A big news day today with Janet Yellen talking about the Fed’s future plans to improve the stability of the financial system. Doubtless she will once again be reaffirming the Fed’s complete commitment, having dug a vast economic hole with overly loose monetary policy and low interest rates since Greenspan’s appointment as the Fed Chairman almost thirty years ago, to keep on digging using the same tools until that hole has entirely disappeared. Obviously we should all hope that the Fed’s efforts doing that in the future are more successful than they have been in the past.

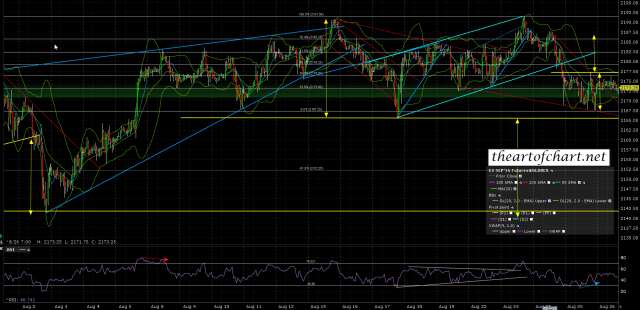

SPX tested and held support at 2168.50 overnight and there is an obvious setup to rally up to what would likely be triangle resistance just under the last high. That might be derailed by news from Jackson Hole of course but 60min buy signals fixed on all of the ES, NQ & TF 60min charts yesterday and that’s looking good at the time of writing. ES Sep 60min chart:

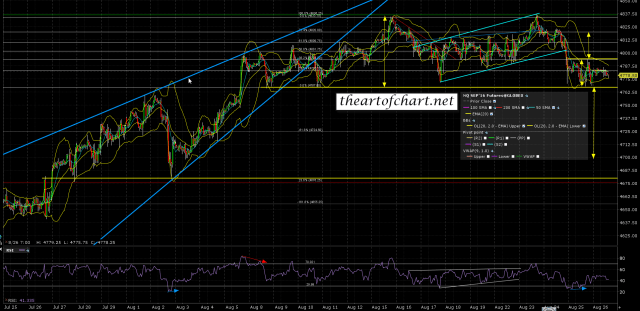

The setup on NQ is very similar to ES. NQ Sep 60min chart:

The rising wedge on TF is the key there. If ES makes a marginal lower high we may well see TF make a higher high into rising wedge resistance. TF Sep 60min chart:

I’m wary today in front of the potential news bombs from Jackson hole. That’s unlikely to change much on the bigger picture but the tape might be much more random today. We shall see. Everyone have a great weekend. 🙂