ES has been retracing somewhat overnight on Brexit fears and I understand that China’s debt to GDP ratio is now in the 250% ratio, which is roughly 50% more than Greece but still significantly behind the world leaders in insanely reckless fiscal policy Japan. Given that everyone knows nowadays though that this problem can be solved just by printing enough money to buy back the debt and cancel it I have no idea why anyone worries about these things any more, but for whatever reason markets are down and people seem to think that has something to do with it.

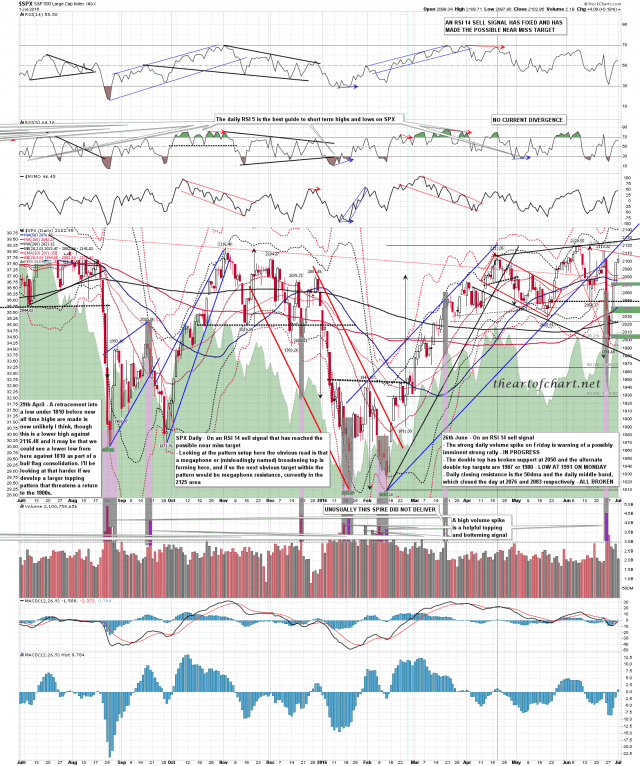

A retracement is overdue, and the first target is a retest of the daily middle band on SPX, which closed at 2083 on Friday. SPX daily chart:

On ES the chart below is the one I posted earlier for subscribers at theartofchart.net, and the H&S has now broken down with a target close to the 38.2% fib retracement target for the move up from last Monday’s low in the 2057 area. That is close to the ES weekly pivot at 2059 which is the next natural support on a break back below the middle band, and will will probably test that on this retracement. ES Sep 60min chart:

Kudos to Stan for calling the 2104 ES target in Chart Chat on Sunday. if you haven’t seen that you can see the recording for that here.