This is some very slow tape. We haven’t seen tape this slow since last August, at the last very hard compression of the daily bollinger bands. One of my trading buds asked then whether we would every see volatility return to SPX and it was back soon after. It should be back soon here too but it may be a few days longer.

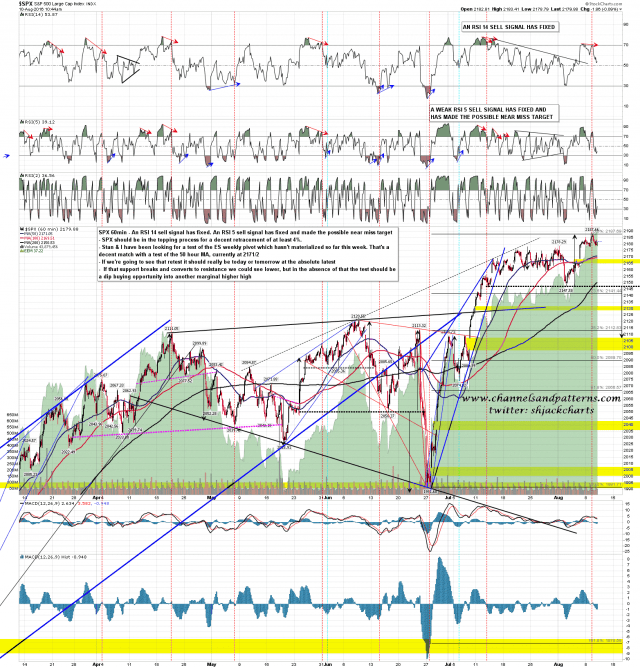

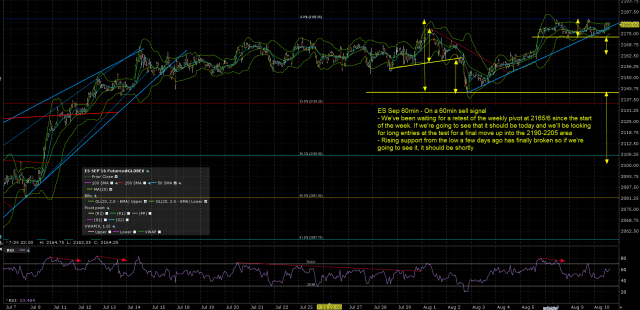

Since the start of the week Stan and I have been waiting for a test of the ES weekly pivot at 2165/6 and that’s a decent match today with the SPX 50 hour MA, currently at 2171/2. A 60min sell signal has now fixed and we should now see that test as a minimum target. If that level breaks and converts to resistance then we could see a larger retracement. SPX 60min chart:

SPX, ES, NDX & RUT have all broken the short term support trendlines I was looking at yesterday morning. If we see that test it should really be today or at most tomorrow. ES Sep 60min chart:

We should see that test and that is a significant inflection point. A sustained break opens lower targets. If it holds we are likely to see another marginal new high. The high we’re expecting will likely be made next week or very shortly after.

What we are looking for here was discussed in some detail in Sunday’s monthly public Chart Chat. If you haven’t seen that yet then the recording for that is posted here.