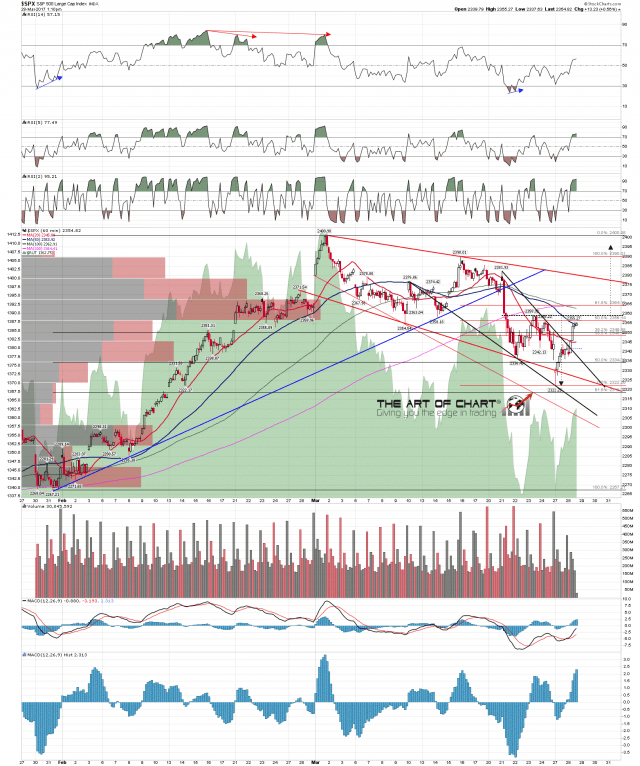

SPX filled the gap from Friday’s close yesterday afternoon, but there is still more to be done to confirm the low. The next test up on SPX is to break the 50 hour MA, currently at 2354 and SPX is testing that at the moment. If broken the next levels are an intraday higher high over the last rally high at 2358.92 and a daily close over the daily middle band, currently at 2367. The 2359 high is a possible IHS neckline so we could see a right shoulder retracement there. If so the ideal right shoulder low would be in the 2336 area, with the 2333-6 area being decent established support. SPX 60min chart:

On ES the key level is the break and conversion to support of the weekly pivot at 2351. With the 50 hour MA at the same level that is very much the key level today. ES Jun 60min chart:

There’s nothing to cheer the bears on the NQ chart, with the overnight retracement backtesting broken channel resistance and NQ breaking over double bottom resistance, well above the weekly pivot there. NQ Jun 60min chart:

TF reversed at weekly pivot last night but is now over it and testing the larger double bottom resistance. A sustained break over 1363.5 looks for the 1395 area. TF Jun 60min chart:

Overall there’s really not much to cheer the bears here, but on SPX/ES we might yet see that IHS right shoulder retracement back into the important support I mentioned before the open in my premarket video. That’s at 2330-2 on ES and 2333-6 SPX. If that retracement is seen, and the short term low is behind us, that area should now be good support.

It has been a few days since I last posted one of the pre-market videos that I do every morning before the open for Daily Video Subscribers at theartofchart.net, so I posted today’s on my twitter at the open today.If you missed that you can see that here, and that also covers the usual USD, oil, natgas, gold and 30 year treasury futures, as well as EUR, copper, coffee and sugar futures today.