Apologies for the late post today. Busy morning.

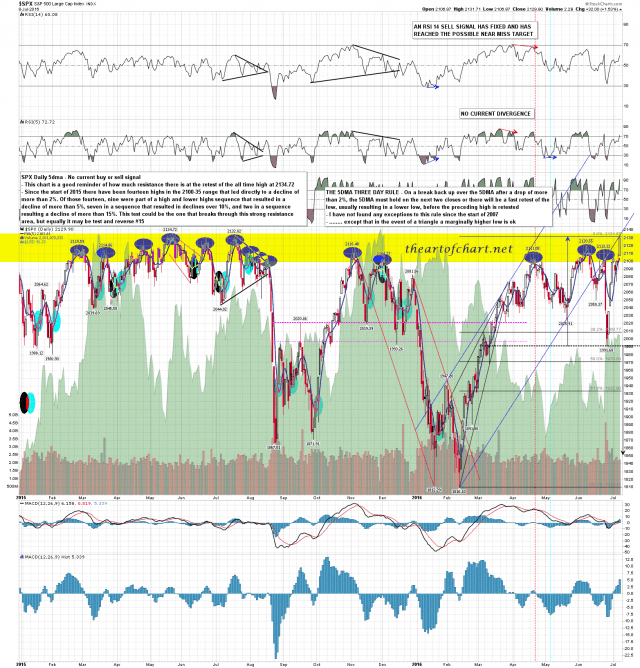

I did the chart below over the weekend for chart service subscribers at theartofchart.net, and it shows the many attempts on SPX to break through resistance in the 2100-35 area. Since the start of 2015 there have been an impressive fourteen highs in this range that have led to short term reversals of over 2.0%, and this morning of course SPX has broken above slightly to make a new all time high at 2141.

This area has a number of big resistance levels. 2138 is a major fibonacci level, the weekly upper band is at 2139, the daily upper band is at 2144. SPX has not broken through these with any confidence yet. SPX daily 5dma chart:

There are a lot of people today looking for a move directly to 2200 or even 2400 next, and while I’m doubtful, there’s only ever one way to find out for sure. I was saying on Friday morning that if SPX broke up then we’d likely see a new all time high soon after and here we are. I was still thinking that a retracement would follow shortly thereafter and I still think so.

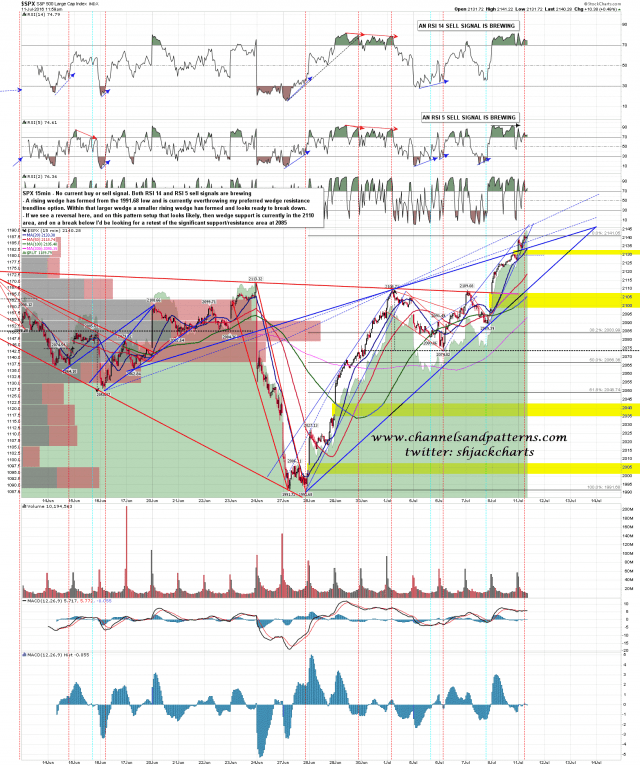

For today though the pattern setup here very much likes a reversal, and when you see a setup like the one below at a major resistance area, it’s best to at least bear it in mind. Better that even odds that this morning’s opening gap up is filled today in my view. If not then likely tomorrow. SPX 15min chart:

Bulls are having an extended test of this reversal area and maybe they’ll get through. If they don’t I have sell signals brewing on the 60min, 15min and 5min charts, and I’ll have my eye on a retest of 2085.