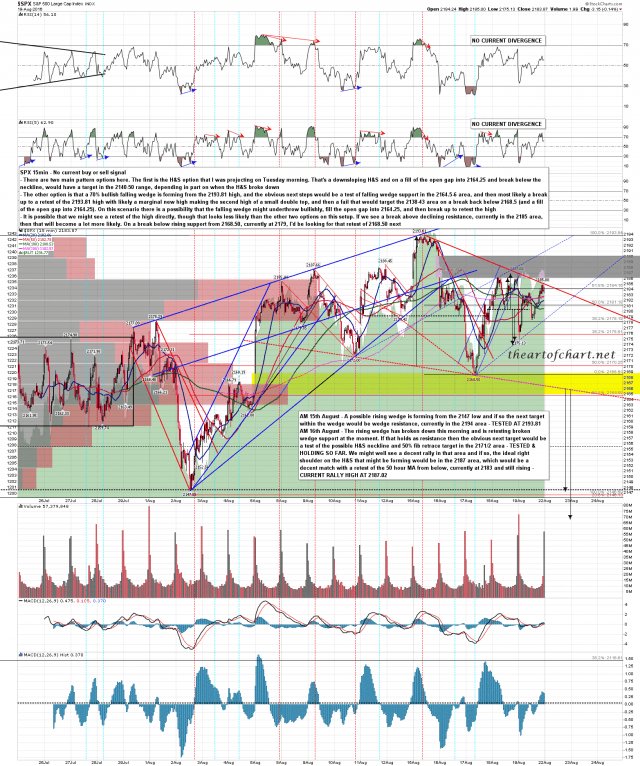

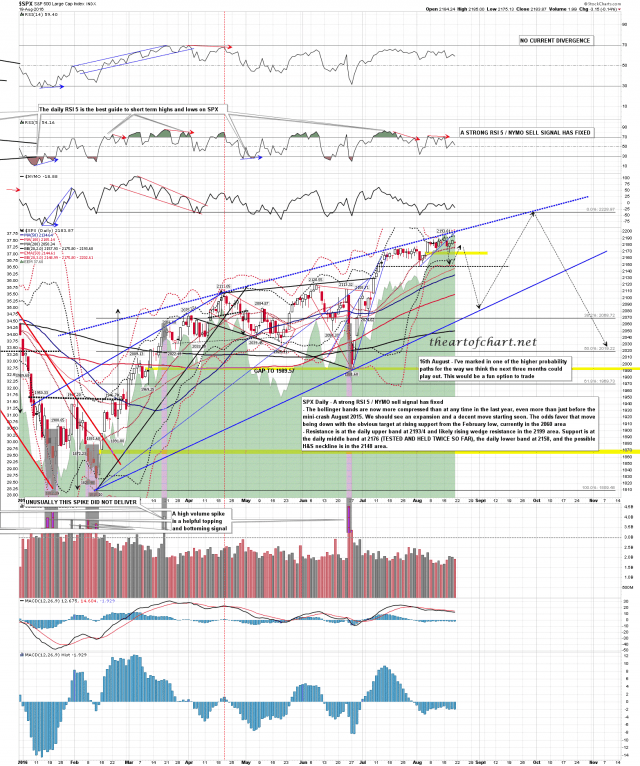

There’s an interesting setup on the SPX 15min coming into this week, with the possible H&S patterns that I was proposing last Tuesday morning still forming on all of SPX, NDX and RUT, but with a possible alternate falling wedge forming on SPX. Either way the obvious next move would be a test of the H&S neckline / possible falling wedge support in the 2166/7 area. At that point we should either see a fill of the open breakaway gap into 2164.25, or a reversal back up to retest 2193 to make a likely second high of a double top.

All charts from the charts I did at the weekend for the Trader’s Chart Service at theartofchart.net. Further notes on the charts as usual.

SPX 15min chart:

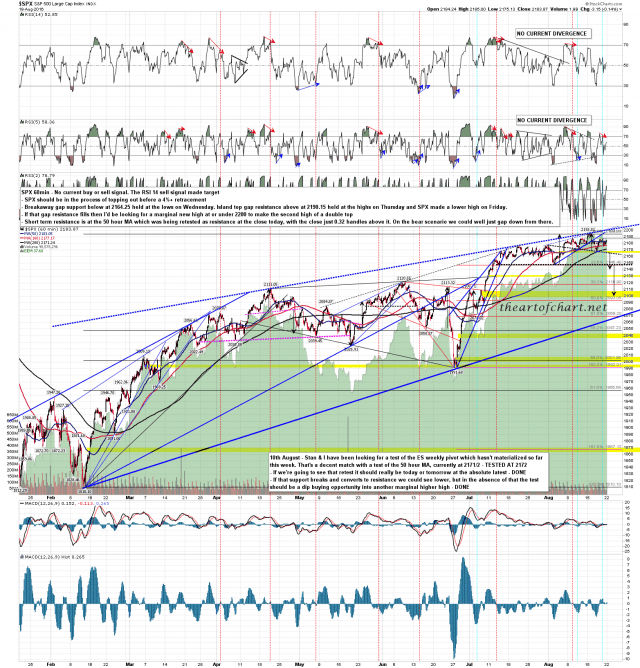

SPX 60min chart:

At the time of writing the daily middle band at 2175/6 is being tested as support and is holding so far. SPX daily chart:

Apologies for the lack of a post on Friday. Stan’s on holiday and I was having a wordpress technical issue that lost me a lot of work on theartofchart.net that I then had to redo. I called a possible island top on SPX on twitter on Friday morning and I’d note that that breakaway gap down didn’t fill. This swing high may well have already been made and, on a fill of the open gap into 2164.25, likely has been made.

Monday’s have been very hard to trade recently, and while the short term setup looks clear, recent history suggests that the tape may be unfriendly. Trade safe.