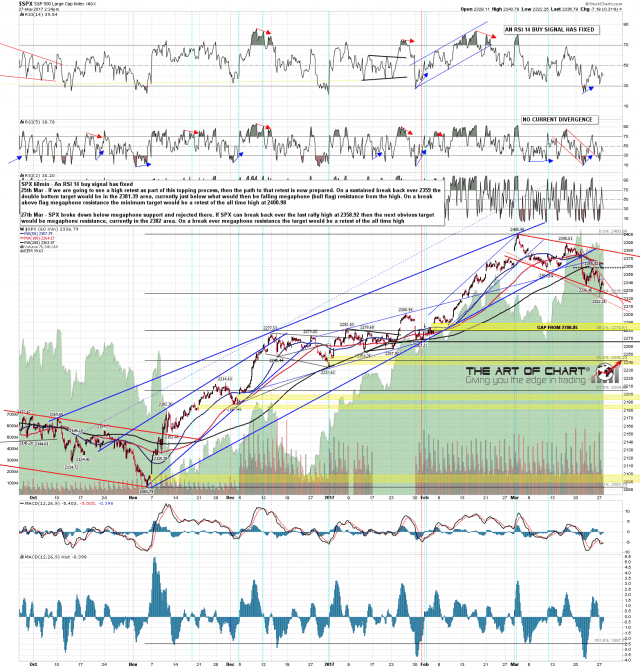

A big gap down this morning from Friday’s close at 2343.98, not quite filled at the time of writing with the high so far today at 2343.79. Unless SPX fails hard here this is a strong candidate low for at least a few days, and the resistance levels I’m watching are the gap fill, then declining resistance in the 2348 area, then the last rally high at 2358.92. On a break over that I’d expect a test of falling megaphone resistance currently in the 2382 area, and on a break over that the obvious target would be a retest of the all time high at 2400.98, very possibly to make the second high of a double top. SPX 60min chart:

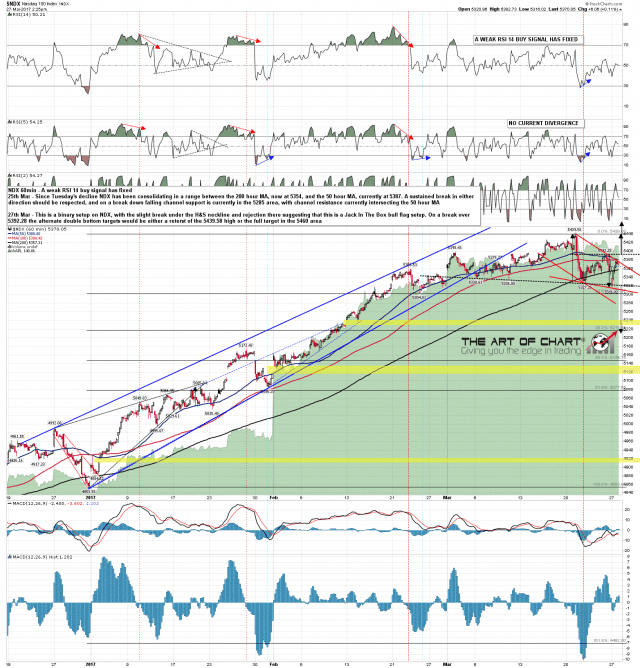

On NDX declining resistance from the all time high is already breaking. On a sustained break over the last rally high at 5392.28 the alternate double bottom targets would be either a retest of the current all time high at 5439.58 or slightly higher in the 5460 area. NDX 60min chart:

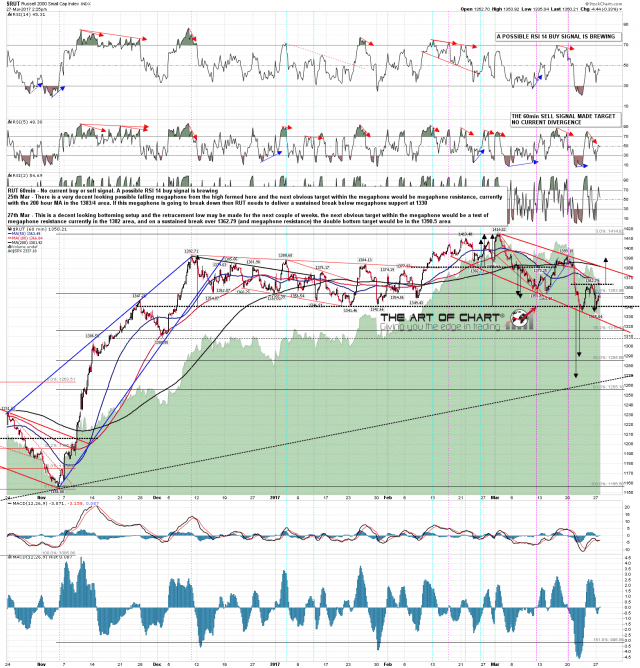

There’s a lovely double bottom setup on RUT, and on a sustained break over double bottom resistance in the 1362.79 area the double bottom target would be in the 1390.50 area, with falling megaphone resistance currently in the 1382 area. RUT 60min chart:

My view is that the short term low is probably in, and as soon as the opening gap on SPX fills, if it does, then the 70% option is that the short term low is in. If so then this would be likely to deliver an ATH retest on NDX and possible on SPX as well. Less likely but still possible on RUT. After the next high we should see the main decline begin into a target low period in July/August.