The opening setup today on both SPX and NDX is close to ideal if we are going to see the swing high that Stan and I are expecting to see here. If that’s going to happen, the odds are decent that it will happen at marginal new highs on SPX and NDX today.

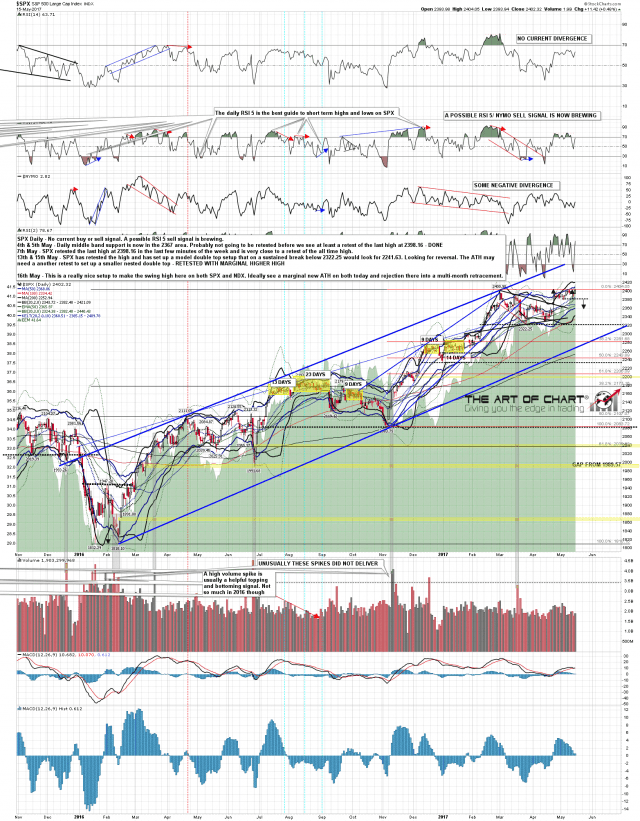

On SPX there is now a nicely formed RSI 5 / NYMO sell signal brewing. That will need some downside to fix the signal but I’m expecting that signal to take SPX on the first leg down on this expected multi-month retracement into the summer. SPX daily chart:

The ES and NQ futures charts below were done before the open for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

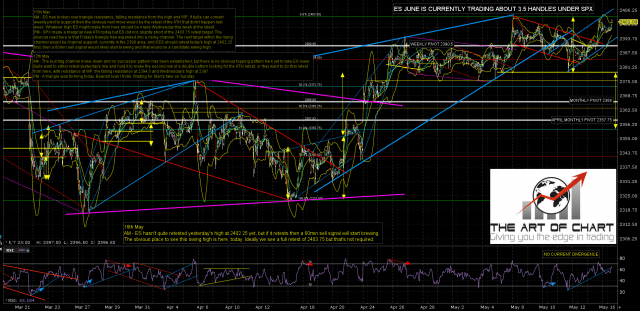

ES has made the marginal new high over the the ATH at 2403.75 that I was looking for and may run a few handles higher, but this setup now looks cooked. ES Jun 60min chart:

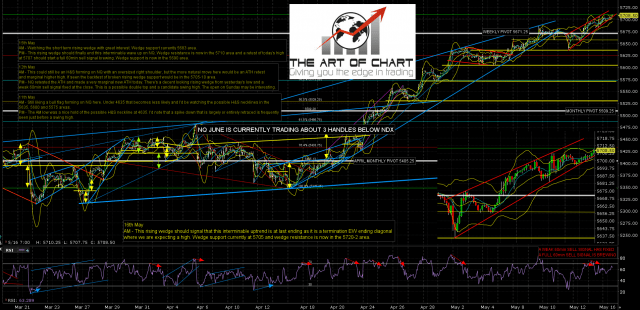

There is a very encouraging perfect rising wedge on NQ here. Wedge resistance currently in the 5722-4 area and, while I’m expecting this to break down, I’d note that we could see a bearish overthrow over wedge resistance at the high. NQ Jun 60min chart:

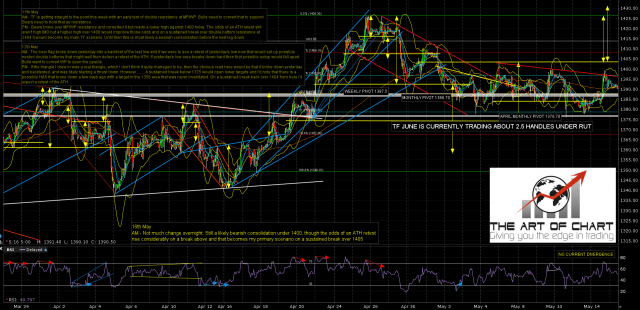

On TF another retest of the all time high looks unlikely unless TF can sustain a break over 2404, which currently looks unlikely. TF regularly surprises though so maybe. TF Jun 60min chart:

This is a very nice topping setup at the end of our cycle high window. Ideally we see marginal new all time highs today on SPX and NDX and then the bears take over the tape until a low in August. We’ll see how that goes 🙂

Stan and I are doing a free public webinar at theartofchart.net an hour after the close on Thursday looking at our Big Five Service stocks (AAPL, AMZN, FB, NFLX, TSLA), and if you’d like to attend then you can register for that on our May Free Webinars page. I would also note that this week’s edition of The Weekly Call is posted and that the model portfolio there is up 167% over the last six months, looking well on course to make our target minimum 200% return over the first year. That’s a free weekly service and if you trade futures I’d suggest adding it to your reading list.