Well the bears tested the daily middle band a third time yesterday and closed above it again, and on the decent NPF number this morning we have a marginal new high on SPX at 2181.80 at the time of writing. So what now?

Well it’s a cycle trend day today and it’s possible that SPX is going to trend up today. If so I’m not expecting bulls to sustain much trade over 2200, and if that area is tested then it will be a compelling short entry area. If that area is to be tested then the best shot for doing that would be today, on a trend up, and we may still see that, if the tape doesn’t freeze into near-immobility as it has been doing every other afternoon recently.

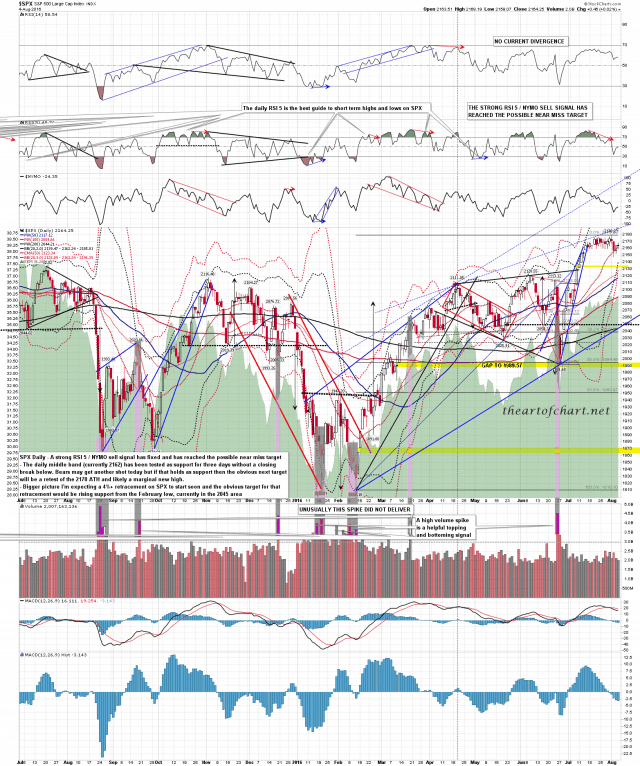

You can see on the daily chart below that the daily bands are now very compressed. We should see a powerful move soon and on the weekly band punch stats that move should be down, with the obvious target being rising support from the February low, currently at 2045. SPX daily chart:

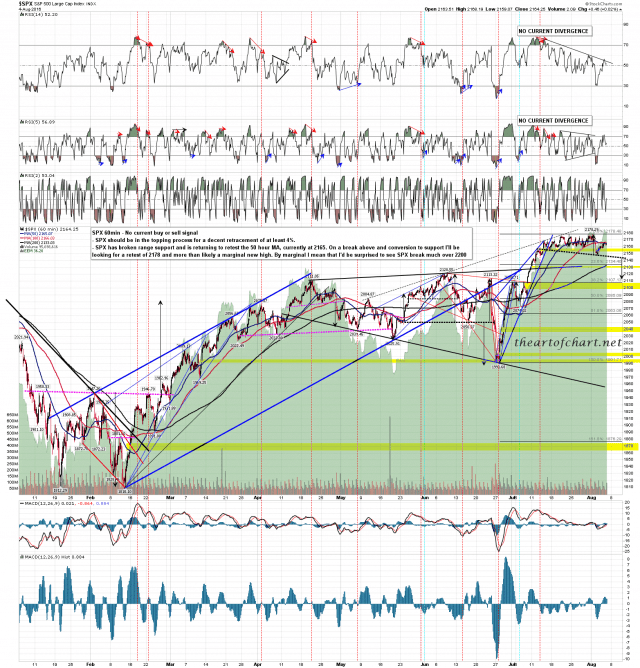

SPX has broken and reconverted the 50 hour MA to support this morning. Next time it breaks hard that would look very bearish. SPX 60min chart:

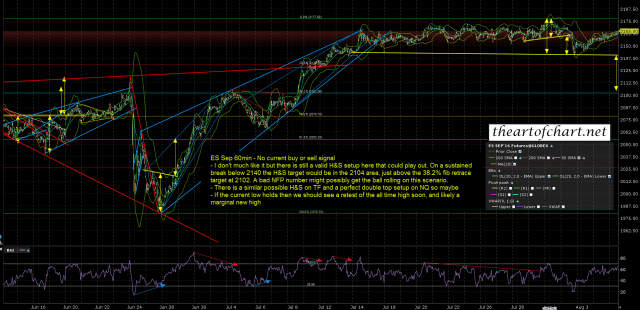

This is the ES bonus chart I posted for subscribers at theartofchart.net before NFP this morning. As I suspected, the H&S scenario has not played out, but there’s a possible double top setup here now that might deliver if we see rejection at this marginal new high. ES Sep 60min chart:

This post has been somewhat delayed by an emergency trip to locate a dumpster truck containing my older son’s iPhone 6 that he had absentmindedly discarded with the remains of his lunch. If this afternoon is as interesting as most afternoons have been recently on ES, then retrieving that phone from a truck then a bag of assorted garbage may well be the most exciting thing to happen this afternoon. We’ll see 🙂

Just a reminder that this month’s public Chart Chat is on Sunday and all are welcome. We’ll be discussing the usual wide range of about 30 instruments covering equity indices in the US and outside, commodities, precious metals and forex, and taking questions, so if you are interested in price moves on any of those then you can sign up for that on this page here. Everyone have a great weekend 🙂