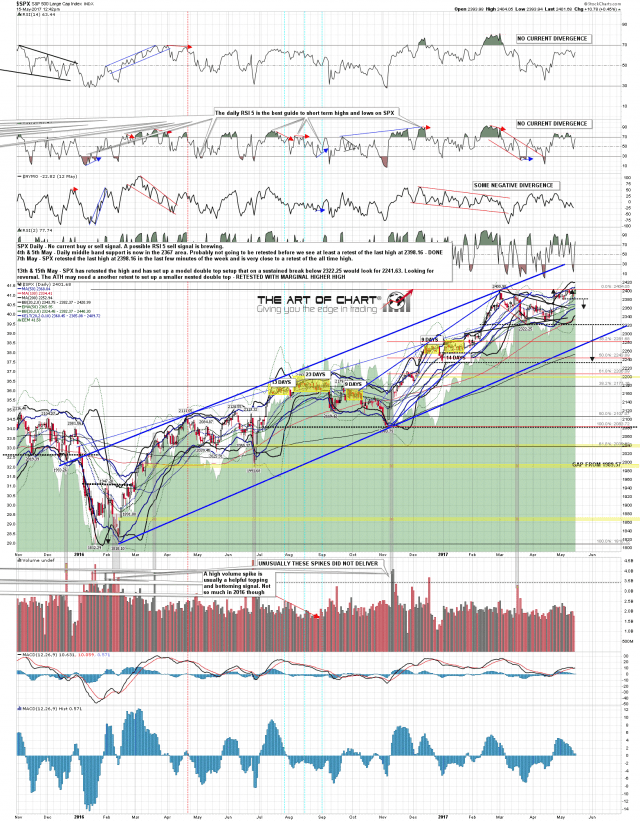

This morning we finally saw the ATH retest on SPX that I was looking for on Thursday and Friday last week, and that delivered a(nother) very marginal new ATH that sets a possible daily RSI 5 sell signal brewing. This is a possible nested double tops setup on SPX that I’m watching with great interest. If this is a top setup here however, I wouldn’t expect to see much downside today and the 60min charts may still need another ATH retest to set up negative divergence there. SPX daily chart:

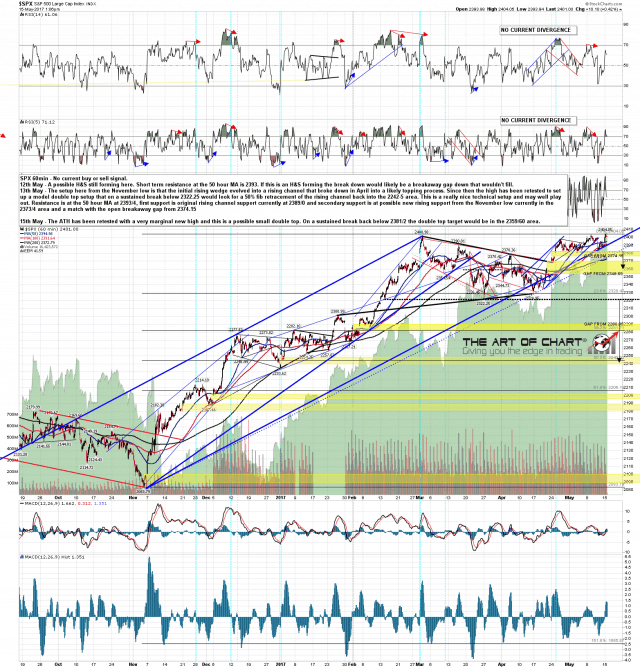

The obvious read on SPX here is that a top is forming, but not necessarily this topping setup. I like it though, and any further higher high here, if seen, we are expecting to be in by Wednesday at the latest. SPX 60min chart:

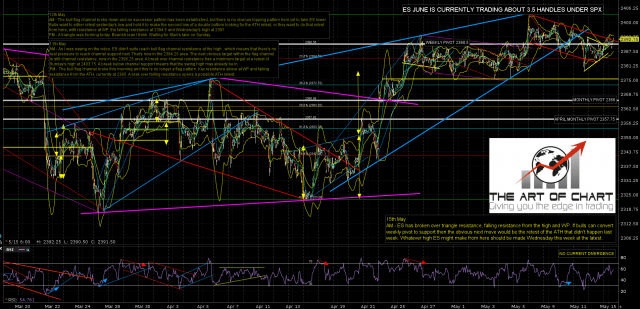

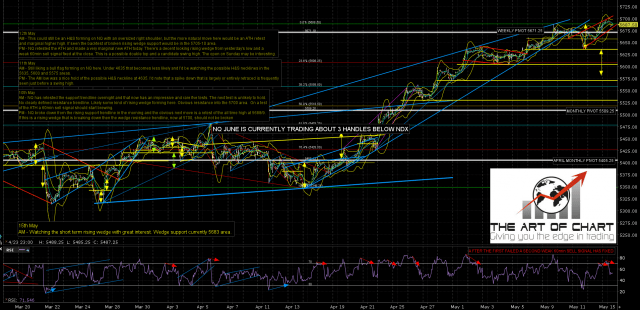

The ES and NQ futures charts below were done before the open for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

ES hasn’t quite reached the ATH retest which is just a little higher at 2403.75. That may need a test. ES Jun 60min chart:

On NQ I’m mainly watching the little rising wedge marked in red from last week’s low. The low this morning was at rising wedge support and if we are going to see another test of wedge resistance, that is currently in the 5710 area. NQ Jun 60min chart:

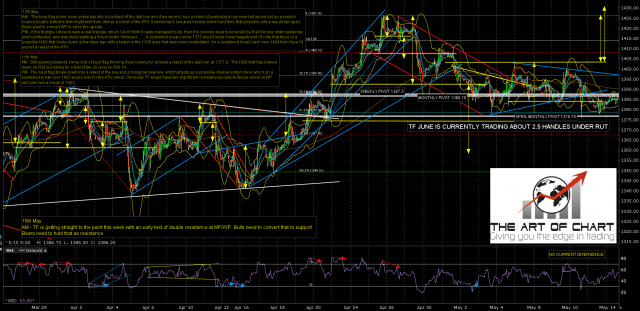

TF has made a lower high against 1400 today, and while that remains the case the best guess is that some kind of bear flag is forming here. Over 1400 the odds that this is a double bottom setup looking for an ATH retest increase. TF Jun 60min

I’m not expecting anything particularly exciting to happen today and would note that on the current setup on SPX the odds would favor any hard break down here starting with a retracement back into support in the 2380-5 area, and then continuing with a breakaway gap through that support before the next open. Not always, but more likely than not.

Stan and I are doing a free public webinar at theartofchart.net an hour after the close on Thursday looking at our Big Five Service stocks (AAPL, AMZN, FB, NFLX, TSLA), and if you’d like to attend then you can register for that on our May Free Webinars page. As it is Monday I would also note that this week’s edition of The Weekly Call is posted and that the model portfolio there is up 167% over the last six months, looking well on course to make our target minimum 200% return over the first year. That’s a free weekly service and if you trade futures I’d suggest adding it to your reading list.