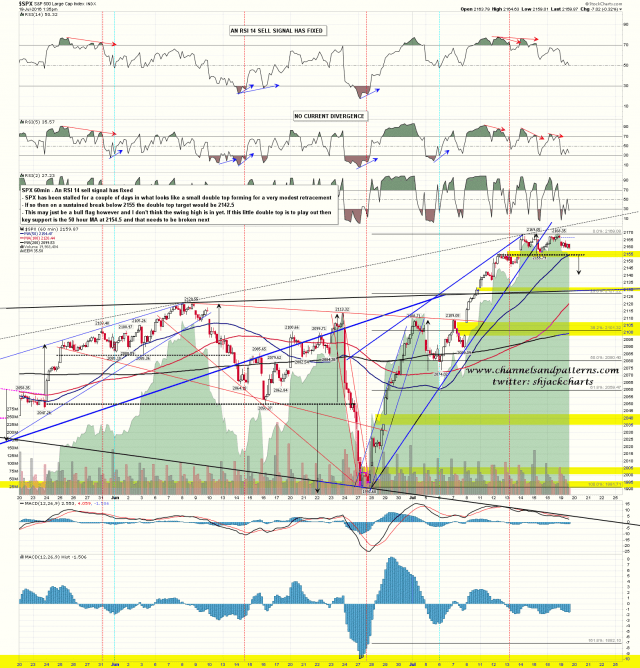

It has been very dull in the afternoon recently, and sometimes not a lot more interesting in the morning. SPX has been stalled for three days now and a possible double top has formed. It’s very small, and after the great leap upward from 1991, one would think that a retracement of slightly over 1% would be easily accomplished, but it seems that SPX is paralysed into a retracement that so far has been only in time.

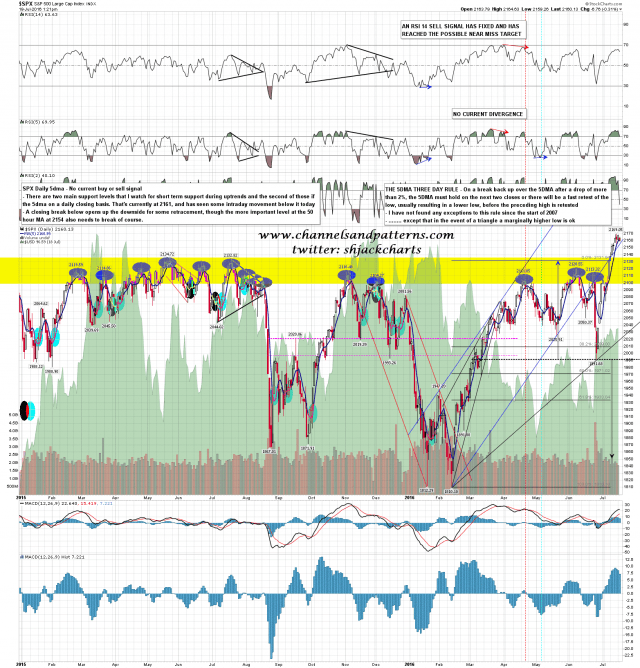

If a surviving bear can be located, then an hourly close below double top support at 2155.79, and the 50 hour MA in the same area, then the pattern target would be in the 2142.50 area. First support on a daily close basis is at the 5dma, currently in the 2160 area. SPX daily chart:

Next support, on an hourly close basis is at the 50 hour MA, currently in the 2155 area. SPX 60min chart:

If this very small double top turns out to be a bull flag instead then I’d expect to see a retest of the current all time high, and likely a marginal new high that would be unlikely to sustain trade over 2190 before a retracement that should run to at least 3% and more likely over 5%, before making more all time highs.

Last post before I go on holiday is tomorrow & I am really looking forward to having some time off, particularly if the intraday tape is going to be more of the same while I’m away. 🙂