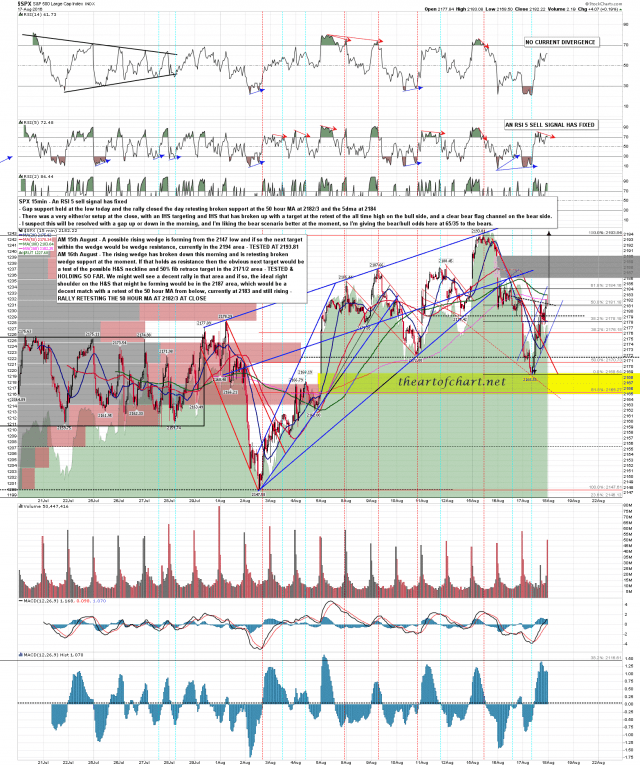

SPX went a bit lower than I was expecting yesterday morning but held breakaway gap support and we have then seen the rally to retest the 50 hour MA from below that I was looking for. That’s holding so far and if that remains the case then on a fill of that breakaway gap support art 2164.25 then I would have an H&S target in the 2142 area, not far below the possible larger H&S neckline in the 2147/8 area. If the candidate island top gap above at 2190.15 fills then I’d expect a marginal new high that should respect trendline resistance slightly under 2200.

I’m using charts that I did yesterday night for subscribers at theartofchart.net. SPX 15min chart:

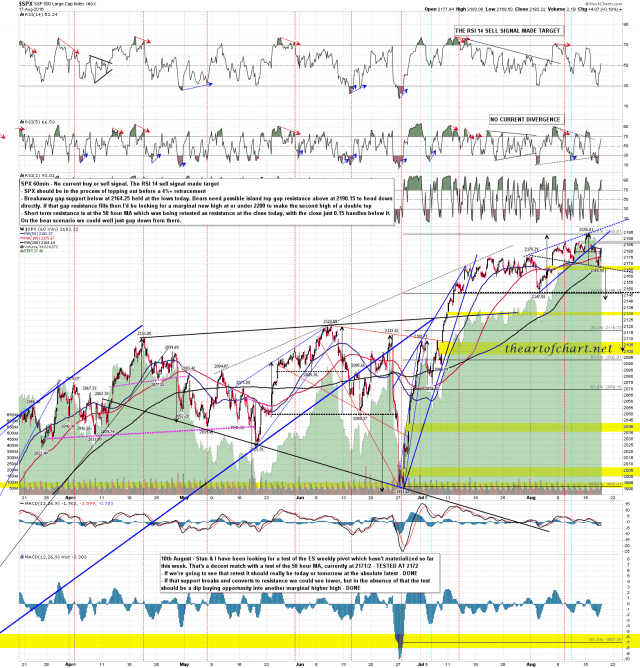

SPX 60min chart:

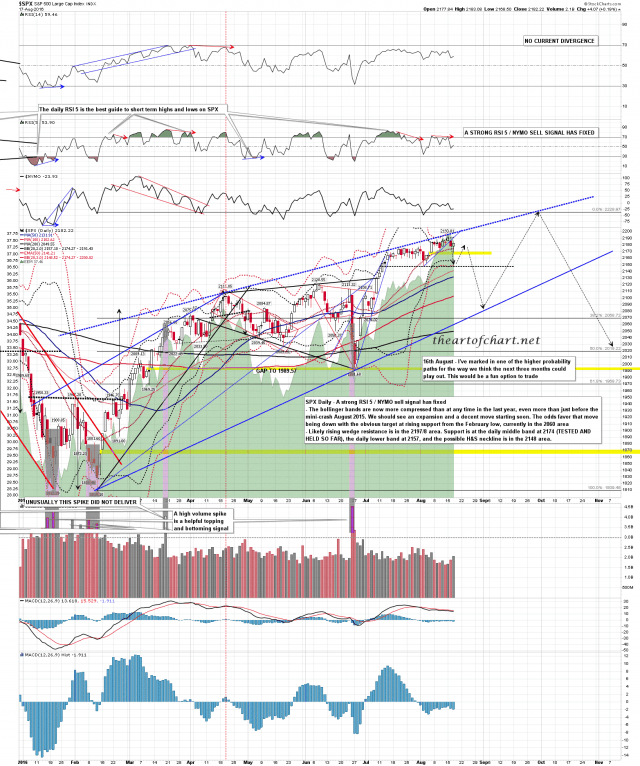

A strong daily RSI5/NYMO sell signal has fixed on SPX, and a daily RSI5 sell signal has also fixed on NDX. Whether SPX fails here or makes a marginal new high we should be starting at least a retest of 2100 support in the very near future. I have sketched out the ideal path I’d like to see SPX take over the next three months on the chart below. We’ll see how that goes. SPX daily chart:

A return to form with a boring narrow range day so far on ES. That may continue, and if SPX fails to fill that island top gap today then that would support the H&S scenario.