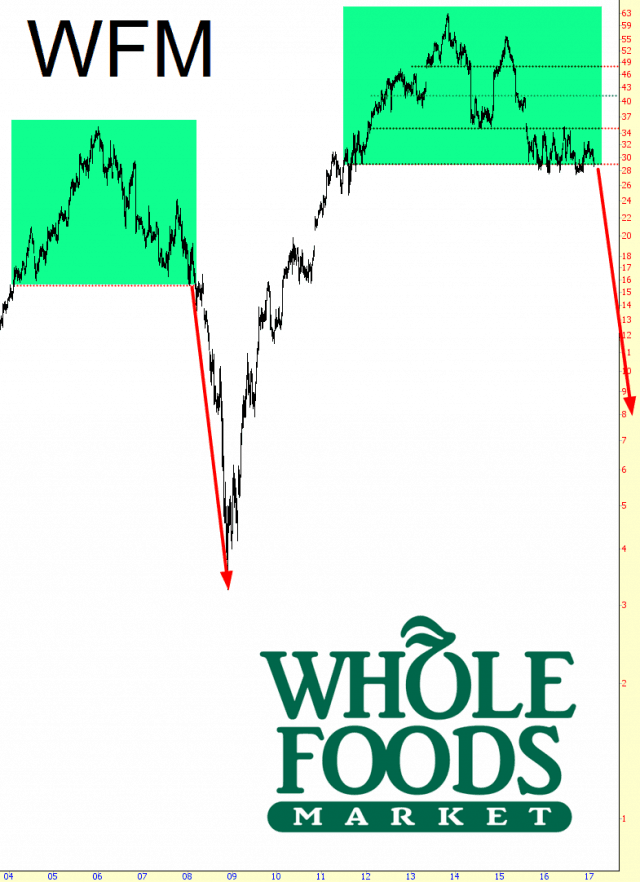

I notice that Whole Foods is dropping after hours. This actually lines up with an analog I’ve been following for years now. My belief is that the market is oh-so-subtly beginning to ape its behavior before the financial crisis, with Whole Foods being just the latest example. I suspect much lower prices are in — umm – – “store”.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

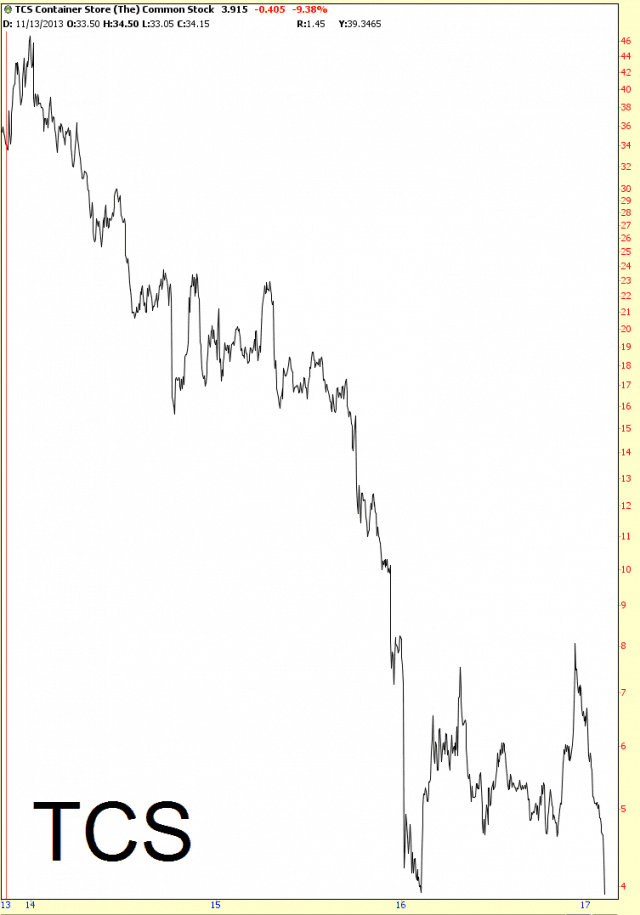

Container Collapse

Apparently selling stuff for 300% what you could pay it for at Ikea isn’t a great business model………not that I didn’t mention it before when the price was three times higher.

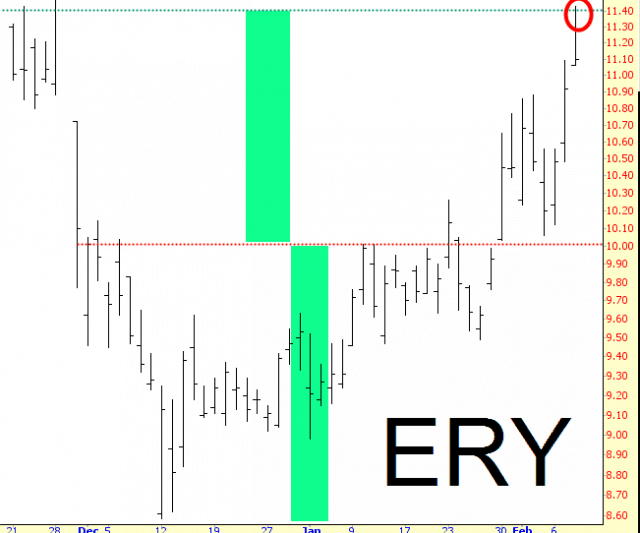

Oil Chart Withstands Huge Inventory Builds

It is remarkable that crude oil has managed to hold its Jan-Feb coil support line in the aftermath of two huge builds in the inventory data. That said, however, I keep thinking that Saudi Arabia (and OPEC) are under the market on every $2-$3 decline to preserve the integrity of “The Agreement” and also to support prices into the Saudi-Aramco public offering later this year.

Whether or not there is any truth to my suspicions, the fact remains that for the time being, the high-level coil-digestion formation remains intact and viable, and as long as that is the case, the overall set-up in oil is bullish and in a holding pattern awaiting upside continuation to $56.00 and then to $61.00. Only a reversal and break below $51.22-$50.71 support will wreck the set-up.

A Clean Getaway

I don’t normally monkey around with leveraged ETFs, but I was so enthralled by energy’s weakness, I had built up a big long position in ERY (as mentioned in my Lake Erie post on Tuesday). Last night, I calculated the measured move on it, drew a horizontal line, and watched it closely. Wednesday morning, before the inventory report, ERY nailed its target, so I GTFO in a big hurry. Thank goodness, eh?

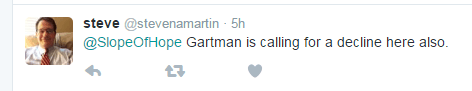

Oh, and, umm, this tweet from this morning kind of sealed the decision for me: