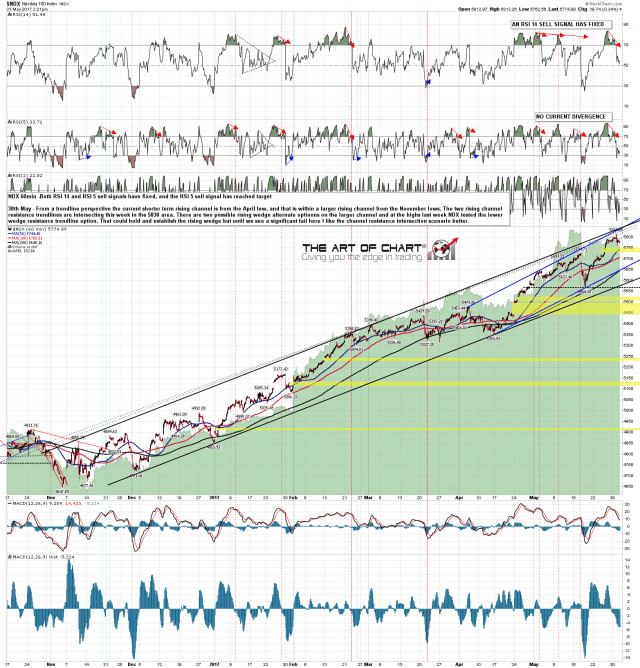

NDX retraced today without hitting my channel resistance trendlines in the 5830 area. My working assumption is that NDX will test those levels tomorrow or Friday. NDX 60min chart

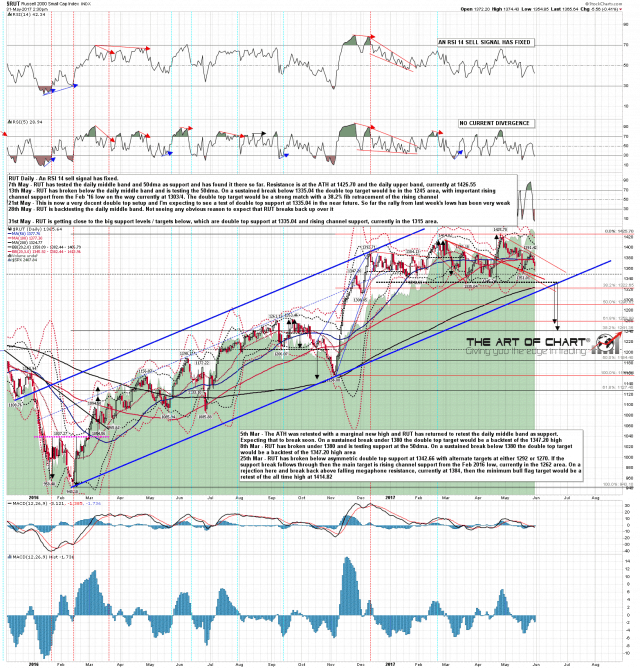

RUT is getting close to some serious support levels. RUT daily chart:

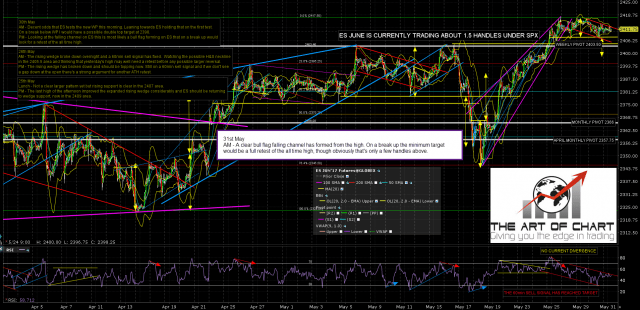

The SPX low this morning was at the 50 hour MA. A red close today followed by a new ATH tomorrow might well set a daily RSI 5 sell signal brewing. SPX daily 5dma chart:

The ES and NQ futures charts below were done before the open for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

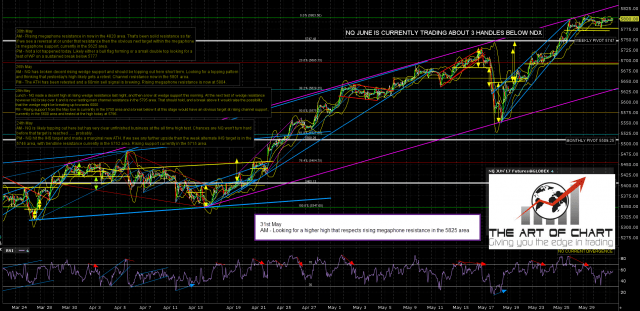

If we see a new ATH next on NQ then today’s decline has set a possible double top forming here. Unsustained spikes down are frequently seen just before swing highs. NQ Jun 60min chart:

TF retraced to falling wedge resistance and then broke down from the wedge, making the H&S target at 1354 and then rallying. The falling wedge may be expanding into a larger pattern, but if that isn’t the case then the falling wedge target is at a retest of the last low at 1344. TF Jun 60min chart:

ES broke up from the bull flag channel I was looking at, made a marginal lower high against the ATH, and then declined to form a larger bull flag, this time as a falling megaphone. Setup here still leans bullish, and still looking for a minimum full ATH retest on a break up. ES Jun 60min chart:

Tomorrow is the first day of the month, historically leaning strongly bullish. On this setup I would be surprised not to see new all time highs on SPX/ES and NDX/NQ this week and I’ll be watching that trendline resistance on NDX/NQ on any new ATH there.