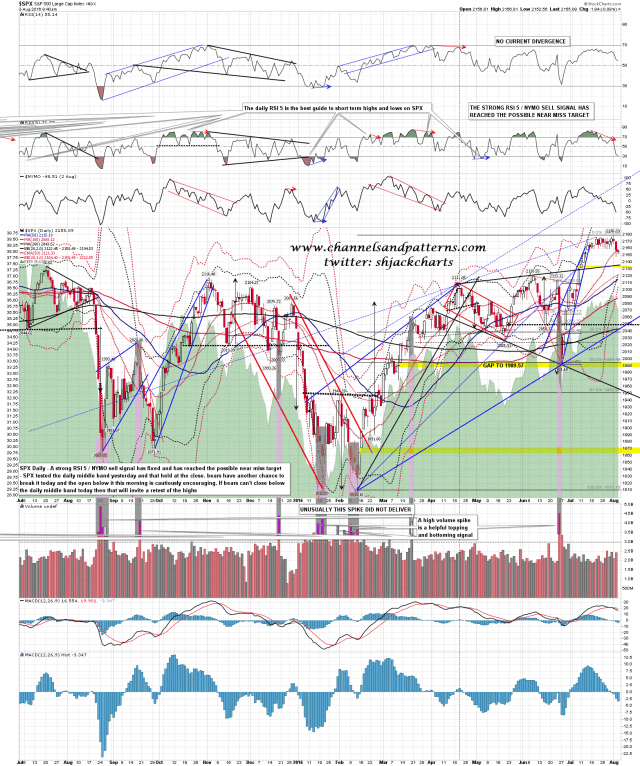

Range support was broken on SPX yesterday but the main task for bears was to deliver a close below the daily middle band and they didn’t manage it. They get another shot today, and if they fail that would invite another retest of the highs and possibly a new all time high. SPX daily chart:

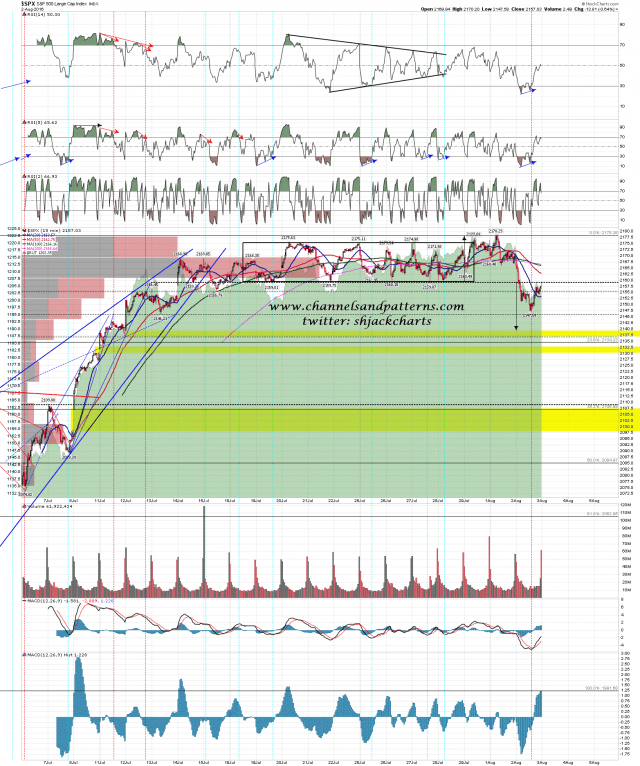

The daily RSI5_NYMO sell signal made the possible near miss target, and the 60min RSI 14 sell signal made target yesterday so the sell signals are all but played out. On the shorter timeframes there are fixed buy signals on the 15min and 5min charts and they have some distance to go. SPX was testing broken range support at 2159 at the close yesterday and is still testing it. If that holds as resistance then the double top target at 2140 I was looking at yesterday morning is still very much on the table. SPX 15min chart:

If we see that move towards 2140 SPX today then I would note that the equivalent level on ES would be in the 2133/4 area, and there is a strong support support level at the monthly pivot at 2136. If we were to see that tested today then a strong reversal there might well deliver a 60min buy signal. ES Sep 60min chart:

The question in my mind here is whether this is the start of the 4%+ retracement that I’m looking for in the near future, or whether this is what I would call the low before the high, which is the spike down you often see just before the high for a move. If bears can deliver that closing break below the daily middle band today then that retracement has likely started. If they can’t then we may well see another retest of the high and very possibly a marginal new all time high.