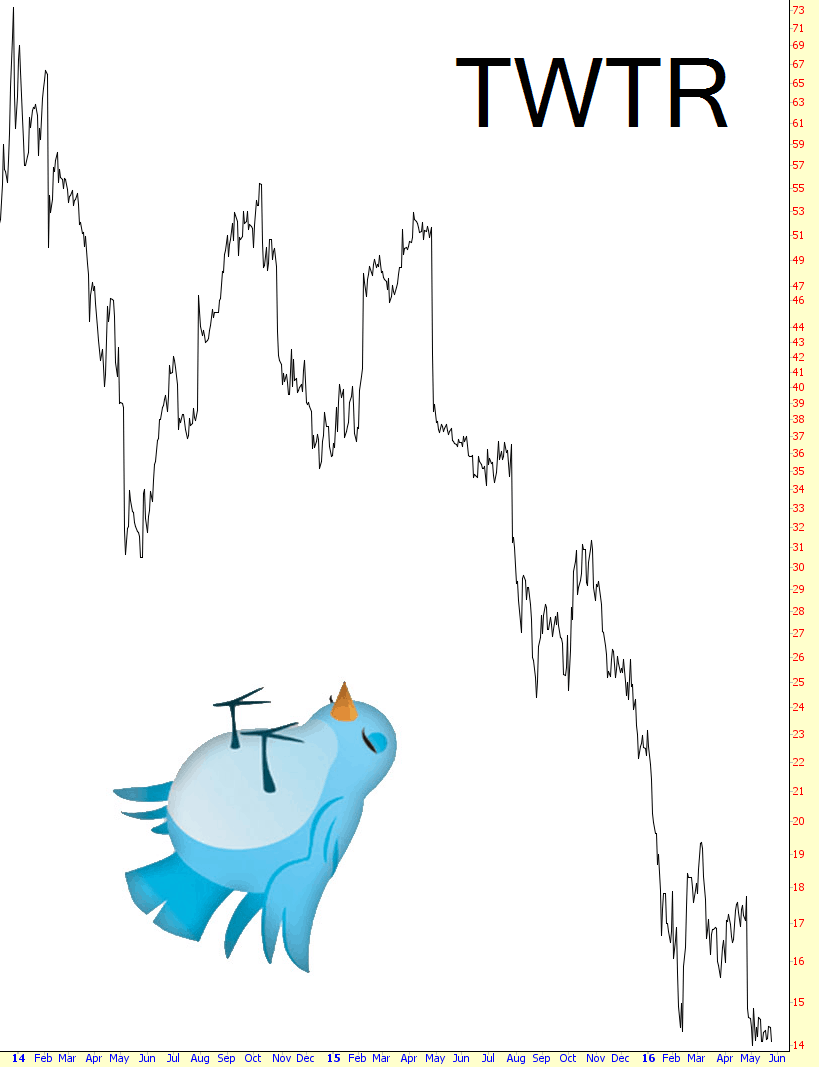

Birdshot

If this is what Twitter looks like in an environment in which the Fed is pulling out all the stops and creating a totally fake, hyper-inflated asset market, could you imagine TWTR in a normal price-discovery situation? Somehow the digit “zero” leaps to mind. But here we have it: new lifetime lows today.

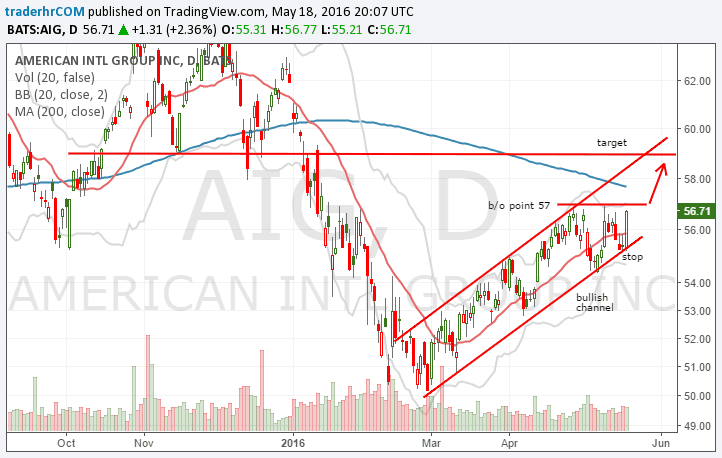

Financial Stocks Ready to Continue Higher

Financials have significantly lagged the market since the bottom in February and the gap might be closing as market sells off while strong move in financials indicates further strength ahead, possibly even longer term as interest rate environment is changing and yield curve might reverse and steepen up again.

Testing The Monthly Pivot

The bears had a chance to fail and continue down yesterday but couldn’t manage it, so we are running the bullish scenario that I was looking at yesterday morning. Since I posted the charts below at theartofchart.net this morning ES has gone through the declining resistance trendline in the 2062 area, and is trying to convert the monthly pivot at 2063.8 to support. If that succeeds the the ideal right shoulder high on the larger alternate H&S that I strongly suspect is forming on ES here would be in the 2072-5 area. ES Jun 60min chart: